Welcome to The Initiative Guide to CFO salaries in 2025!

This article is designed to provide valuable insights into the range of CFO salaries and the various factors that influence Chief Financial Officer compensation, including company size, industry, location, and experience.

Key Takeaways

Key Takeaways

- Company size significantly impacts CFO compensation, with larger firms offering higher salaries.

- The average CFO salary ranges from $150,000 in small companies to over $1 million in large firms.

- Industry, location, and experience also influence CFO salary levels. Additional compensation includes bonuses, stock options, and long-term incentives.

- Recent trends show salary increases and a shift towards equity-based compensation.

- Effective negotiation strategies can significantly impact a CFO's compensation package.

Understanding these aspects is crucial for both current CFOs and aspiring financial executives as it empowers them to make informed decisions about their career trajectories and negotiate effectively for their compensation packages.

To get the most out of this article, we recommend focusing on the sections that are most relevant to your current situation or aspirations.

Table of Contents

Table of Contents

Don’t miss out on this opportunity to elevate your financial career.

Continue reading to uncover the secrets to maximizing your earning potential as a CFO…

What is the Average CFO Salary?

The average salary for a Chief Financial Officer (CFO) varies widely based on factors such as company size, industry, location, and experience.

CFO Salary for Small Company:

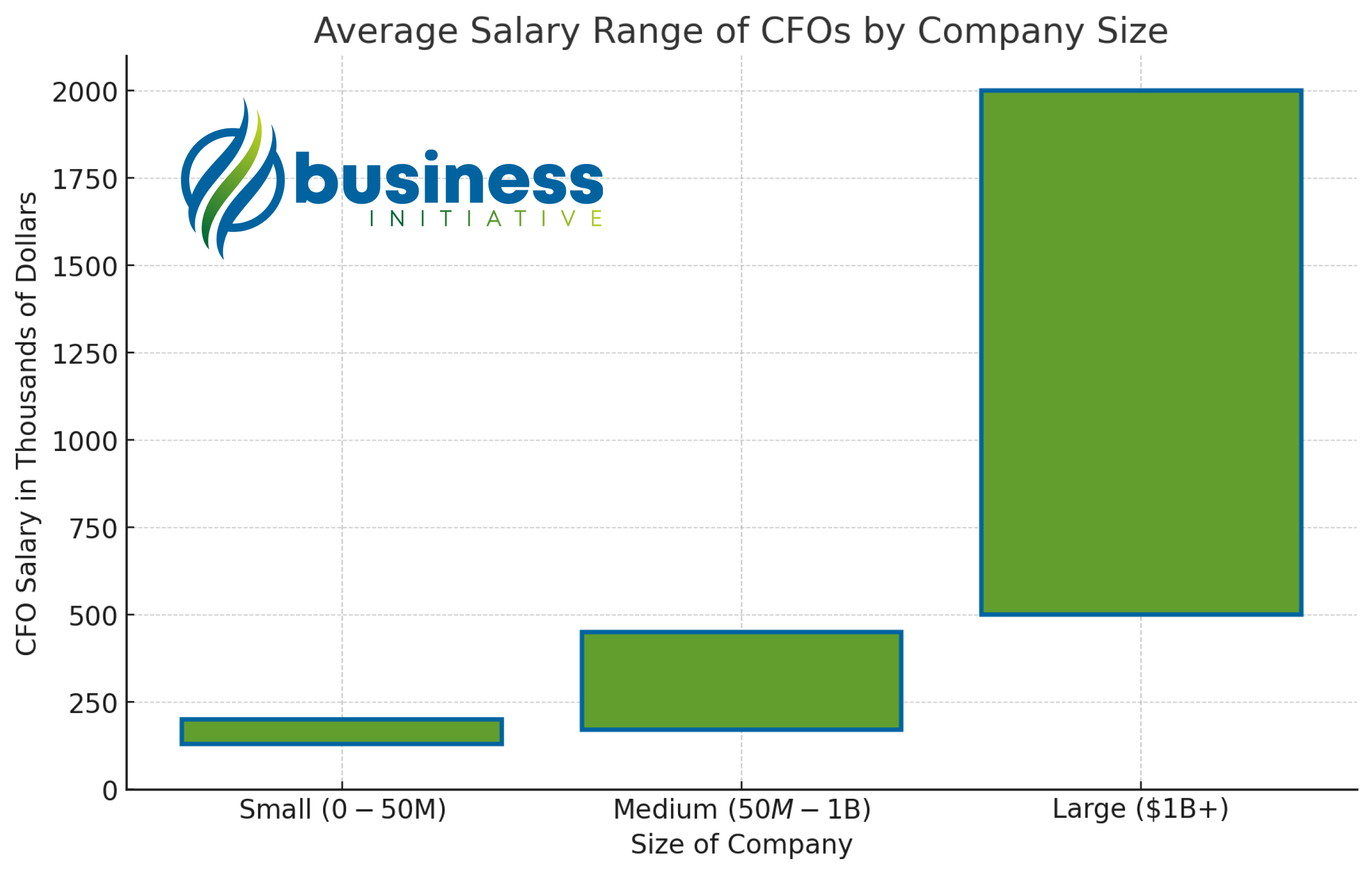

In small companies with revenue under $50 million, the average CFO salary ranges from $130,000 to $200,000.

When looking specifically at how much a CFO of a small company makes, figures can vary around this range depending on specific business conditions and revenue size.

For medium-sized companies with revenue between $50 million and $1 billion, the salary range typically falls between $170,000 and $450,000.

Large companies with revenue over $1 billion tend to offer the highest salaries, with the average CFO salary often exceeding $500,000.

Additionally, CFOs in larger firms or in high-cost locations may command salaries of over $1 million.

What is the Highest CFO Salary?

According to data from 2023, Gunnar Wiedenfels, the CFO of Warner Bros Discovery had a base salary of $2,000,000.

It is intersting to point out that this was only his base salary and does not account for additional benefits like bonuses or stock options.

When accounting for both the benefits and the base salary the highest paid CFO in 2023 was Joe Berchtold.

Joe is the CFO for Live Nation Entertainment, the company behind Ticketmaster.

When all things are considered, Joe made out with $52.4 million.

Not too shabby.

The Evolving Role of the Chief Financial Officer

The Chief Financial Officer (CFO) plays a critical role in the strategic and financial management of an organization.

Traditionally, the CFO’s responsibilities included overseeing the financial operations, reporting, and compliance of a company.

However, the role has evolved to encompass a broader range of duties, making the CFO a key player in shaping the company’s strategic direction.

The modern CFO is not just a financial gatekeeper but also a strategic partner to the CEO, involved in decision-making processes that impact the entire organization.

The influence of company size on CFO compensation is significant.

As the size of a company increases, the complexity of its financial operations and the scope of the CFO’s responsibilities also grow.

This expansion in role and responsibilities is typically reflected in the compensation package offered to the CFO.

Larger companies often have more resources and a greater ability to pay higher salaries, bonuses, and other forms of compensation.

Furthermore, the CFO’s impact on a larger organization’s financial health and strategic direction is more pronounced, justifying higher compensation levels.

In contrast, smaller companies may offer lower salaries due to budget constraints and a more limited scope of responsibilities for the CFO.

In the following sections, we will delve deeper into how company size influences CFO compensation and explore the average salaries for CFOs across different company sizes.

Beyond financial oversight, CFOs also play a key role in fostering high performance within their teams.

Custom Coins serve as a powerful way to recognize employees’ outstanding contributions, reinforcing their value to the company.

More than just a token, these coins symbolize achievement and inspire employees to push for higher goals, strengthening morale and company culture.

What is a CFO?

The Chief Financial Officer (CFO) is a senior executive responsible for managing the financial actions of a company.

The CFO’s duties include tracking cash flow, financial planning, analyzing the company’s financial strengths and weaknesses, and proposing corrective actions.

The role of the CFO has evolved from being a mere financial overseer to a strategic partner to the CEO, playing a crucial role in shaping the company’s strategy and direction.

CFO Requirements

Becoming a CFO typically requires a combination of education, experience, and skills. Key requirements include:

- Education:

A bachelor’s degree in finance, accounting, economics, or business administration is essential.

An MBA or a professional certification such as a Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA) is highly desirable.

- Experience:

Extensive experience in finance or accounting, typically at least 10-15 years, with a proven track record in financial management and leadership roles.

- Skills:

Strong analytical, strategic thinking, and leadership skills are crucial.

The ability to communicate effectively with stakeholders, manage a team, and make informed decisions based on financial data is also important.

CFO Job Description

The CFO’s job description encompasses a wide range of responsibilities, including:

- Financial Management:

Overseeing the company’s financial operations, developing financial strategies, and ensuring financial stability and growth.

- Risk Management:

Identifying and mitigating financial risks, ensuring compliance with financial regulations, and managing investments.

- Reporting:

Preparing and presenting financial reports to stakeholders, including shareholders, the board of directors, and regulatory bodies.

- Budgeting and Forecasting:

Developing and managing the company’s budget, forecasting financial trends, and planning for the company’s financial future.

- Strategic Planning:

Collaborating with the CEO and other executives to develop and implement the company’s strategic plan, with a focus on financial aspects.

Factors Influencing CFO Salary

The salary of a Chief Financial Officer (CFO) is influenced by a variety of factors, including company size, industry, location, and experience.

Understanding these factors can help both employers and potential CFOs gauge what to expect in terms of compensation.

1. Company Size:

The size of the company plays a significant role in determining a CFO’s salary.

Larger companies typically offer higher salaries due to the increased complexity and responsibilities of the role.

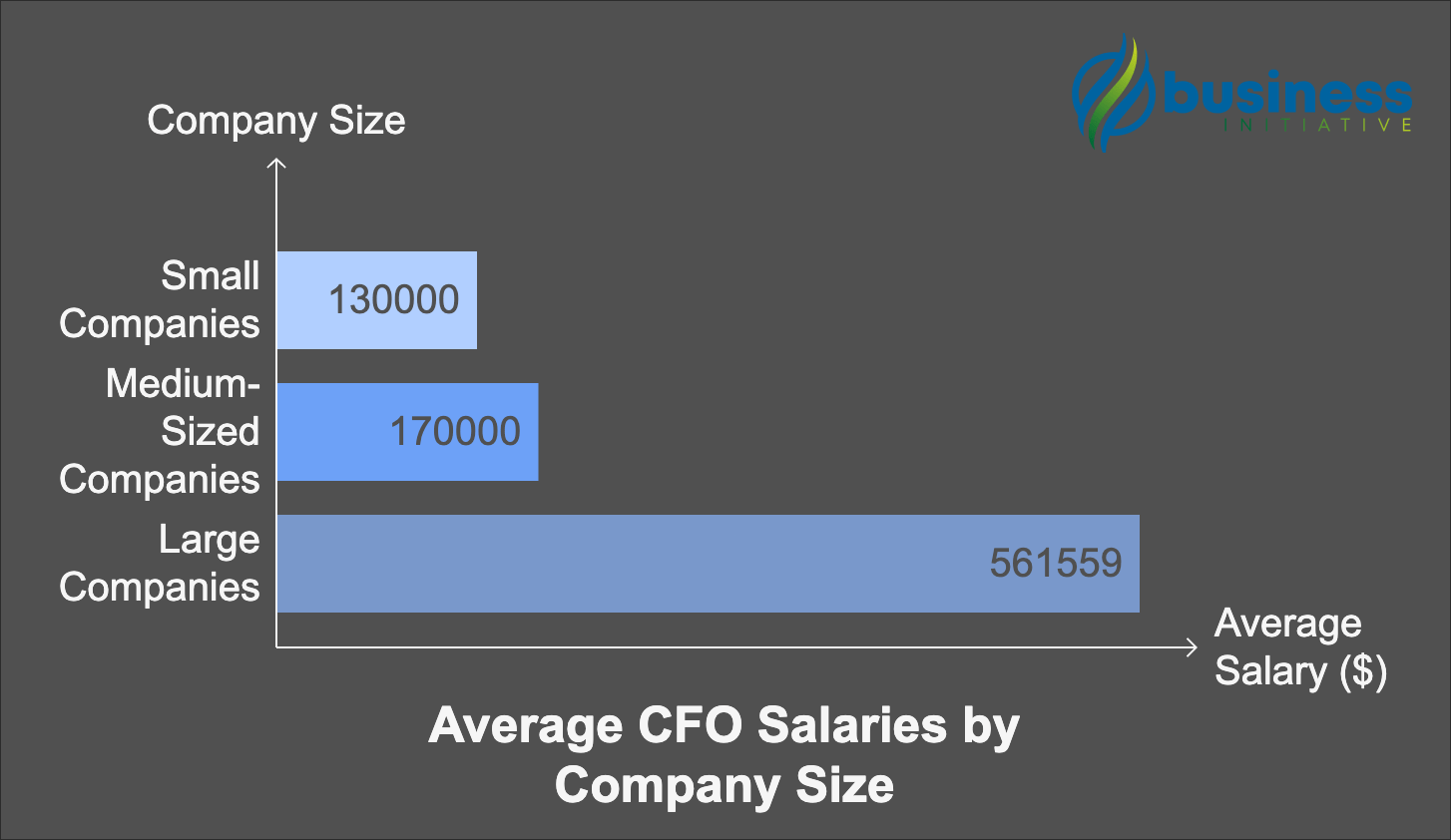

For example, startups often pay an average salary of roughly $130,546, whereas major firms pay an average of $362,030.

2. Industry:

The industry in which a company operates can also impact CFO compensation.

Industries with higher revenue potential or more complex financial structures may offer higher salaries to attract top talent.

3. Location:

Geographic location significantly affects a CFO’s salary.

Salaries can vary based on the cost of living, demand for CFOs, and economic conditions in different regions.

For instance, CFOs in Washington, D.C., earn more than those in North Carolina.

4. Experience:

Experience is another crucial factor. CFOs with a longer track record of success in financial management roles are likely to command higher salaries.

For top-level CFO positions, a decade or more of relevant work experience is frequently required.

5. Education and Qualifications:

Higher education levels and professional certifications, such as an MBA, CPA, or CMA, can enhance a CFO’s earning potential.

These qualifications are often associated with a higher level of expertise and competence.

6. Skills:

Specific skills that are highly valued for the CFO role, such as strategic planning, financial reporting, and leadership, can also influence salary levels.

In today’s data-driven world, CFOs with strong skills in data analysis and digital technology are in high demand.

7. Company Performance:

In many companies, particularly publicly traded ones, a portion of the CFO’s salary may be tied to the company’s financial performance.

This can include bonuses and stock options, aligning the CFO’s interests with those of the shareholders.

CFO salaries are influenced by a combination of factors, including company size, industry, location, experience, and qualifications.

Understanding these factors can help both CFOs and employers navigate the complexities of compensation in this critical role.

Average CFO Salary by Company Size

CFO compensation by company size: Smaller companies may offer less in terms of base salary but can supplement with performance bonuses or equity to make the total compensation package more attractive.

Small Companies (Revenue less than $50 million):

- CFO salary for small company:

The average salary for a CFO in small companies is typically lower compared to larger companies.

The compensation for a CFO in a small business typically ranges from $130,000 to $200,000 annually.

According to PayScale, the average salary for a CFO in 2024 is around $200,000.

This reflects the CFO salary based on revenue, which aligns with the company’s ability to pay based on its financial size.

- Key Responsibilities and Challenges:

CFOs in small companies often wear multiple hats, overseeing not just finance but also areas like operations and strategy.

They may face challenges such as limited resources and the need to be more hands-on in day-to-day financial management.

Medium-Sized Companies (Revenue between $50 million and $1 billion):

- Average Salary Range for CFOs in Mid-sized Businesses:

CFOs in medium-sized companies can expect a higher salary range due to the increased complexity and responsibility.

The salary can vary widely depending on the exact revenue size, with those in companies closer to the $1 billion mark earning more.

For example, the average salary for a CFO in companies bringing in between $50 million and $999 million is between $170,000 and $450,000.

The exact figures can vary widely, reflecting the CFO salary by company revenue.

The more the company makes, the more the C-Suite makes.

- Key Responsibilities and Challenges:

In medium-sized companies, CFOs are more involved in strategic planning and may need to deal with more complex financial structures and reporting requirements.

Large Companies (Revenue over $1 billion):

- Average Salary Range in Large Businesses:

CFOs in large companies command the highest salaries, with the 75th percentile earning $561,559 and the 90th percentile earning $674,315 as of January 26, 2024.

The average CFO salaries by company size in these firms are significantly greater than small and medium sized companies because there is more weight placed on company decisions.

The exact salary can vary based on the specific revenue size and other factors such as industry and location.

CFOs in large companies have a more strategic role, focusing on long-term financial planning, risk management, and investor relations.

They may face challenges such as managing a global finance team and navigating complex regulatory environments.

Compensation Considerations

When considering how to structure CFO compensation, it’s essential to consider more than the size of the company and its revenue, as these factors are critical in determining pay scales.

For example, the answer to: “How much does a CFO of a startup make?” can vary widely, often starting lower but with potential for significant equity compensation, which can be extremely valuable in successful ventures.

In addition to base salary, CFOs often receive various forms of additional compensation, including bonus structures, stock options, and other incentives.

CFO salary small company setups often focus on a mix of salary and equity to compensate for the lower initial cash compensation compared to larger firms.

This structure is essential to attract top talent who can drive the company’s financial strategy towards growth.

These components can vary significantly depending on the size of the company.

Overview of Bonus Structures and Stock Options

- Bonus Structures:

Bonuses are a common form of additional compensation for CFOs, usually tied to individual and company performance metrics.

The structure of these bonuses can vary widely from one organization to another.

Generally, CFOs have an average bonus potential of around 30-60% of their base salary, with the possibility of higher payouts in larger organizations.

- Stock Options:

Stock options are a prevalent form of equity compensation for CFOs, especially in public companies.

These options give the CFO the right to purchase company stock at a predetermined price, potentially allowing them to benefit from increases in the company’s stock value.

Equity stakes and the types of equity plans offered can differ significantly among organizations.

Variation by Company Size

- Small Companies:

In smaller companies, CFOs may have a lower base salary and bonus potential compared to larger companies.

Equity compensation, such as stock options or restricted stock units (RSUs), may be less common or have a lower value.

- Medium-Sized Companies:

As companies grow in revenue and complexity, CFO compensation packages typically become more substantial.

Bonuses may increase as a percentage of the base salary, and equity compensation becomes a more significant component of the total compensation package.

- Large Companies:

In large companies, CFOs often have higher base salaries, larger bonus potentials, and more substantial equity compensation packages.

The complexity of the organization and the CFO’s role in strategic financial management contribute to the increased compensation.

Additional Considerations

- Performance-Based Equity:

Nearly 95% of companies grant performance-based equity to their CFOs, emphasizing the importance of aligning the CFO’s compensation with the company’s long-term success.

- Long-Term Incentive Plans (LTIPs):

LTIPs are designed to reward CFOs for achieving long-term company goals, often tied to total shareholder return or financial performance metrics.

These plans can include a mix of restricted stock, stock options, and other performance-based awards.

- Benefits and Perquisites:

Beyond salary, bonuses, and equity, CFOs may receive additional benefits such as retirement plans, health insurance, and other perks.

These can vary by company size and industry.

In summary, CFO compensation packages are multifaceted and can vary significantly based on the size of the company, industry, and geographic location.

Understanding the different components of these packages is essential for both current and aspiring CFOs to negotiate effectively and align their compensation with their responsibilities and the company’s performance.

CFO Salary Trends and Future Outlook

Recent Trends in CFO Compensation

1. Salary Increases:

Approximately 80% of CFOs received salary increases, with a median increase of 5.5%.

This trend indicates a positive trajectory in CFO compensation, with salary increases generally larger for CFOs compared to CEOs.

2. Annual Bonuses:

Bonuses have declined for just over half of CFOs, with an average decrease of 12%.

This reduction in bonuses may reflect a shift towards more long-term incentive plans.

3. Equity Awards:

The grant date fair value of equity awards increased by 17%, on average, for CFOs.

This significant increase suggests a growing emphasis on equity-based compensation as part of the total pay package.

4. Total Compensation:

Overall, total compensation increased modestly for CFOs by approximately 2%, with significant fluctuations observed for some individuals.

5. Pay Mix:

Equity awards comprised 56% of total compensation for CFOs, indicating a continued focus on aligning executive interests with shareholder value.

The Future of CFO Salaries

1. Stable Median Compensation:

The median total reported compensation for CFOs remained stable at $4.7 million across 2021 and 2022.

This stability suggests a cautious approach to CFO compensation amid economic uncertainties.

2. Sector-Specific Changes:

Different sectors have experienced varying trends in CFO compensation.

For instance, the communication services sector saw a substantial surge in median pay, while other sectors like consumer cyclical and basic materials witnessed declines.

3. Shift Towards Stock-Based Compensation:

Stock grants have become more prevalent in executive compensation, with stock-based compensation rising by 9.7% since 2018.

This trend reflects a shift towards long-term incentives over fixed and short-term compensation.

4. Economic Influences:

The future outlook for CFO salaries will likely be influenced by broader economic factors such as inflation, market volatility, and industry performance.

Companies may continue to adjust their compensation structures to balance short-term financial challenges with long-term strategic goals.

While recent trends in CFO compensation show a mix of stability and variability, the future outlook remains cautiously optimistic, with a continued emphasis on equity-based incentives and alignment with long-term company performance.

Strategies for Negotiating CFO Compensation

Negotiating compensation is a critical aspect of any CFO’s career progression.

Understanding how to navigate these discussions can significantly impact your financial package and career trajectory.

Here are some strategies for effectively negotiating CFO compensation:

1. Know Your Worth:

Research the market rates for CFO positions within companies of similar size and industry.

Websites like Glassdoor, PayScale, and the Bureau of Labor Statistics can provide valuable insights into average salaries and compensation packages.

For example, according to a 2023 report by PayScale, the average salary for a CFO in the United States is approximately $140,000 to $250,000, depending on the company size and location.

2. Leverage Your Experience:

Highlight your unique qualifications, achievements, and contributions to previous organizations.

Prepare a list of your accomplishments, such as successful financial strategies you implemented or how you improved the company’s bottom line.

3. Consider the Entire Compensation Package:

Look beyond the base salary.

Negotiate for bonuses, stock options, retirement plans, and other benefits that can enhance your overall compensation.

For instance, a study by Equilar found that long-term incentive awards constitute a significant portion of a CFO’s total compensation in large corporations.

4. Be Prepared to Walk Away:

Knowing your bottom line and being willing to walk away from an offer that doesn’t meet your expectations is a powerful negotiating tool.

It demonstrates your confidence and value as a professional.

5. Seek Professional Advice:

Consider consulting with a career coach or compensation specialist who can provide personalized advice and negotiation strategies.

6. Practice Negotiation:

Role-play negotiation scenarios with a trusted colleague or mentor to build your confidence and refine your approach.

Remember, negotiation is a two-way street.

Approach the discussion with a collaborative mindset, aiming for a compensation package that reflects your value to the company while aligning with its financial capabilities.

FAQs - Frequently Asked Questions About CFO Salaries

What is the average salary for a CFO in 2024?

The average salary for a CFO in 2024 ranges from $150,000 to over $1 million, depending on company size.

Learn More...

CFO salaries vary significantly based on the size of the company.

In small companies with revenue less than $50 million, CFOs can expect an average salary of $150,000 to $250,000.

For medium-sized companies with revenue between $50 million and $1 billion, the range increases to $250,000 to $400,000.

Large companies with revenue over $1 billion offer the highest salaries, with CFOs earning an average of $400,000 to over $1 million, often supplemented with substantial bonuses and stock options.

How does company size impact CFO compensation?

Larger companies typically offer higher salaries to CFOs due to increased complexity and responsibilities.

Learn More...

As the size of a company increases, so does the complexity of its financial operations and the scope of the CFO's responsibilities.

This expansion in role and responsibilities is typically reflected in the compensation package offered to the CFO.

Larger companies often have more resources and a greater ability to pay higher salaries, bonuses, and other forms of compensation.

Additionally, the CFO's impact on a larger organization's financial health and strategic direction is more pronounced, justifying higher compensation levels.

What factors influence CFO salary besides company size?

Industry, location, experience, education, skills, and company performance are key factors influencing CFO salary.

Learn More...

Besides company size, several other factors impact CFO compensation:

- Industry: Industries with higher revenue potential or more complex financial structures may offer higher salaries.

- Location: Geographic location affects salary levels due to variations in the cost of living and demand for CFOs.

- Experience: CFOs with a longer track record of success in financial management roles command higher salaries.

- Education and Qualifications: Higher education levels and professional certifications can enhance earning potential.

- Skills: Skills such as strategic planning, financial reporting, and leadership are highly valued for the CFO role.

- Company Performance: In many companies, a portion of the CFO's salary may be tied to the company's financial performance.

What additional compensation do CFOs receive?

CFOs often receive bonuses, stock options, long-term incentive plans, and other benefits.

Learn More...

In addition to base salary, CFOs typically receive various forms of additional compensation:

- Bonuses: Usually tied to individual and company performance metrics, with average bonus potential around 30-60% of base salary.

- Stock Options: Common in public companies, allowing CFOs to purchase company stock at a predetermined price.

- Long-Term Incentive Plans (LTIPs): Designed to reward CFOs for achieving long-term company goals, often tied to shareholder return or financial performance.

- Benefits and Perquisites: Can include retirement plans, health insurance, and other perks, varying by company size and industry.

How can CFOs negotiate their compensation effectively?

Research market rates, leverage experience, consider the entire compensation package, and be prepared to walk away.

Learn More...

Effective negotiation strategies for CFOs include:

- Know Your Worth: Research average salaries for similar positions in your industry and location.

- Leverage Your Experience: Highlight your achievements and contributions to previous organizations.

- Consider the Entire Compensation Package: Look beyond base salary and negotiate for bonuses, equity, and benefits.

- Be Prepared to Walk Away: Knowing your bottom line and being willing to walk away from an offer that doesn't meet your expectations demonstrates confidence and value.

- Seek Professional Advice: Consulting with a career coach or compensation specialist can provide personalized advice and negotiation strategies.

In Summary…

In our analysis, we’ve explored the average CFO salary across different company sizes, shedding light on how the scale of an organization influences compensation.

Our findings reveal a clear correlation between company size and CFO remuneration, with larger companies typically offering higher salaries to reflect the increased complexity and responsibility of the role.

- Small Companies (Revenue less than $50 million):

CFOs in these firms earn an average salary range of $150,000 to $250,000 annually.

- Medium-Sized Companies (Revenue between $50 million and $1 billion):

The average salary range for CFOs increases to $250,000 to $400,000.

- Large Companies (Revenue over $1 billion):

CFOs in these organizations command the highest salaries, with an average range of $400,000 to over $1 million, often supplemented with substantial bonuses and stock options.

These figures, drawn from reputable sources such as the Bureau of Labor Statistics and industry reports, underscore the significant impact of company size on CFO compensation.

However, it’s important to note that these are averages, and actual salaries can vary based on factors such as industry, geographic location, and individual experience.

Additionally, the article has offered practical strategies for negotiating compensation, emphasizing the importance of research, leveraging experience, and considering the entire compensation package.

Ready to take the next step in your career or enhance your company’s financial leadership?

Contact us today to schedule your consultation and unlock new opportunities!

The role of the CFO is continually evolving, with an increasing emphasis on strategic decision-making and business leadership.

As companies navigate the complexities of the modern business environment, the value placed on effective financial leadership is likely to rise, potentially leading to even greater increases in CFO salaries.

As the role of the CFO continues to evolve, staying informed about compensation trends will be crucial for both individuals and companies alike.

Applying the information found here can help you make more informed career decisions, improve negotiation outcomes, and better align a CFO’s compensation and their value to the company.

For businesses, this knowledge can aid in attracting and retaining top financial talent, ensuring that compensation packages are competitive and aligned with the company’s goals.

If you’re looking to further understand how these insights can be applied to your specific situation or if you’re seeking personalized advice on navigating CFO compensation, we encourage you to schedule a consultation call with Business Initiative.

We provide tailored guidance to help you maximize your earning potential and career growth.

Don’t miss out on the latest insights and updates - subscribe to our The Initiative Newsletter and follow us on X (Twitter) for regular tips and industry news.

Methodology

To provide an accurate and comprehensive analysis of CFO salaries based on company size, we have employed a multifaceted approach in gathering and analyzing data.

Our methodology is outlined below:

Data Sources:

We have utilized data from several reputable sources to ensure the reliability of our findings.

These can be found in the sources dropdown right before this section.

Criteria for Defining Company Size:

Company size has been defined based on annual revenue, which is a common metric used to categorize companies into different size segments.

The revenue ranges used in our analysis are as follows:

-

Small Companies: Revenue less than $50 million

-

Medium-Sized Companies: Revenue between $50 million and $1 billion

-

Large Companies: Revenue over $1 billion

Statistical Methods:

Our analysis employs the following statistical methods to calculate average salaries and analyze trends:

-

Descriptive Statistics: Calculating average salaries and compensation packages for CFOs within each company size category.

-

Comparative Analysis: Comparing average salaries and equity grants across different company sizes to identify trends and disparities.

-

Trend Analysis: Examining changes in CFO compensation over time to identify emerging patterns and insights.

By adhering to this methodology, we have worked to provide a comprehensive and accurate overview of CFO salaries by company size, enabling YOU, the reader, to understand the various factors that influence compensation in this critical executive role.

Sources

- McKinsey & Company: How the role of the CFO is evolving

- Cowen Partners: CFO Salary Guide 2023

- BDO: Private Company Executive Compensation Survey Report 2023

- Comparably: Salaries for CFO

- iProledge: Understanding CFO Salaries - How Much Can a CFO Earn?

- DigitalDefynd: CFO Salaries in the US and the World

- PayScale: Chief Financial Officer (CFO) Salary

- Cowen Partners: Average CFO Salary by Revenue

- Salary.com: Chief Financial Officer Salary

- CFO Search: CFO Salary

- Harvard Law School Forum on Corporate Governance: An Early Look at 2023 CEO & CFO Pay Actions

- Equilar: 2023 CFO Pay Trends

- Deloitte: Executive Compensation Plan - Perform & Pay

- Harvest CFO: CFO Compensation in PE Portfolio Companies

- CAP: Pay Trends Spotlight on Chief Financial Officers - 2023 Update