You’re expanding to a new state.

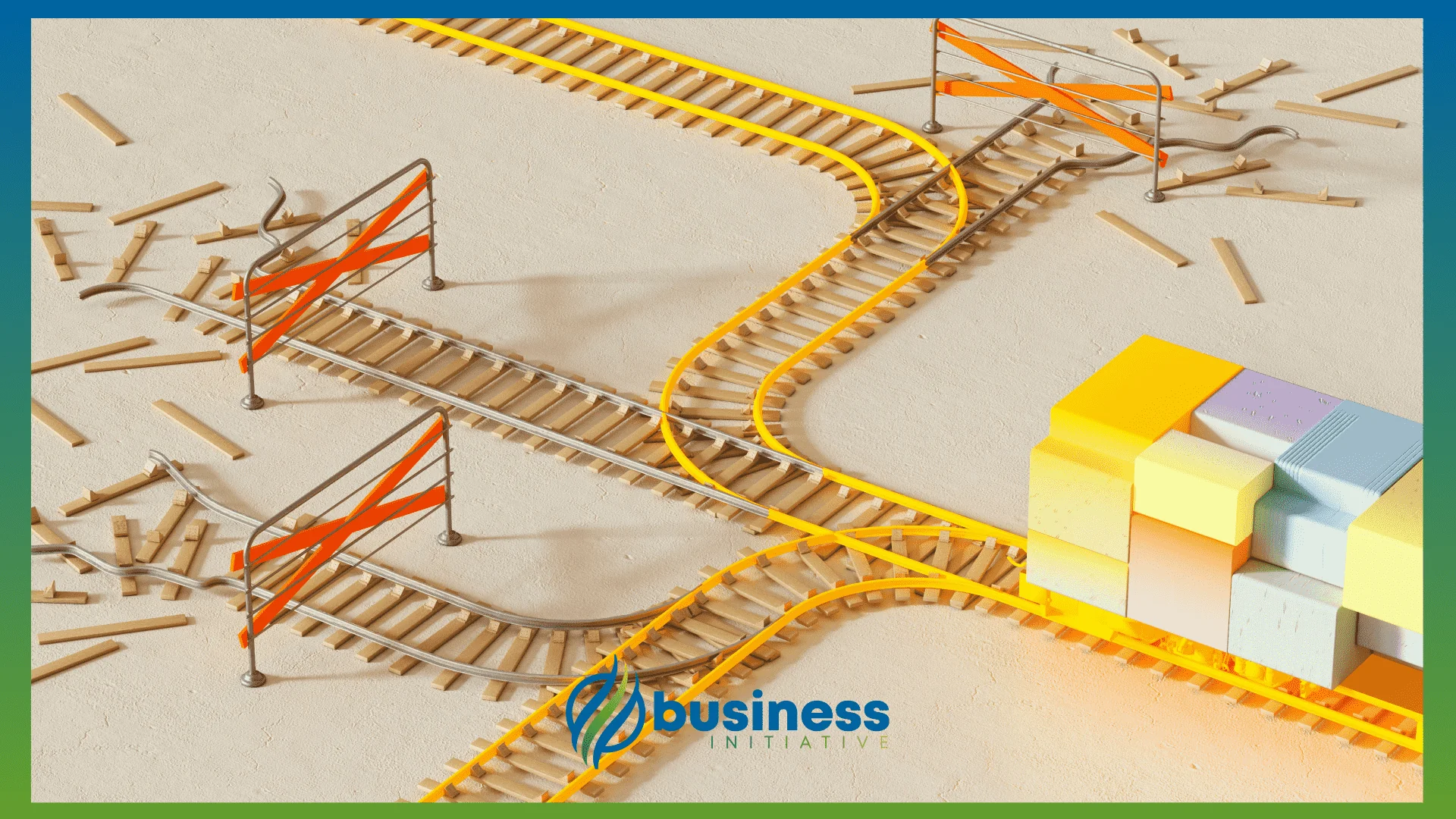

But you don’t know which structure to use. Foreign qualify your existing entity? Or form a new entity in the new state?

The wrong choice costs you.

More fees. More compliance. More complexity. Or missed opportunities.

This guide shows you how to decide.

When to foreign qualify. When to form new. Decision framework. Your choice.

Read this. Understand the options. Choose correctly.

Key Takeaways

Key Takeaways

- Foreign qualify when expanding the same business—if you're operating the same business in a new state, foreign qualification is usually the right choice

- Form a new entity when starting a different business—if the new state operation is a separate business, a new entity makes more sense

- Consider tax implications—foreign qualification keeps everything under one entity for tax purposes, new entities create separate tax filings

- Factor in compliance costs—foreign qualification adds compliance in one state, new entities require full compliance in each state

- Think about liability separation—new entities provide liability separation between operations, foreign qualification keeps everything together

Table of Contents

Table of Contents

Why the Choice Matters

The choice affects everything.

What happens if you choose wrong:

- Pay unnecessary fees

- Create unnecessary complexity

- Miss liability protection

- Create tax problems

What happens if you choose right:

- Minimize costs

- Simplify compliance

- Maximize protection

- Optimize taxes

The reality: The right choice saves money and simplifies operations.

Option 1: Foreign Qualification

What It Is:

- Register existing entity in new state

- Same entity operates in multiple states

- One entity, multiple states

When It Works:

- Same business expanding

- Same operations in new state

- Want unified tax treatment

- Want simpler structure

Pros:

- Single entity structure

- Unified tax treatment

- Simpler compliance

- Lower initial costs

Cons:

- Liability not separated

- All states see same entity

- Compliance in multiple states

- No liability protection between operations

Pro tip: Foreign qualification works best when you’re expanding the same business. See our foreign qualification guide for the process.

Option 2: New Entity

What It Is:

- Form new entity in new state

- Separate entity for new state

- Multiple entities, separate operations

When It Works:

- Different business in new state

- Want liability separation

- Want separate tax treatment

- Want independent operations

Pros:

- Liability separation

- Independent operations

- Separate tax treatment

- Protection between operations

Cons:

- Multiple entity compliance

- More complex structure

- Higher initial costs

- Separate tax filings

Pro tip: New entities work best when you want liability separation or are starting a different business. See our structure comparison guide for entity types.

Decision Framework

Use this framework to decide:

Step 1: Assess Your Situation

Questions to ask:

- Is this the same business?

- Do you want liability separation?

- Do you want unified tax treatment?

- What are your compliance goals?

Why it matters: Your situation determines the best choice.

Step 2: Evaluate Your Goals

What to consider:

- Liability protection needs

- Tax optimization goals

- Compliance complexity tolerance

- Cost considerations

Why it matters: Your goals determine priorities.

Step 3: Make Your Decision

Decision rule:

- Same business + unified taxes → Foreign qualify

- Different business + liability separation → New entity

- Same business + liability separation → Consider both options

- Different business + unified taxes → Usually new entity

Pro tip: Most expansions are the same business, so foreign qualification is usually the right choice. See our multi-state map guide for when registration is required.

Common Scenarios

These scenarios show common decisions:

Scenario 1: Same Business, New Location

Situation:

- Existing business expanding to new state

- Same operations, new location

- Want unified tax treatment

Decision: Foreign qualify

Why: Same business benefits from unified structure.

Scenario 2: Different Business, New State

Situation:

- Starting different business in new state

- Want liability separation

- Want independent operations

Decision: New entity

Why: Different business needs separate structure.

Scenario 3: Same Business, High Risk

Situation:

- Same business expanding

- High-risk operations

- Want liability protection

Decision: Consider new entity

Why: Liability separation may be worth the complexity.

Scenario 4: Same Business, Low Risk

Situation:

- Same business expanding

- Low-risk operations

- Want simplicity

Decision: Foreign qualify

Why: Simplicity outweighs liability separation.

Pro tip: Most scenarios point to foreign qualification. Only choose new entity if you have specific reasons for separation.

Your Next Steps

Understand the options. Make your decision. Execute correctly.

This Week:

- Review this guide

- Assess your situation

- Evaluate your goals

- Make your decision

This Month:

- Execute your chosen option

- File foreign qualification or form new entity

- Set up compliance

- Monitor operations

Going Forward:

- Maintain compliance in all states

- Review structure as you grow

- Adjust if needed

- Stay organized

Need help? Check out our foreign qualification guide for the registration process, our multi-state map guide for when registration is required, and our multi-state compliance guide for staying organized.

Stay informed about business strategies and tools by following us on X (Twitter) and signing up for The Initiative Newsletter.

FAQs - Frequently Asked Questions About Foreign vs. New Entity: How to Decide the Best Structure for Expansion

What is foreign qualification and when should I use it for state expansion?

Foreign qualification registers your existing entity in a new state, letting the same business operate in multiple states—use it when you're expanding the same business to a new location.

Learn More...

Foreign qualification means your existing LLC or corporation gets permission to do business in an additional state. You don't create a new entity—your original entity simply registers its presence in the new state.

This approach works best when you're running the same business in both states, want unified tax treatment under one entity, prefer simpler compliance, and don't need liability separation between state operations.

When does it make sense to form a new entity instead of foreign qualifying?

Form a new entity when you're starting a different business in the new state, want liability separation between operations, need separate tax treatment, or want independent management.

Learn More...

A new entity creates a completely separate legal structure. This provides liability protection—if one operation gets sued, the other is shielded. It also enables separate tax filings and independent operational control.

The trade-off is more complexity: multiple entities mean multiple compliance obligations, separate tax returns, higher initial formation costs, and ongoing administrative overhead. Choose this route only when the benefits of separation outweigh the complexity.

How does the choice between foreign qualification and a new entity affect my taxes?

Foreign qualification keeps everything under one entity with unified tax treatment, while a new entity creates separate tax filings and potentially different tax obligations in each state.

Learn More...

With foreign qualification, your single entity files one federal return and manages multi-state tax obligations within that return. This simplifies accounting and tax preparation, though you'll still need to allocate income across states.

A new entity means separate tax returns for each business. This can be advantageous if operations have very different revenue profiles, but it increases accounting costs and complexity. Consult a tax professional to model both scenarios for your specific situation.

Does foreign qualification provide liability protection between my state operations?

No—foreign qualification keeps everything under one entity, so liability from any state operation can potentially affect the entire business. Only a separate entity provides liability isolation.

Learn More...

Under foreign qualification, your entity is the same legal person in every state. A lawsuit or debt in one state can reach assets in all states because there's no legal wall between operations.

If liability separation matters—for example, if one state's operations are high-risk—forming a new entity in that state creates a separate legal shield. This is why high-risk scenarios may justify the added complexity of a new entity despite the higher cost.

What decision framework should I use to choose between foreign qualifying and forming a new entity?

Ask four questions: Is this the same business? Do you need liability separation? Do you want unified taxes? What's your compliance tolerance? Same business with unified taxes points to foreign qualification; different business with liability needs points to a new entity.

Learn More...

Start by assessing whether the new state operation is the same business or something different. Then evaluate your liability protection needs, tax optimization goals, and willingness to manage additional compliance complexity.

The general decision rule is: same business + unified taxes = foreign qualify; different business + liability separation = new entity; same business + liability separation = consider both options carefully. Most expansions of the same business favor foreign qualification because it's simpler and cheaper.

What are the compliance differences between foreign qualification and a new entity?

Foreign qualification adds compliance in one additional state for your existing entity, while a new entity requires full formation and ongoing compliance as a separate business from scratch.

Learn More...

With foreign qualification, you add annual reports, fees, and a registered agent in the new state, but everything stays under your existing entity's umbrella. Your compliance burden increases incrementally.

A new entity requires full formation paperwork, its own EIN, separate annual reports, separate tax filings, its own registered agent, and all other state-specific obligations. This effectively doubles your compliance workload. Factor these ongoing costs into your decision.

Sources & Additional Information

This guide provides general information about expansion structure decisions. Your specific situation may require different choices.

For foreign qualification process, see our Foreign Qualification Guide.

For multi-state registration, see our Multi-State Map Guide.

For multi-state compliance, see our Multi-State Compliance Guide.

Consult with legal and tax professionals for advice specific to your situation.