Dissolving a corporation is a more complex process than closing other business structures, requiring careful attention to shareholder rights, regulatory compliance, and proper documentation.

Key Takeaways

Key Takeaways

- Board and shareholders must both approve dissolution before filing official paperwork with the state.

- Obtain tax clearance certificates and file final returns to avoid future tax complications.

- Notify all creditors, employees, and stakeholders in writing to prevent legal claims.

- Distribute remaining assets to shareholders only after settling all outstanding debts first.

- Keep detailed records of all dissolution steps for at least 7 years after closing.

Whether you’re closing due to retirement, market changes, or completing a successful exit strategy, this comprehensive guide will walk you through the corporate dissolution process, covering shareholder requirements, state regulations, tax implications, and asset distribution.

Table of Contents

Table of Contents

Common Reasons for Corporate Dissolution

Several factors may lead to the decision to dissolve a corporation:

- Strategic mergers or acquisitions:

The corporation may be dissolved as part of a larger M&A transaction or corporate restructuring.

- Financial considerations:

Market conditions, competitive pressures, or financial performance may necessitate closure.

- Shareholder decisions:

Major shareholders or the board of directors may vote to cease operations and dissolve.

- Regulatory compliance issues:

Inability to maintain compliance with corporate regulations or excessive regulatory burden.

Understanding these motivations helps ensure proper planning and execution of the dissolution process.

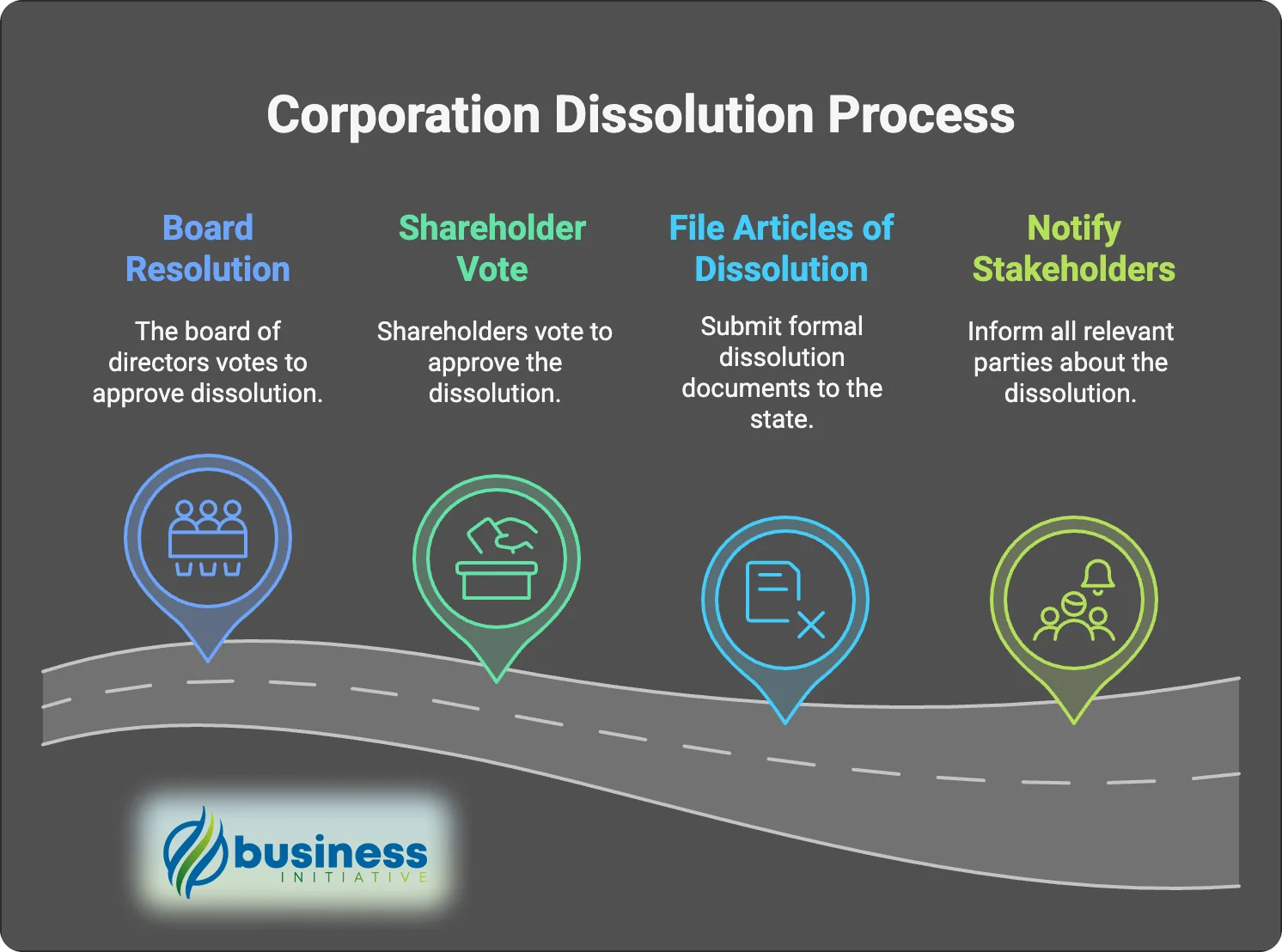

Legal Requirements and Shareholder Approval

Dissolving a corporation involves more stringent requirements than other business structures:

1. Board Resolution:

The board of directors must first vote to approve the dissolution and prepare a resolution.

2. Shareholder Vote:

Shareholders must approve the dissolution, typically requiring a majority or supermajority vote as specified in the corporate bylaws.

3. File Articles of Dissolution:

Submit formal dissolution documents with the Secretary of State, including:

- Corporate information

- Effective date of dissolution

- Confirmation of shareholder approval

- Statement of no pending legal actions

- Tax clearance certificates (if required)

4. Notify Stakeholders:

Formal notification must be provided to:

- All shareholders

- Known creditors

- Potential claimants

- Regulatory agencies

- Stock exchange (if publicly traded)

Corporate Wind-Down Process

1. Cease Operations

- Complete existing contracts

- Terminate leases and service agreements

- Cancel licenses and permits

- Notify employees and provide required notices

2. Asset Liquidation

- Inventory all corporate assets

- Obtain professional valuations

- Conduct orderly sale of assets

- Document all transactions

3. Debt Settlement

- Create creditor priority list

- Negotiate settlements

- Pay secured creditors

- Address unsecured claims

- Maintain detailed payment records

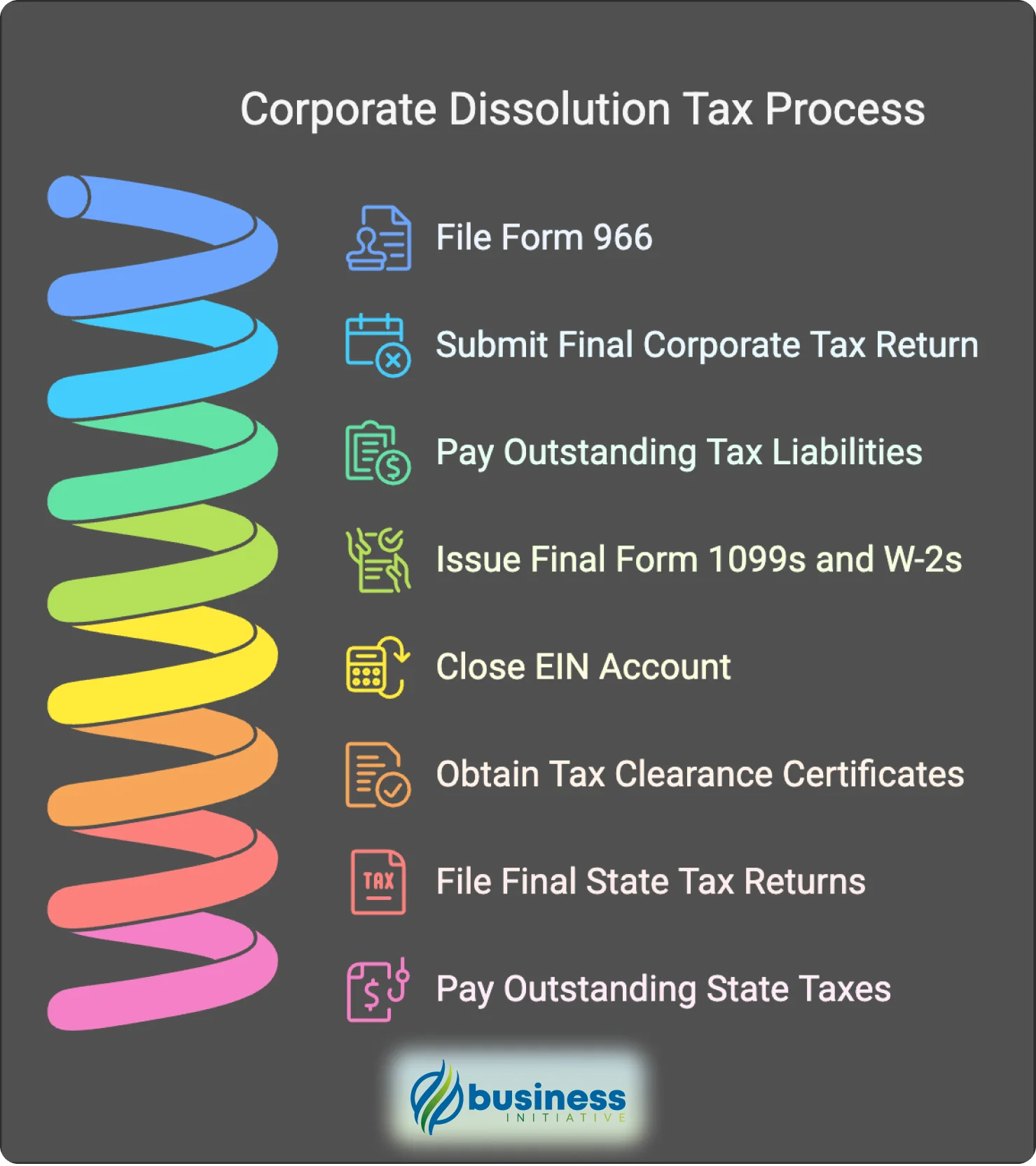

Tax Implications and Requirements

Dissolving a corporation requires careful attention to tax obligations:

Federal Tax Requirements

- File Form 966 (Corporate Dissolution)

- Submit final corporate tax return

- Pay outstanding tax liabilities

- Issue final Form 1099s and W-2s

- Close EIN account

State Tax Considerations

- Obtain tax clearance certificates

- File final state tax returns

- Pay outstanding state taxes

- Cancel state tax registrations

- Address sales tax obligations

Shareholder Tax Impact

- Distribution taxation

- Capital gains considerations

- Stock basis calculations

- Final K-1 reporting

Asset Distribution Process

After settling all debts, remaining assets must be distributed following strict protocols:

1. Distribution Priority

- Preferred shareholders

- Common shareholders

- Pro-rata distribution calculations

- Special class considerations

2. Documentation Requirements

- Board resolution approving distributions

- Shareholder acknowledgments

- Transfer documentation

- Tax basis statements

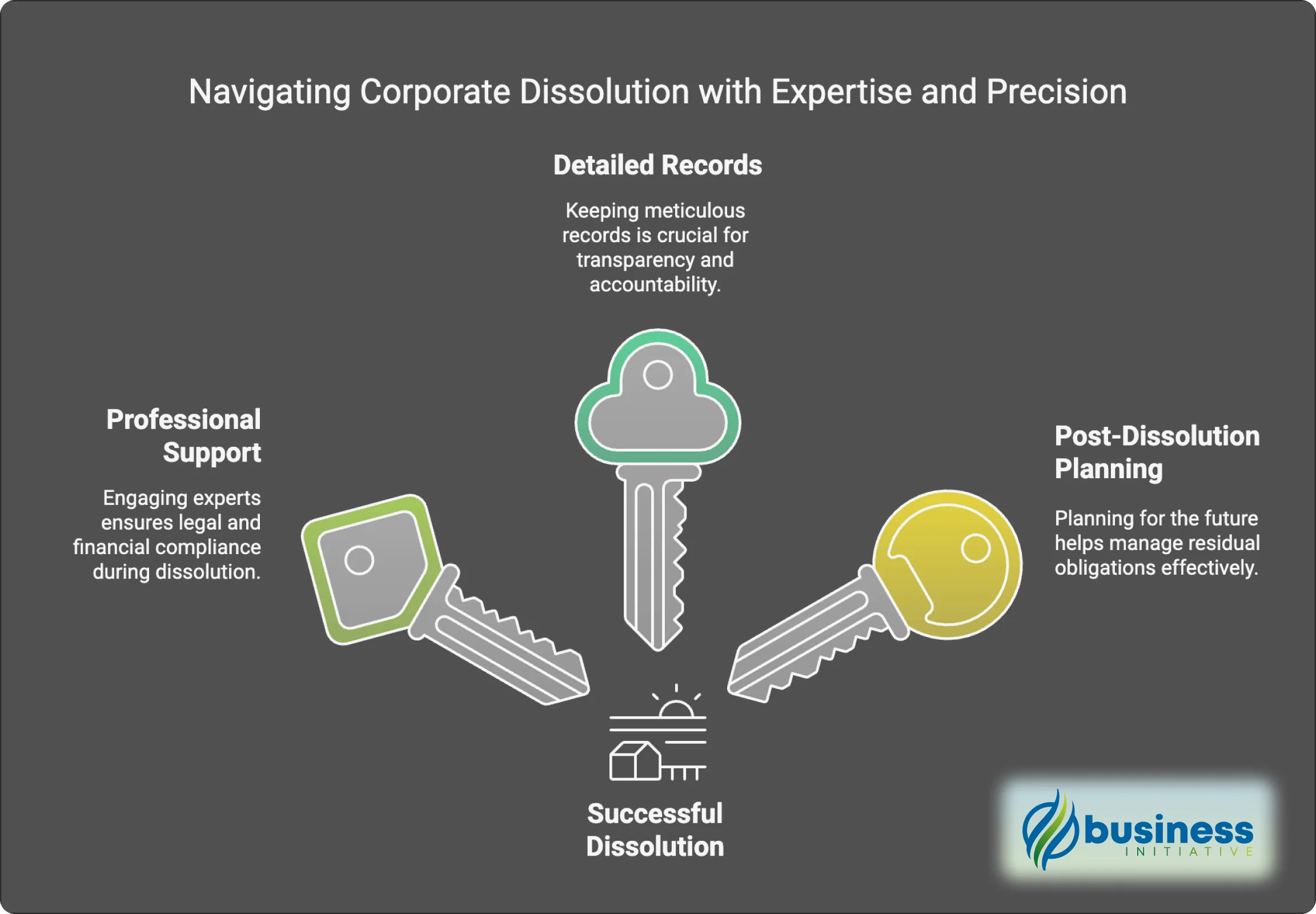

Practical Tips for Successful Dissolution

1. Engage Professional Support:

- Corporate attorney

- Tax accountant

- Valuation experts

- Dissolution specialists

2. Maintain Detailed Records:

- Board minutes

- Shareholder votes

- Creditor communications

- Asset disposition

- Distribution calculations

3. Plan for Post-Dissolution:

- Record retention

- Contact point designation

- Future claims handling

- Tax document storage

Historical Examples

General Motors (2009)

The “old” General Motors Corporation underwent a structured dissolution through bankruptcy, emerging as a new entity.

This case demonstrates how even large corporations can require dissolution and restructuring.

Eastman Kodak (2012)

Kodak’s bankruptcy and restructuring illustrates the importance of adapting to market changes and planning for potential dissolution before it becomes urgent.

Key Takeaways

Corporate dissolution requires careful attention to:

- Shareholder rights and approval

- Regulatory compliance

- Tax obligations

- Asset distribution rules

- Stakeholder communications

Proper planning and professional guidance can help ensure a smooth dissolution process that protects all stakeholders’ interests.

Need expert guidance for your corporation’s dissolution?

Schedule a consultation with our corporate specialists

FAQs - Frequently Asked Questions About Corporate Dissolution

How long does it take to dissolve a corporation?

The process typically takes 3-6 months from start to finish.

Timing depends on state requirements and complexity of your business.

Learn More...

Corporate dissolution involves multiple phases that can extend the timeline significantly.

The initial board and shareholder approval process usually takes 2-4 weeks.

Filing articles of dissolution with the Secretary of State typically takes 1-2 weeks for processing.

The wind-down process, including asset liquidation and debt settlement, can take 2-4 months.

Obtaining tax clearance certificates from federal and state agencies often adds 4-8 weeks.

Final asset distribution and record-keeping setup typically takes 2-4 weeks.

Complex corporations with multiple subsidiaries, international operations, or significant assets may require 6-12 months.

Factors that can delay the process include pending lawsuits, regulatory investigations, or complex asset portfolios.

Proper planning and professional assistance can significantly reduce the overall timeline.

What happens to my personal assets if I dissolve my corporation?

Your personal assets remain protected if the corporation was properly maintained.

Corporate dissolution only affects business assets and liabilities.

Learn More...

One of the primary benefits of incorporating is the separation between business and personal assets.

When you dissolve a corporation, only the business assets and liabilities are affected.

Your personal bank accounts, real estate, investments, and other personal property remain completely separate.

However, this protection only applies if you maintained proper corporate formalities throughout the business's existence.

If you commingled personal and business finances, creditors might be able to pierce the corporate veil.

Personal guarantees you signed for business loans or leases remain enforceable even after dissolution.

Any personal investments you made in the corporation (beyond your initial capital contribution) may be lost.

Your personal credit score is generally not affected by corporate dissolution unless you personally guaranteed business debts.

It's crucial to maintain clear separation between personal and business finances throughout the entire process.

Can I dissolve a corporation with outstanding debts?

Yes, but you must settle all debts before distributing assets to shareholders.

Creditors have priority over shareholders in asset distribution.

Learn More...

Dissolving a corporation with outstanding debts is legally possible but requires careful debt management.

All creditors must be notified of the dissolution and given opportunity to file claims.

Secured creditors (like banks with liens on business assets) have first priority in asset distribution.

Unsecured creditors (like suppliers, landlords, or service providers) have second priority.

Shareholders only receive distributions after all creditor claims are satisfied.

If assets are insufficient to pay all debts, the corporation may need to file for bankruptcy protection.

Personal liability for business debts depends on whether you signed personal guarantees.

Some states require proof of debt settlement before issuing dissolution certificates.

It's essential to create a comprehensive creditor list and maintain detailed records of all payments.

Consider negotiating settlements with creditors to reduce the total amount owed.

What tax forms do I need to file when dissolving a corporation?

File Form 966 (Corporate Dissolution) and final corporate tax returns.

Issue final W-2s and 1099s to employees and contractors.

Learn More...

The IRS requires specific documentation when dissolving a corporation to ensure proper tax treatment.

Form 966 (Corporate Dissolution or Liquidation) must be filed within 30 days of adopting the dissolution plan.

Final corporate income tax returns (Form 1120) must be filed for the year of dissolution.

All employment tax returns (Forms 941, 940, and state equivalents) must be filed and taxes paid.

Final W-2 forms must be issued to all employees, and 1099 forms to independent contractors.

Sales tax returns must be filed in all states where the corporation had nexus.

State tax clearance certificates are often required before final dissolution approval.

The corporation's EIN (Employer Identification Number) should be closed with the IRS.

Any remaining tax credits or net operating losses may be available to shareholders.

Consult with a tax professional to ensure compliance with all federal and state requirements.

Do I need a lawyer to dissolve my corporation?

While not legally required, professional legal assistance is highly recommended.

Corporate dissolution involves complex legal and tax requirements.

Learn More...

Corporate dissolution involves numerous legal requirements that vary significantly by state.

A corporate attorney can ensure proper compliance with state dissolution statutes and regulations.

Legal professionals can help draft proper board resolutions and shareholder consent documents.

Attorneys can assist with creditor notification requirements and debt settlement negotiations.

Professional guidance helps avoid personal liability issues and ensures proper asset distribution.

Legal counsel can help resolve disputes between shareholders or with creditors.

Attorneys can ensure proper documentation for tax purposes and regulatory compliance.

Professional assistance is especially important for corporations with multiple shareholders, complex assets, or significant debts.

The cost of legal representation is typically much lower than the potential costs of mistakes.

Consider it an investment in protecting your personal assets and ensuring a clean dissolution.

What happens to my employees when I dissolve the corporation?

You must provide proper notice and final paychecks to all employees.

Comply with federal and state employment laws during the termination process.

Learn More...

Employee termination during corporate dissolution requires careful attention to employment laws.

The WARN Act may require 60-day advance notice if you have 100+ employees and are closing a facility.

All final wages, including accrued vacation time and benefits, must be paid immediately upon termination.

COBRA continuation coverage must be offered to eligible employees and their dependents.

Final W-2 forms must be issued to all employees by January 31st of the following year.

State-specific requirements may include additional notice periods or severance pay obligations.

Consider providing outplacement services or references to help employees transition to new positions.

Document all termination procedures and maintain records for at least 3 years.

Failure to comply with employment laws can result in personal liability for corporate officers.

Consult with an employment attorney to ensure compliance with all applicable regulations.

Can I restart my business after dissolving a corporation?

Yes, you can start a new business entity after dissolution.

The new business will be completely separate from the dissolved corporation.

Learn More...

Corporate dissolution doesn't prevent you from starting a new business venture.

You can form a new LLC, corporation, or other business entity under a different name.

The new business will have no connection to the dissolved corporation's assets, liabilities, or history.

You'll need to obtain new EINs, business licenses, and permits for the new entity.

Consider choosing a different business name to avoid confusion with the dissolved corporation.

The new business can operate in the same industry and serve similar customers.

Any intellectual property, trade secrets, or customer relationships from the dissolved corporation may need to be transferred properly.

Starting fresh can provide opportunities to implement lessons learned from the previous business.

Ensure you've completed all dissolution requirements before starting the new business to avoid legal complications.

Consult with legal and tax professionals to ensure proper separation between the old and new entities.

What records should I keep after dissolving my corporation?

Keep all dissolution-related documents for at least 7 years.

Maintain records of tax filings, creditor settlements, and asset distributions.

Learn More...

Proper record retention is crucial for legal protection and tax compliance after corporate dissolution.

Keep all board minutes, shareholder resolutions, and dissolution filings for at least 7 years.

Maintain copies of all tax returns, including final corporate returns and employment tax filings.

Preserve records of all creditor notifications, debt settlements, and payment confirmations.

Keep documentation of asset valuations, sales transactions, and distribution records.

Maintain employment records, including termination notices and final payroll documentation.

Preserve copies of all contracts, leases, and agreements that were terminated during dissolution.

Keep records of any legal proceedings, regulatory filings, or compliance documentation.

Consider digitizing important documents and storing them securely in multiple locations.

These records may be needed for future tax audits, legal proceedings, or regulatory inquiries.

Proper record-keeping demonstrates compliance and can protect against future claims or liabilities.