Discover the transformative power of record-breaking charitable giving in our comprehensive analysis of the CCS Fundraising 2025 Philanthropic Landscape report.

With $592.5 billion flowing through the U.S. charitable sector in 2024, this landmark study from CCS Fundraising reveals the seismic shifts reshaping how nonprofits connect with donors, leverage technology, and build sustainable impact.

From the Great Wealth Transfer of $124 trillion to the 77% of nonprofits preparing to adopt AI, we analyze the key findings from this authoritative research that will define nonprofit success in the coming decade.

Key Takeaways

Key Takeaways

- Record giving creates opportunity: $592.5B in 2024 charitable giving shows unprecedented resources available, with individuals contributing 66% of total donations.

- The Great Wealth Transfer is here: $124T shifting to Millennials and Gen Z over 25 years requires new engagement strategies focused on impact and digital connection.

- AI adoption is accelerating: 77% of nonprofits plan AI implementation within 3-5 years for personalized communications and predictive donor analytics.

- Corporate partnerships are growing: $44.4B in corporate giving (+9.1%) presents massive opportunities, with billions in matching gifts still unclaimed.

- High-net-worth focus on impact: Top donors expect transparency, measurable outcomes, and personalized engagement—lessons all nonprofits can apply.

This analysis transforms complex philanthropic data into actionable strategies for nonprofit leaders, fundraising professionals, and business owners seeking meaningful partnerships.

We’ll show you how to harness these macro trends for micro-level success in your organization.

Table of Contents

Table of Contents

- Record-Breaking Giving: The $592.5B Landscape

- High-Net-Worth Donor Strategies

- The Great Wealth Transfer: Preparing for $124T

- Corporate Partnership Opportunities

- AI and Technology in Modern Fundraising

- Sector-Specific Growth Opportunities

- Global Philanthropy Insights

- Nonprofit Leadership Challenges

- For Business Owners: Strategic Philanthropy

- FAQs about Philanthropic Trends

- Conclusion

Ready to transform your understanding of the philanthropic landscape and unlock new opportunities for impact?

Let’s dive into the data that’s reshaping nonprofit strategy across America and beyond.

Record-Breaking Giving: The $592.5B Landscape

According to the CCS Fundraising 2025 Philanthropic Landscape report, the 2024 charitable giving landscape reached unprecedented heights with $592.5 billion in total contributions—a record that signals both opportunity and evolution in the nonprofit sector.

The Giving Breakdown:

- Individuals: $392.5B (66%, +8.2% growth)

- Foundations: $109.8B (19%, +2.4% growth)

- Corporations: $44.4B (7%, +9.1% growth)

- Bequests: $45.8B (8%)

This distribution reveals a critical insight: individual donors remain the backbone of American philanthropy, contributing two-thirds of all charitable dollars.

Economic Context:

- Disposable personal income grew 5.3% (current dollars), 2.2% (inflation-adjusted)

- Giving as share of income held steady at 1.8% in 2024

- Historical range: 1.7% (1995 low) to 2.4% (2005 peak)

The Religious Giving Shift:

A profound transformation is underway: religious giving declined from 56% of charitable dollars (1985-89) to just 25% (2020-24).

This shift redirects billions toward secular causes, creating opportunities for nonprofits in education, health, environment, and social services.

Initiative Insight:

The steady 1.8% giving rate amid record absolute dollars indicates wealth concentration driving philanthropy.

Nonprofits must balance broad-based donor cultivation with high-impact donor strategies.

High-Net-Worth Donor Strategies

High-net-worth individuals are reshaping philanthropy with unprecedented generosity and strategic focus:

The Numbers That Matter:

- Global HNWI wealth: +4.2% growth in 2024

- North America: +8.9% HNWI wealth, +7.3% population growth

- Top 25 U.S. philanthropists: $241B lifetime giving (+14%)

- Top 50 U.S. donors: $16.2B in 2024 alone (+32%)

Mega-Gifts of 2024:

- Reed Hastings & Patty Quillin: $1.1B (Netflix stock to Silicon Valley Community Foundation)

- Michael Bloomberg: $1B (Johns Hopkins University)

- Ruth Gottesman: $1B (Albert Einstein College of Medicine)

The Strategic Focus:

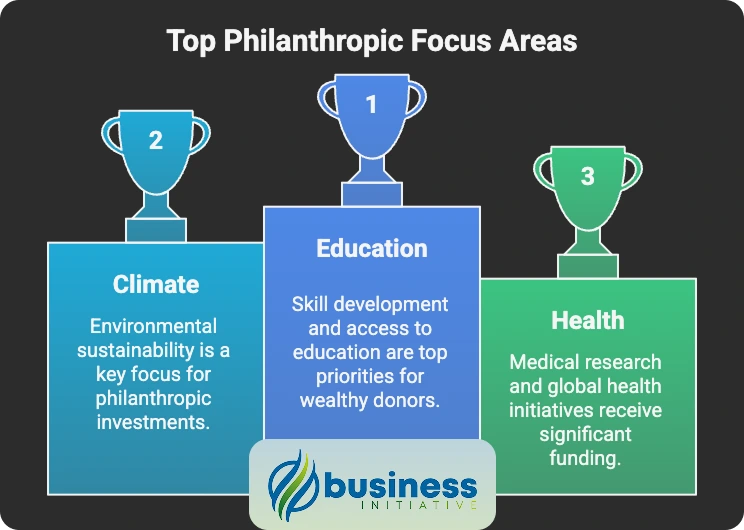

Wealthy donors prioritize five key areas:

- Education (skill development, access)

- Climate (environmental sustainability)

- Health (medical research, global health)

- Equity & Democracy (social justice, civic engagement)

- AI for Good (ethical technology development)

The MacKenzie Scott Model:

As CCS Fundraising notes: “Her philanthropy challenges traditional assumptions… Over $2B in unrestricted grants in 2024.” This approach emphasizes:

- Trust-based philanthropy (minimal reporting requirements)

- Unrestricted funding (organizational flexibility)

- Rapid deployment (quick decision-making)

Initiative Insight:

Even smaller nonprofits can apply HNWI principles: demonstrate measurable impact, provide transparent reporting, and offer personalized engagement. The expectation for professionalism scales down, not the standards.

The Great Wealth Transfer: Preparing for $124T

The largest intergenerational wealth transfer in history is underway, fundamentally altering philanthropic engagement:

The Scale:

- $124 trillion shifting over 25 years

- $85 trillion flowing to Millennials and Gen Z

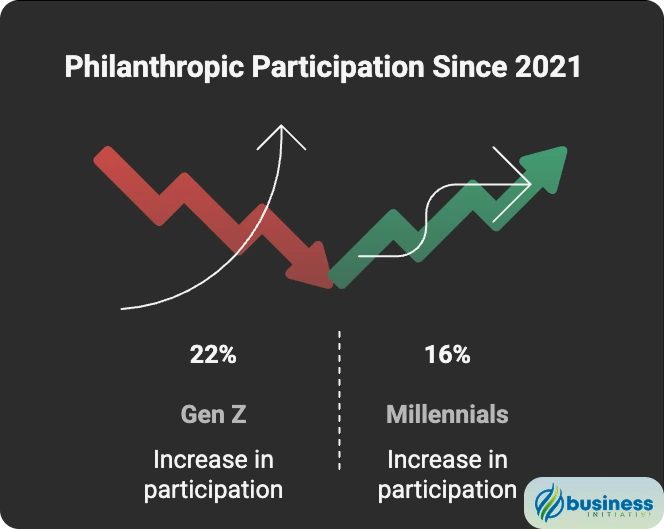

- Millennial participation: +16% since 2021

- Gen Z participation: +22% since 2021

Generational Giving Preferences:

Millennials & Gen Z Demand:

- Visible, immediate impact (not long-term endowments)

- Authentic digital engagement (social media integration)

- Matching grant opportunities (72% Millennials, 71% Gen Z respond positively)

- Cause alignment with personal values

Traditional Donors (Boomers/Gen X):

- Institutional loyalty (repeat giving to same organizations)

- Major gift capacity (larger individual contributions)

- Board service (governance engagement)

- Legacy planning (bequest commitments)

The Engagement Challenge:

Younger donors expect nonprofits to:

- Communicate impact in real-time (social media updates, video testimonials)

- Offer multiple giving channels (mobile-optimized, social giving)

- Provide volunteer opportunities (hands-on engagement)

- Demonstrate organizational diversity (inclusive leadership, equitable practices)

Initiative Insight:

Create dual engagement strategies: maintain traditional stewardship for current major donors while building digital-first relationships with younger prospects.

The organizations that master both approaches will thrive during this transition.

Corporate Partnership Opportunities

Corporate philanthropy presents massive untapped opportunities for strategic nonprofits:

Corporate Giving Growth:

- Total 2024: $44.4B (7% of all U.S. giving)

- Growth rate: +9.1% (current dollars), +6% (inflation-adjusted)

- Drivers: Record corporate profits, strong stock market performance

The Matching Gift Goldmine:

65% of Fortune 500 companies offer matching gift programs, yet billions remain unclaimed annually.

This represents immediate revenue potential for nonprofits that:

- Educate donors about employer matching

- Streamline the process (online matching gift databases)

- Follow up systematically (automated reminders)

- Track completion rates (measure and optimize)

Corporate Focus Areas:

Growing Investment:

- Health initiatives (employee wellness alignment)

- Economic development (community impact)

- Skills-based volunteering (employee engagement)

Declining Investment:

- Equity-related programs (post-2020 pullback)

- General diversity initiatives (political sensitivities)

Partnership Strategies:

For Nonprofits:

- Target companies with mission alignment (environmental nonprofits → green companies)

- Propose employee engagement opportunities (volunteer days, skills sharing)

- Offer measurable business value (community goodwill, employee satisfaction)

For Businesses:

- Seek nonprofits with transparent impact measurement

- Prioritize local community connections (where employees live/work)

- Consider multi-year commitments (deeper relationship building)

Initiative Insight:

Corporate partnerships work best when they’re mutually beneficial.

Nonprofits should position themselves as solutions to business challenges (employee retention, community relations, ESG goals) rather than just funding recipients.

AI and Technology in Modern Fundraising

According to the CCS Fundraising study, artificial intelligence is revolutionizing nonprofit operations with 77% of organizations planning adoption within 3-5 years:

AI Applications in Fundraising:

Generative AI:

- Personalized donor communications (customized thank-you letters, impact reports)

- Grant proposal writing (template generation, language optimization)

- Social media content (cause-specific messaging, donor stories)

Predictive AI:

- Donor behavior forecasting (likelihood to give, optimal ask amounts)

- Retention risk analysis (identify at-risk donors)

- Campaign optimization (timing, channels, messaging)

The CCS Insight:

Advanced modeling using 5 years of donor data helps nonprofits simulate scenarios like:

- Major gift portfolio changes (what if top 10 donors reduce giving?)

- Staff reduction impacts (how does fundraiser turnover affect revenue?)

- Economic downturn effects (recession response planning)

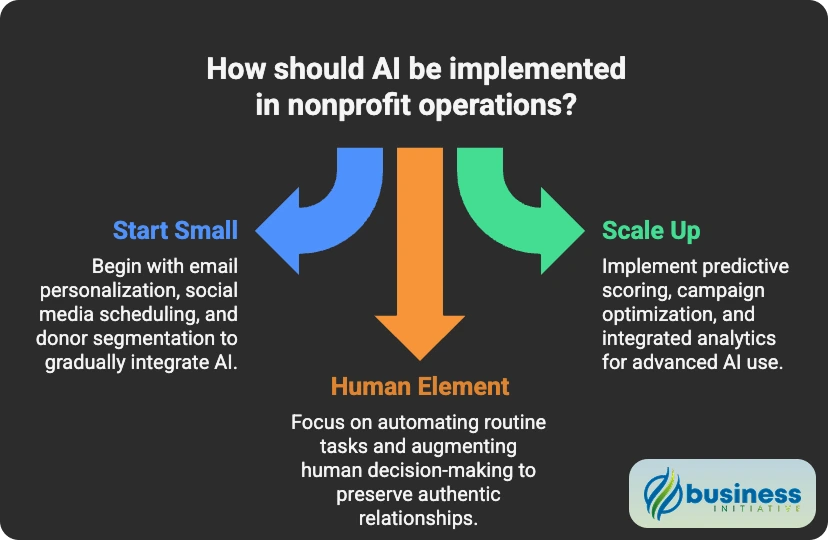

Implementation Strategies:

Start Small:

- Email personalization (donor name, giving history, interests)

- Social media scheduling (optimal posting times, content themes)

- Donor segmentation (automated list building, targeted campaigns)

Scale Up:

- Predictive scoring (prospect identification, major gift timing)

- Campaign optimization (A/B testing automation, performance tracking)

- Integrated analytics (cross-channel donor journey mapping)

The Human Element:

AI enhances but doesn’t replace human connection. The most successful implementations:

- Automate routine tasks (data entry, basic communications)

- Augment human decision-making (provide insights, not decisions)

- Preserve authentic relationships (AI-informed but human-delivered)

Initiative Insight:

Start with donor data quality before implementing AI. Clean, comprehensive data is essential for effective AI applications.

Consider partnering with technology providers rather than building in-house capabilities initially.

Sector-Specific Growth Opportunities

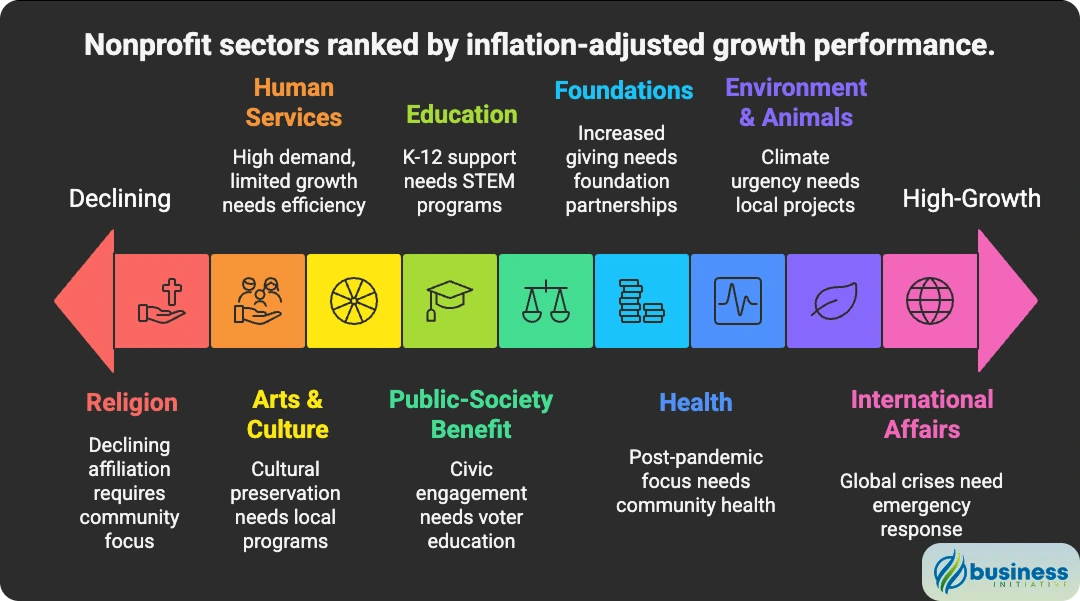

The CCS Fundraising report shows that all nine major nonprofit sectors grew in current dollars during 2024, but inflation-adjusted performance reveals strategic opportunities:

High-Growth Sectors:

International Affairs: +9.5% (inflation-adjusted)

- Drivers: Global crises, humanitarian needs

- Opportunity: Emergency response, refugee support, global health

Environment & Animals: +7.7% (inflation-adjusted)

- Drivers: Climate urgency, conservation awareness

- Opportunity: Local environmental projects, wildlife protection

Health: +5.0% (inflation-adjusted)

- Drivers: Post-pandemic focus, medical research

- Opportunity: Community health, disease research, mental health

Foundations: +5.0% (inflation-adjusted)

- Drivers: Increased foundation giving, DAF growth

- Opportunity: Foundation partnerships, capacity building

Moderate Growth Sectors:

Public-Society Benefit: +3.5%

- Focus: Civic engagement, democracy support

- Opportunity: Voter education, government transparency

Education: +2.0%

- Focus: K-12 support, higher education

- Opportunity: STEM programs, educational equity

Arts & Culture: +1.9%

- Focus: Cultural preservation, community arts

- Opportunity: Local arts programs, cultural education

Challenging Sectors:

Human Services: +0.1%

- Challenge: High demand, limited growth

- Strategy: Efficiency improvements, partnership development

Religion: -1.0%

- Challenge: Declining religious affiliation

- Strategy: Community service focus, interfaith collaboration

Strategic Implications:

For Growing Sectors:

- Capitalize on momentum with expanded programs

- Attract new donors interested in trending causes

- Build strategic reserves for future downturns

For Stable Sectors:

- Focus on efficiency and cost optimization

- Develop unique value propositions

- Strengthen donor relationships for retention

For Declining Sectors:

- Diversify funding sources beyond traditional donors

- Emphasize community impact over institutional identity

- Consider strategic partnerships or mergers

Initiative Insight:

Sector trends inform but shouldn’t dictate strategy.

A well-run organization in a declining sector can outperform a poorly-managed one in a growing sector.

Focus on organizational excellence while staying aware of macro trends.

Global Philanthropy Insights

The CCS Fundraising global analysis reveals philanthropy patterns that offer valuable insights for U.S. nonprofits expanding internationally or serving diverse communities:

Global Giving Patterns:

- Average giving worldwide: 1% of income

- Most generous nations: Nigeria, Egypt, China, Ghana, Kenya

- Giving preferences: 71% local, 46% national, 23% international (in-country), 12% international (abroad)

Regional Insights:

Africa - The Generosity Leader:

- Most generous continent: 1.5% of income donated

- Nigeria leads: 2.8% of income donated

- Notable initiatives:

- Tony Elumelu Foundation: $100M to 20,000 entrepreneurs

- Gift of the Givers (South Africa): 100 disaster responses

Asia - Technology-Driven Giving:

- Average giving: 1.3% of income

- Major donors: Yu Renrong $745M (China), Lei Jun $182M (Xiaomi founder)

- Environmental focus: Vietnam (37%), China (27%), India (24%) lead in environmental giving

Middle East - Crisis Response:

- High giving rates: Qatar, UAE, Egypt donors give 1.9%+ of income

- Humanitarian focus: Qatar Charity provided 70K food packages, 12K blankets for Gaza

- Education investment: Saudi Arabia $38M to Global Partnership for Education

Oceania - Major Gift Culture:

- Australia giving: 0.7% of income (4th globally)

- Large individual gifts:

- Geoff Cumming: A$250M for pandemic therapeutics

- Nicola Forrest: A$100M for women’s fund

Lessons for U.S. Nonprofits:

Local Focus Wins Globally: The 71% preference for local giving reinforces the importance of community connection in fundraising appeals.

Crisis Response Mobilizes: Middle Eastern and African examples show how immediate humanitarian needs can generate extraordinary giving.

Technology Enables Giving: Asian philanthropy’s tech integration suggests opportunities for digital innovation in donor engagement.

Environmental Urgency: High environmental giving rates in developing nations indicate global climate consciousness that U.S. nonprofits can tap into.

Initiative Insight:

U.S. nonprofits can learn from global patterns: emphasize local impact even in national campaigns, leverage technology for engagement, and recognize that crisis response generates immediate donor interest across all cultures.

Nonprofit Leadership Challenges

According to the CCS Fundraising research, the nonprofit sector faces significant leadership and operational challenges that create both risks and opportunities:

The Leadership Crisis:

One-third of nonprofit CEOs plan to leave within 2 years, creating unprecedented succession challenges.

Contributing Factors:

- Burnout from pandemic demands

- Increased accountability pressures

- Compensation gaps with private sector

- Board governance challenges

As CCS Fundraising notes: “Nonprofits must proactively plan for succession by assessing talent and preserving institutional knowledge.”

DEI Implementation Struggles:

Diversity, Equity & Inclusion Challenges:

- 49% struggle to reach diverse donors

- 45% unsure how to measure DEI progress

- 30% face internal resistance to DEI initiatives

The Opportunity: Organizations that successfully implement DEI strategies gain:

- Broader donor base (reflecting community demographics)

- Enhanced credibility with younger donors

- Improved staff retention (inclusive workplace culture)

- Stronger community partnerships (authentic relationships)

Donor Acquisition & Retention:

Acquisition Challenges:

- 53% saw donor growth in 2024 (down from 57% in 2023)

- Competition increasing for donor attention

- Digital fatigue affecting online engagement

Retention Obstacles:

- 33% cite limited resources for donor stewardship

- 22% report low donor engagement levels

- 19% blame economic factors for donor attrition

Strategic Solutions:

Leadership Development:

- Succession planning (identify and develop internal candidates)

- Board engagement (active governance, strategic oversight)

- Professional development (leadership training, peer networks)

- Compensation review (competitive packages, benefits)

DEI Integration:

- Community engagement (authentic relationship building)

- Measurement systems (track progress, adjust strategies)

- Staff training (cultural competency, inclusive practices)

- Leadership diversity (board and staff representation)

Donor Relationship Management:

- Retention focus (stewardship over acquisition)

- Personalized engagement (tailored communications)

- Value demonstration (clear impact reporting)

- Multi-channel approach (digital + traditional touchpoints)

Initiative Insight:

Organizations that address these challenges proactively will gain competitive advantage.

Invest in leadership pipeline development, authentic DEI implementation, and donor-centric operations to build resilience during this transition period.

For Business Owners: Strategic Philanthropy

Based on the CCS Fundraising findings, the 2025 philanthropic landscape creates unprecedented opportunities for business owners to engage strategically with nonprofits:

Partnership Opportunities:

Matching Gift Programs:

- Immediate impact: Double employee contributions automatically

- Employee engagement: 72% of Millennials respond positively to matching opportunities

- Tax benefits: Corporate deductions plus employee satisfaction

- Implementation: Partner with platforms like Benevity or Double the Donation

Skills-Based Volunteering:

- Professional expertise: Marketing, finance, technology, operations

- Employee development: Leadership skills, team building, purpose-driven work

- Nonprofit capacity: Access to expensive professional services

- Measurable impact: Track volunteer hours and project outcomes

Strategic Sector Alignment:

High-Growth Sectors for Business Partnership:

Environmental & Climate (+7.7% growth)

- Tech companies: Carbon offset programs, renewable energy

- Manufacturing: Sustainable supply chain initiatives

- Real estate: Green building certifications, conservation

Health (+5.0% growth)

- Healthcare businesses: Community health programs

- Wellness companies: Mental health initiatives

- Food industry: Nutrition education, food security

International Affairs (+9.5% growth)

- Global companies: International development, education

- Import/export businesses: Fair trade, economic development

- Technology firms: Digital inclusion, global connectivity

➤ MORE: Unlock the Secrets of Nonprofit Profitability

The Business Case:

Brand Benefits:

- Community goodwill (local market reputation)

- Employee retention (purpose-driven workplace culture)

- Customer loyalty (shared values alignment)

- ESG compliance (environmental, social, governance reporting)

Financial Advantages:

- Tax deductions (charitable contributions, volunteer time)

- Grant opportunities (government incentives for community investment)

- Cost savings (employee engagement reduces turnover costs)

- Risk mitigation (community relationships provide crisis support)

Implementation Strategy:

Phase 1: Foundation Building

- Assess company values (mission alignment with nonprofit causes)

- Employee surveying (gauge interest, identify passion areas)

- Local research (identify high-performing nonprofits)

- Initial partnership (start small, measure impact)

Phase 2: Program Development

- Formal giving policy (budget allocation, decision criteria)

- Employee engagement (volunteer time off, skills sharing)

- Measurement systems (track participation, outcomes, satisfaction)

- Communication strategy (internal and external messaging)

Phase 3: Strategic Integration

- Board service (executive leadership on nonprofit boards)

- Long-term commitments (multi-year partnerships)

- Collaborative initiatives (joint programs, shared resources)

- Industry leadership (model for peer companies)

Initiative Insight:

The most successful business-nonprofit partnerships are mutually beneficial and strategically aligned.

Focus on causes that resonate with your company values, employee interests, and customer base. Start small, measure impact, and scale successful initiatives.

FAQs - Frequently Asked Questions About Philanthropic Trends in 2025

What are the biggest trends in charitable giving for 2025?

Record-breaking $592.5B in giving, with individuals contributing 66% of donations.

The Great Wealth Transfer of $124T to younger generations is reshaping donor preferences.

Learn More...

The 2025 philanthropic landscape shows unprecedented growth with $592.5 billion in total U.S. charitable giving, representing a new record high.

Individual donors remain the backbone of American philanthropy, contributing $392.5 billion (66% of total giving) with 8.2% growth year-over-year.

Corporate giving reached $44.4 billion with impressive 9.1% growth, while foundation giving totaled $109.8 billion.

The Great Wealth Transfer is accelerating, with $124 trillion shifting to Millennials and Gen Z over 25 years, fundamentally changing how nonprofits must engage donors.

- Millennial charitable participation increased 16% since 2021

- Gen Z participation surged 22% in the same period

- Religious giving declined from 56% (1985-89) to 25% (2020-24)

- Environmental and climate causes saw 7.7% inflation-adjusted growth

These trends indicate a shift toward impact-focused, digitally-engaged philanthropy that demands transparency and measurable outcomes.

How is AI transforming nonprofit fundraising in 2025?

77% of nonprofits plan to adopt AI within 3-5 years for donor analytics and personalized communications.

Learn More...

According to the CCS Fundraising study, artificial intelligence is revolutionizing nonprofit operations with 77% of organizations planning implementation within the next 3-5 years.

Generative AI enables personalized donor communications, including customized thank-you letters, impact reports, and grant proposal writing with template generation and language optimization.

Predictive AI applications include donor behavior forecasting to determine likelihood to give and optimal ask amounts, retention risk analysis to identify at-risk donors, and campaign optimization for timing, channels, and messaging.

- Email personalization using donor history and interests

- Social media scheduling for optimal engagement times

- Automated donor segmentation and targeted campaigns

- Predictive scoring for prospect identification

- Cross-channel donor journey mapping

Advanced modeling using 5 years of donor data helps nonprofits simulate scenarios like major gift portfolio changes, staff reduction impacts, and economic downturn effects.

The most successful AI implementations automate routine tasks while augmenting human decision-making and preserving authentic donor relationships.

What is the Great Wealth Transfer and how does it affect nonprofit donations?

$124 trillion is transferring to Millennials and Gen Z over 25 years, changing donor expectations.

Younger donors demand visible impact, digital engagement, and cause alignment with personal values.

Learn More...

The Great Wealth Transfer represents the largest intergenerational wealth shift in history, with $124 trillion moving over 25 years and $85 trillion specifically flowing to Millennials and Gen Z.

This demographic shift is already impacting charitable giving patterns, with Millennial participation increasing 16% and Gen Z participation growing 22% since 2021.

Younger donors have fundamentally different expectations compared to traditional donors, demanding visible immediate impact rather than long-term endowments, authentic digital engagement through social media integration, and cause alignment with personal values.

- 72% of Millennials and 71% of Gen Z respond positively to matching grant opportunities

- They expect real-time impact communication through social media and video testimonials

- Multiple giving channels are required, including mobile-optimized and social giving platforms

- Volunteer opportunities and hands-on engagement are essential

- Organizational diversity in leadership and equitable practices are non-negotiable

Traditional donors (Boomers/Gen X) maintain institutional loyalty with larger individual contributions and board service commitments, while younger donors prefer frequent, smaller contributions tied to immediate, measurable outcomes.

Nonprofits must develop dual engagement strategies to maintain traditional stewardship while building digital-first relationships with younger prospects to thrive during this transition.

Which nonprofit sectors are growing fastest in 2025?

International Affairs leads with 9.5% growth, followed by Environment & Animals at 7.7%.

Health sector grew 5.0% driven by post-pandemic focus and medical research funding.

Learn More...

The CCS Fundraising report reveals that while all nine major nonprofit sectors grew in current dollars during 2024, inflation-adjusted performance shows distinct winners and challenges.

International Affairs leads growth at 9.5% inflation-adjusted, driven by global crises, humanitarian needs, and increased focus on emergency response, refugee support, and global health initiatives.

Environment & Animals achieved 7.7% inflation-adjusted growth, powered by climate urgency, conservation awareness, and opportunities in local environmental projects and wildlife protection.

- Health: 5.0% growth from post-pandemic focus and medical research

- Foundations: 5.0% growth from increased giving and DAF expansion

- Public-Society Benefit: 3.5% growth in civic engagement and democracy support

- Education: 2.0% growth in K-12 and higher education support

- Arts & Culture: 1.9% growth in cultural preservation and community arts

Challenging sectors include Human Services with minimal 0.1% growth due to high demand but limited funding growth, and Religion with -1.0% decline reflecting broader demographic shifts and declining religious affiliation.

Strategic implications suggest nonprofits in growing sectors should capitalize on momentum with expanded programs and attract new donors interested in trending causes, while those in stable or declining sectors should focus on efficiency, unique value propositions, and strategic partnerships.

How much do high-net-worth individuals donate and what causes do they support?

Top 25 U.S. philanthropists gave $241B lifetime (+14% growth), with $16.2B from top 50 donors in 2024 alone.

They prioritize Education, Climate, Health, Equity & Democracy, and AI for Good initiatives.

Learn More...

High-net-worth individuals are reshaping philanthropy with unprecedented generosity, as global HNWI wealth grew 4.2% in 2024, with North America seeing 8.9% HNWI wealth growth and 7.3% population increase.

The top 25 U.S. philanthropists have contributed $241 billion in lifetime giving with 14% growth, while the top 50 U.S. donors alone gave $16.2 billion in 2024, representing a remarkable 32% increase.

Major 2024 gifts include Reed Hastings & Patty Quillin's $1.1 billion Netflix stock donation to Silicon Valley Community Foundation, Michael Bloomberg's $1 billion to Johns Hopkins University, and Ruth Gottesman's $1 billion to Albert Einstein College of Medicine.

- Education: Skill development and access initiatives

- Climate: Environmental sustainability and conservation programs

- Health: Medical research and global health improvements

- Equity & Democracy: Social justice and civic engagement

- AI for Good: Ethical technology development and implementation

The MacKenzie Scott model exemplifies modern philanthropic approaches with over $2 billion in unrestricted grants in 2024, emphasizing trust-based philanthropy with minimal reporting requirements, unrestricted funding for organizational flexibility, and rapid deployment with quick decision-making.

Even smaller nonprofits can apply HNWI principles by demonstrating measurable impact, providing transparent reporting, and offering personalized engagement, as the expectation for professionalism scales down but standards remain high.

What corporate giving opportunities exist for businesses in 2025?

Corporate giving reached $44.4B with 9.1% growth, and 65% of Fortune 500 companies offer matching gifts.

Billions in matching gift programs remain unclaimed annually, representing immediate revenue potential.

Learn More...

Corporate philanthropy presents massive untapped opportunities with total 2024 giving reaching $44.4 billion (7% of all U.S. giving) and growth rates of 9.1% in current dollars and 6% inflation-adjusted, driven by record corporate profits and strong stock market performance.

The matching gift goldmine represents perhaps the greatest immediate opportunity, as 65% of Fortune 500 companies offer matching gift programs, yet billions remain unclaimed annually.

Corporate focus areas show growing investment in health initiatives aligned with employee wellness, economic development for community impact, and skills-based volunteering for employee engagement.

- Environmental & Climate partnerships: Carbon offset programs, renewable energy initiatives

- Health sector collaborations: Community health programs, mental health initiatives, nutrition education

- International Affairs partnerships: Fair trade, economic development, digital inclusion

- Skills-based volunteering: Marketing, finance, technology, and operations expertise

The business case for corporate philanthropy includes brand benefits like community goodwill and customer loyalty, financial advantages including tax deductions and cost savings from improved employee retention, and ESG compliance for environmental, social, and governance reporting.

Implementation should follow a three-phase approach: Foundation Building (assess values, survey employees, research local nonprofits), Program Development (formal giving policies, employee engagement, measurement systems), and Strategic Integration (board service, long-term commitments, collaborative initiatives).

The most successful partnerships are mutually beneficial and strategically aligned, focusing on causes that resonate with company values, employee interests, and customer base while starting small, measuring impact, and scaling successful initiatives.

What challenges are nonprofit organizations facing in 2025?

One-third of nonprofit CEOs plan to leave within 2 years, creating succession challenges.

49% struggle with DEI implementation and donor acquisition declined from 57% to 53%.

Learn More...

According to CCS Fundraising research, the nonprofit sector faces significant leadership and operational challenges that create both risks and opportunities for organizations.

The leadership crisis is unprecedented, with one-third of nonprofit CEOs planning to leave within 2 years, driven by burnout from pandemic demands, increased accountability pressures, compensation gaps with the private sector, and board governance challenges.

Diversity, Equity & Inclusion implementation struggles affect nearly half of all organizations, with 49% struggling to reach diverse donors, 45% unsure how to measure DEI progress, and 30% facing internal resistance to DEI initiatives.

- Donor acquisition: Only 53% saw growth in 2024 (down from 57% in 2023)

- Retention obstacles: 33% cite limited stewardship resources, 22% report low engagement

- Competition: Increasing competition for donor attention and digital fatigue

- Economic factors: 19% blame economic conditions for donor attrition

Strategic solutions require comprehensive approaches including succession planning to identify internal candidates, board engagement for active governance, professional development through leadership training, and competitive compensation reviews.

Organizations that successfully implement DEI strategies gain broader donor bases reflecting community demographics, enhanced credibility with younger donors, improved staff retention through inclusive workplace culture, and stronger community partnerships built on authentic relationships.

The path forward involves focusing on retention over acquisition, personalizing engagement through tailored communications, demonstrating clear value through impact reporting, and implementing multi-channel approaches combining digital and traditional touchpoints.

How are donor-advised funds (DAFs) impacting charitable giving in 2025?

DAF assets reached $251B in 2023 with a 560% increase since 2011.

They contributed $59.4B and granted $54.8B with a historic high 24% payout rate.

Learn More...

Donor-Advised Funds represent one of the fastest-growing vehicles in American philanthropy, with assets reaching $251 billion in 2023, representing a staggering 560% increase since 2011.

DAF activity in 2023 included $59.4 billion in contributions (down 21.7% from previous year) and $54.8 billion in grants (down 1.4%), but the payout rate reached a historic high of approximately 24%.

This growth reflects changing donor preferences for flexible, tax-advantaged giving that allows donors to contribute assets, receive immediate tax benefits, and then recommend grants to qualified nonprofits over time.

- Tax efficiency: Immediate deduction when contributing to DAF

- Investment growth: Assets can grow tax-free while deciding on grants

- Flexibility: No requirement to distribute immediately like private foundations

- Simplified giving: Streamlined process for supporting multiple charities

- Family engagement: Multi-generational philanthropic planning tool

The high payout rate indicates DAFs are actively distributing funds rather than warehousing assets, countering criticism that they delay charitable dollars reaching operating nonprofits.

For nonprofits, DAFs represent both opportunity and challenge - they provide access to significant funding pools but require different cultivation strategies focused on long-term relationship building with DAF holders rather than immediate transactional giving.

The integration of DAFs into comprehensive fundraising strategies should include donor education about DAF benefits, cultivation of existing DAF holders, and partnerships with DAF sponsors to reach new prospects.

What global philanthropy trends can inform U.S. nonprofit strategies?

Global average giving is 1% of income, with Nigeria leading at 2.8%.

71% prefer local giving, showing the importance of community connection worldwide.

Learn More...

The CCS Fundraising global analysis reveals philanthropy patterns that offer valuable strategic insights for U.S. nonprofits, with worldwide average giving at 1% of income and the most generous nations being Nigeria, Egypt, China, Ghana, and Kenya.

Giving preferences show strong local focus globally, with 71% preferring local causes, 46% supporting national initiatives, 23% backing international in-country projects, and only 12% supporting international abroad causes.

Africa emerges as the generosity leader, being the most generous continent at 1.5% of income donated, with Nigeria leading globally at 2.8% of income and notable initiatives like Tony Elumelu Foundation's $100 million to 20,000 entrepreneurs.

- Asia shows 1.3% income giving with major donors like Yu Renrong ($745M in China)

- Middle East donors in Qatar, UAE, Egypt give 1.9%+ of income with strong crisis response

- Oceania averages 0.8% with Australia at 0.7% but featuring large individual gifts

- Environmental giving rates: Vietnam (37%), China (27%), India (24%) lead globally

Key lessons for U.S. nonprofits include the universal preference for local focus, which reinforces the importance of community connection even in national campaigns, and crisis response mobilization, as Middle Eastern and African examples show how immediate humanitarian needs generate extraordinary giving.

Technology enablement is evident in Asian philanthropy's tech integration, suggesting opportunities for digital innovation in donor engagement, while environmental urgency shown by high environmental giving rates in developing nations indicates global climate consciousness that U.S. nonprofits can leverage.

Strategic applications include emphasizing local impact in all communications, leveraging technology for enhanced engagement, maintaining crisis response capabilities for immediate donor mobilization, and recognizing that environmental consciousness transcends geographic and economic boundaries.

In Summary…

The CCS Fundraising 2025 Philanthropic Landscape study reveals a sector in transformation, with $592.5 billion in charitable giving creating unprecedented opportunities for strategic nonprofits and forward-thinking businesses.

The convergence of record-breaking individual giving, the Great Wealth Transfer, AI adoption, and evolving donor expectations demands new approaches to fundraising, donor engagement, and organizational strategy.

For Nonprofits, the path forward requires:

- Embracing technology while maintaining human connection

- Preparing for generational change in donor preferences

- Building strategic partnerships with corporations and foundations

- Focusing on measurable impact and transparent communication

- Developing leadership pipelines to navigate succession challenges

For Business Owners, the opportunities include:

- Strategic philanthropy that aligns with business objectives

- Employee engagement through meaningful volunteer opportunities

- Community investment that generates long-term value

- Partnership development with high-performing nonprofits

- ESG leadership that differentiates in competitive markets

The organizations and businesses that act on these insights will thrive in the evolving philanthropic landscape, creating sustainable impact while building stronger communities.

To explore how these trends can transform your organization’s approach to philanthropy and partnerships, we invite you to schedule a consultation call with our Business Initiative team or reach out via our contact form.

Stay informed about the latest philanthropic trends and nonprofit strategies by subscribing to our Initiative Newsletter and following us on X for real-time insights and analysis.

Sources

- CCS Fundraising: 2025 Philanthropic Landscape 14th Edition

- BoardSource: Nonprofit Board Leadership

- Bolder Advocacy: Nonprofit Advocacy Tools

- Candid: Nonprofit Funding Data

- CCS Fundraising: Philanthropic Landscape

- Giving USA Foundation: Annual Reports on Giving

- Chronicle of Philanthropy: Nonprofit News

- Inside Philanthropy: Donor Profiles

- Independent Sector: Advocacy & Policy

- National Council of Nonprofits: Policy Analysis