As an entrepreneur, deciding on a business structure is one of the first critical decisions you’ll make.

One popular option is the sole proprietorship, a business owned and operated by a single individual.

But what are the chances of success with this type of business structure?

Key Takeaways

Key Takeaways

- Only 49.2% of businesses survive past their fifth year, with sole proprietorships facing even greater challenges due to single-owner dependency.

- 86.3% of nonemployer firms are sole proprietorships, representing approximately 24.6 million of the 28.5 million nonemployer businesses.

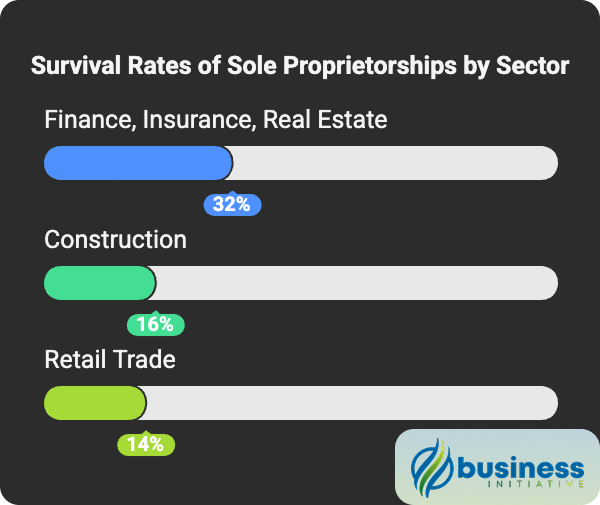

- Industry choice significantly impacts survival rates: finance/insurance/real estate (32%) vs construction (16%) and retail trade (14%).

- Limited access to capital is a major weakness - develop solid financial plans and explore alternative funding sources early.

- Strong networking, continuous skill development, and comprehensive business planning are the key differentiators between success and failure.

In this article, we’ll dive into the statistics surrounding the success and failure rates of sole proprietorships and the factors that contribute to these outcomes.

By the end of this article, you’ll be better prepared to make an informed decision about whether a sole proprietorship is right for you.

Table of Contents

Table of Contents

Success Rates of Sole Proprietorships

According to the latest Small Business Administration (SBA) 2024 report, sole proprietorships continue to dominate the U.S. business landscape.

Understanding how many sole proprietorships are there in the US and their success rates is crucial for aspiring entrepreneurs.

Current sole proprietorship statistics:

- 86.3% of nonemployer firms are sole proprietorships (Source: SBA 2024 FAQ)

- 13.0% of small employer firms are sole proprietorships (Source: SBA 2024 FAQ)

- With 28,477,518 nonemployer firms in the U.S., this means approximately 24.6 million sole proprietorships operate without employees (Source: SBA 2024 FAQ)

Despite their prevalence, the success rates for these businesses can be somewhat discouraging.

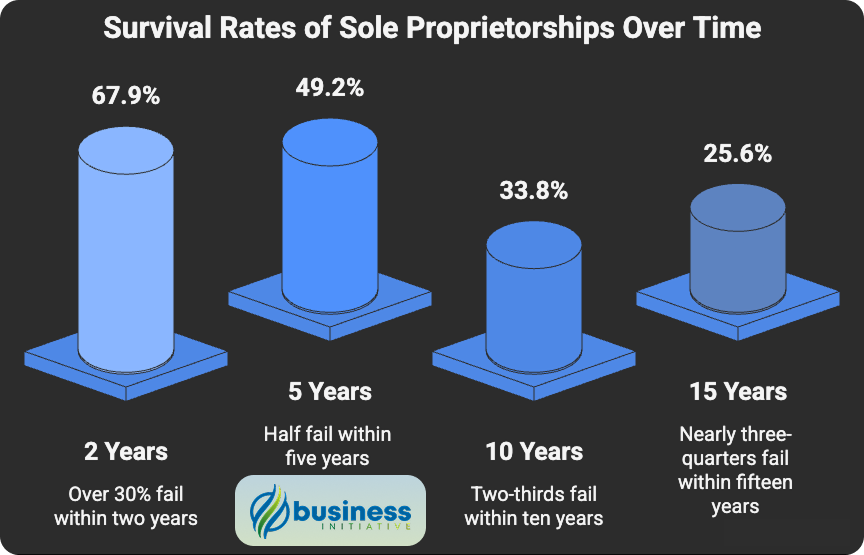

The latest SBA 2024 data reveals updated survival rates for new business establishments:

Updated business survival rates (1994-2021):

- 67.9% survive at least two years (Source: SBA 2024 FAQ)

- 49.2% survive five years (Source: SBA 2024 FAQ)

- 33.8% survive ten years (Source: SBA 2024 FAQ)

- 25.6% survive fifteen years (Source: SBA 2024 FAQ)

Key findings specifically for sole proprietorships:

- Sole proprietorships, representing the majority of nonemployer firms, face even greater challenges than these general statistics suggest

- Single-owner dependency creates unique vulnerabilities not present in other business structures

- Success varies dramatically by industry and individual circumstances

However, it’s worth noting that the success rates vary significantly according to the industry.

For example, sole proprietorships in the finance, insurance, and real estate sectors have a higher survival rate (32%) than those in the construction (16%) and retail trade (14%) sectors.

Failure Rates of Sole Proprietorships

As mentioned earlier, the overall failure rate for sole proprietorships can be quite high.

According to the latest SBA 2024 data, 50.8% of new business establishments do not survive past their fifth year.

However, it’s essential not to view this statistic in isolation.

The updated survival timeline shows: (Source: SBA 2024 FAQ)

- 32.1% fail within two years

- 50.8% fail within five years

- 66.2% fail within ten years

- 74.4% fail within fifteen years

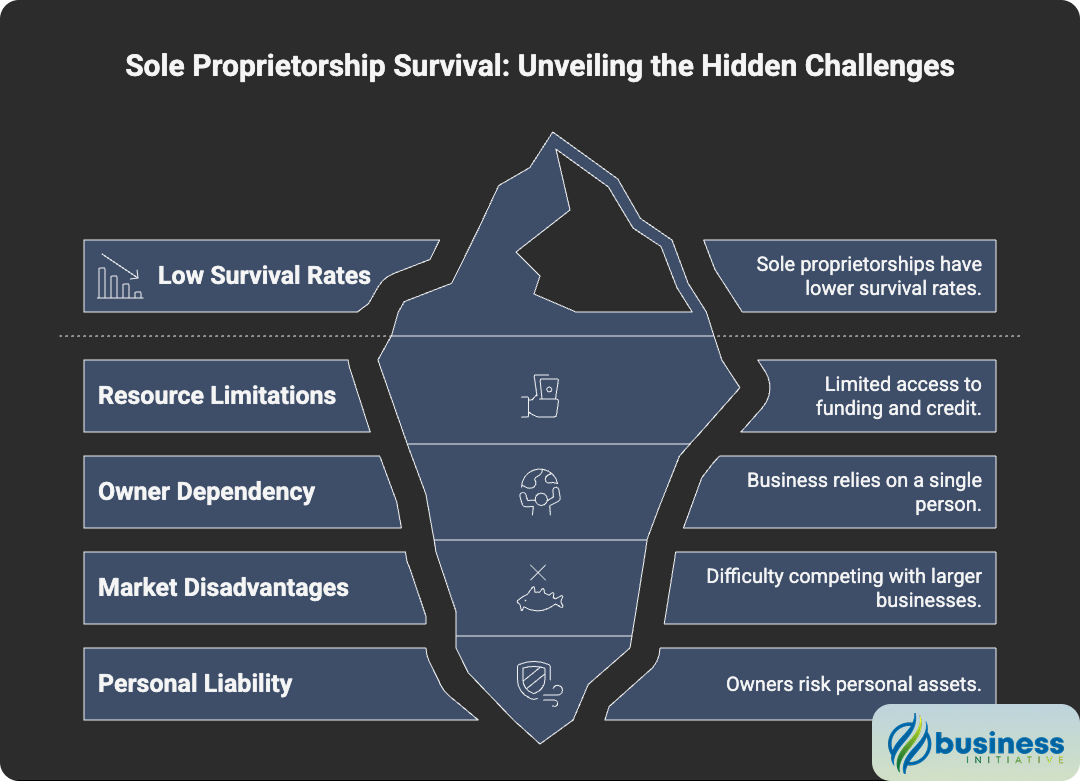

What makes sole proprietorship failure rates particularly concerning:

- Single point of failure: Unlike other business structures, sole proprietorships depend entirely on one person’s health, skills, and availability

- Limited capital access: Banks and investors are less likely to fund sole proprietorships compared to incorporated businesses

- No liability protection: Personal assets are at risk, making failure more devastating than for protected business structures

These factors explain some of the main reasons sole proprietorships fail at higher rates than other business structures.

Another study by the Fed Small Business revealed that sole proprietorships tend to have a lower survival rate than other types of business structures.

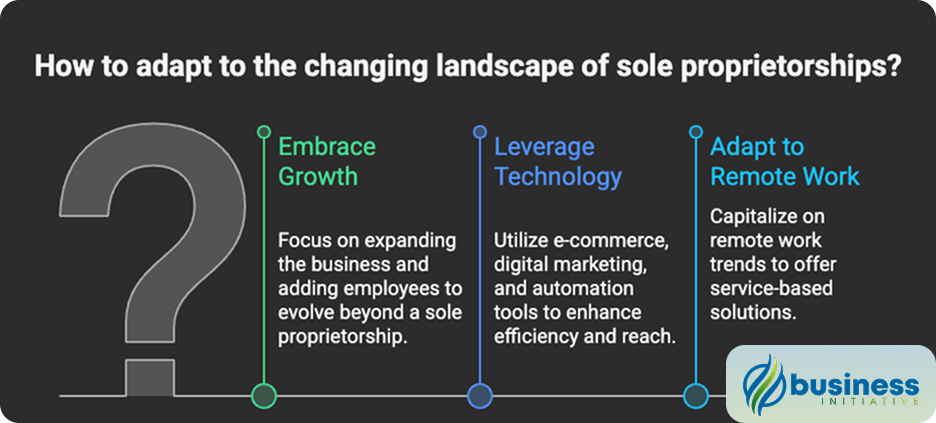

The study found that 46% of non-employer firms (businesses without employees) were planning to add employees in the next 12 months.

This doesn’t necessarily mean the business failed.

Rather, it shows successful sole proprietorships don’t remain sole proprietorships for long as they grow and expand.

➤ Discover: Unlock the secrets to avoid the most common pitfalls small businesses face in 2025!

Sole Proprietorship Survival Patterns: The Reality Check

While general business establishment data provides context, sole proprietorships face unique challenges that often result in even lower survival rates than the overall business average.

Critical factors affecting sole proprietorship survival:

- Year 1: The first year is crucial as sole proprietors must establish cash flow without employee support or corporate resources

- Years 2-3: Many sole proprietors struggle during this period due to limited growth capital and increasing competition

- Year 5 and beyond: Only the most resilient sole proprietorships survive, often by either incorporating or finding sustainable niche markets

Why sole proprietorships struggle more than other business structures:

- Resource limitations: No access to corporate credit lines or investor funding

- Owner dependency: Business success entirely dependent on one person’s capabilities and availability

- Market disadvantages: Difficulty competing against larger, incorporated competitors

- Personal liability: Owners risk personal assets, creating additional stress and conservative decision-making

Industry-Specific Survival Rates: Choose Your Battlefield Wisely

Industry choice significantly impacts sole proprietorship survival rates, making industry selection one of the most critical decisions for aspiring sole proprietors.

Industries Where Sole Proprietorships Thrive:

- Health Care and Social Assistance: Higher survival rates due to essential services and recurring revenue

- Finance, Insurance, and Real Estate: 32% five-year survival rate - benefits from high-value transactions

- Professional Services: Above-average survival rates due to lower startup costs and skill-based services

These represent some of the most successful sole proprietorship businesses across different sectors.

Industries Where Sole Proprietorships Struggle:

- Construction: 16% five-year survival rate - high competition, seasonal work, and capital requirements

- Retail Trade: 14% five-year survival rate - difficult to compete with large retailers and e-commerce

- Accommodation and Food Services: High failure rates due to intense competition and thin profit margins

Why these differences matter for sole proprietors: Industries with higher survival rates typically have:

- Lower barriers to entry for individual entrepreneurs

- More predictable cash flows that support single-owner operations

- Less seasonal variation that can devastate cash flow

- Higher profit margins that can sustain one-person businesses

- Lower capital requirements that sole proprietors can manage

Sole Proprietorship Trends: What’s Changing for Solo Entrepreneurs

The landscape for sole proprietorships has evolved significantly, presenting both challenges and opportunities for individual entrepreneurs.

The number of sole proprietorships in the United States continues to grow substantially:

Growth in Non-Employer Businesses: The SBA 2024 data shows significant growth in nonemployer firms:

- 28,477,518 nonemployer firms exist in the U.S., with 86.3% being sole proprietorships (Source: SBA 2024 FAQ)

- Nonemployer firms have increased by 84% since 1997 (Source: SBA 2024 FAQ)

- According to the Federal Reserve’s 2023 report, 46% of non-employer firms are planning to add employees within 12 months, indicating:

- Successful sole proprietorships are growing and evolving

- Many start as solo ventures but don’t remain sole proprietorships long-term

- The gig economy is creating more opportunities for individual entrepreneurs

Technology’s Impact on Sole Proprietorships:

- E-commerce platforms have made it easier for sole proprietors to reach customers

- Digital marketing tools level the playing field with larger competitors

- Remote work trends have created opportunities for service-based sole proprietorships

- Automation tools help solo entrepreneurs manage operations more efficiently

Factors Contributing to Success and Failure

Understanding the factors that contribute to the success or failure of sole proprietorships can help potential entrepreneurs make informed decisions.

These business success statistics reveal key patterns that determine entrepreneurship success rate statistics.

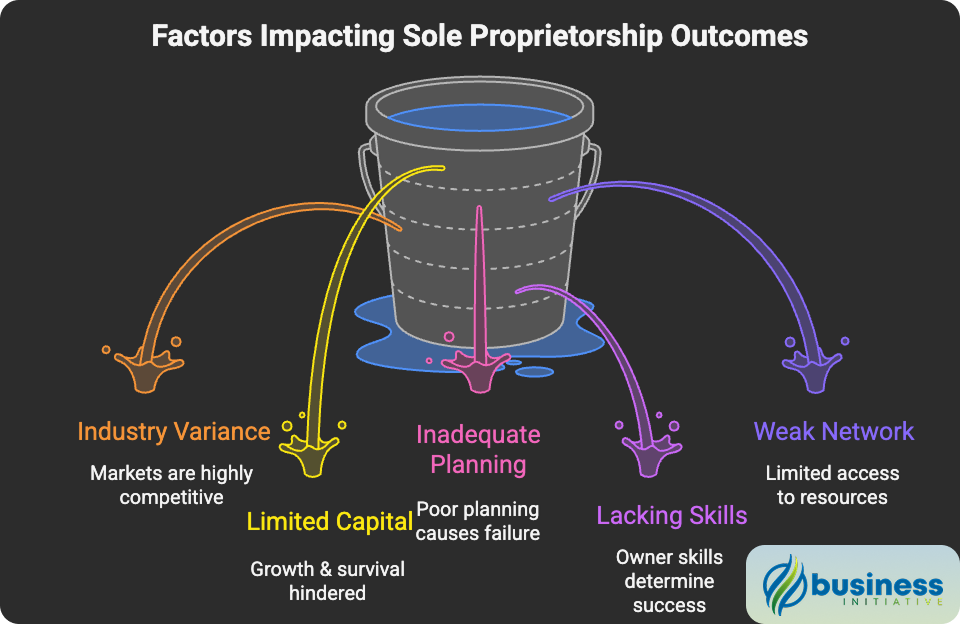

Some of the key factors include:

1. Industry:

As mentioned earlier, the success and failure rates vary significantly across industries.

Conducting thorough market research and understanding the trends within your chosen industry can help set you up for success.

2. Capital:

Sole proprietorships often have limited access to capital, which can hinder their growth and ability to survive in competitive markets.

Having a solid financial plan and exploring alternative funding sources can help overcome this challenge.

3. Planning:

Poor planning is a major contributor to business failure.

Developing a comprehensive business plan, including a marketing strategy and financial projections, is vital for any entrepreneur.

4. Skills and experience:

The success of a sole proprietorship largely depends on the skills and experience of the owner.

Continuously investing in personal and professional development can help increase your chances of success.

5. Networking:

Building a strong professional network can be beneficial for any business owner, but it’s particularly crucial for sole proprietorships.

A robust network can provide valuable resources, advice, and potential clients or customers.

FAQs - Frequently Asked Questions About Sole Proprietorship Success Rates

What is a sole proprietorship?

A sole proprietorship is a type of business structure where an individual operates as both the owner and operator of the business.

The owner is personally responsible for all assets, liabilities, and taxes associated with the business.

Learn More...

A sole proprietorship is a business structure with one individual as the owner and operator.

The owner is personally responsible for all business-related assets, liabilities, and taxes.

How common are sole proprietorships?

Sole proprietorships make up 86.3% of nonemployer firms and 13.0% of small employer firms in the United States.

Learn More...

According to the latest U.S. Small Business Administration (SBA) 2024 data, sole proprietorships make up 86.3% of nonemployer firms and 13.0% of small employer firms.

With 28,477,518 nonemployer firms in the U.S., this means approximately 24.6 million sole proprietorships operate without employees.

What are the benefits of choosing a sole proprietorship business structure?

Simplicity, complete control, and tax advantages.

Learn More...

Benefits of a sole proprietorship include simplicity, complete control, and tax advantages.

- Simplicity: Setting up a sole proprietorship is relatively easy, with minimal paperwork and low startup costs.

- Complete control: As the sole owner, you have full authority over business decisions.

- Tax advantages: Business income and expenses are reported on your personal tax return, and there are no separate business taxes.

What are the disadvantages of a sole proprietorship?

Personal liability, difficulty raising capital, and limited growth potential.

Learn More...

Disadvantages include personal liability, difficulty raising capital, and limited growth potential.

- Personal liability: As the owner, you are personally responsible for all debts and legal liabilities incurred by the business.

- Difficulty raising capital: Sole proprietorships may face challenges in securing loans or attracting investors.

- Limited growth potential: The business structure can limit opportunities for expansion and diversification.

What are the tax implications of a sole proprietorship?

Business income and expenses are reported on the owner's personal tax return using Schedule C.

The owner is subject to self-employment taxes calculated using Schedule SE.

Learn More...

In a sole proprietorship, business income and expenses are reported on the owner's personal tax return using Schedule C.

The owner is subject to self-employment taxes, which include Social Security and Medicare taxes, calculated using Schedule SE.

How are sole proprietorships different from other business structures?

Sole proprietorships have one owner responsible for all aspects, while other structures vary in ownership, liability, and tax treatment.

Learn More...

- Partnership: A partnership involves two or more people sharing ownership and management responsibilities, as well as profits and losses. In contrast, a sole proprietorship has only one owner who assumes all responsibilities.

- Limited Liability Company (LLC): An LLC is a hybrid business structure that combines the simplicity of a sole proprietorship with the liability protection of a corporation. Unlike a sole proprietorship, the owner's personal assets are protected from the business's debts and liabilities.

- Corporation: A corporation is a separate legal entity that offers liability protection for its owners (shareholders) but is subject to double taxation (corporate income tax and personal income tax on dividends). A sole proprietorship, on the other hand, is not a separate legal entity and is subject to single taxation (personal income tax).

What are the statistics on sole proprietorship success rates?

Based on 1994-2021 data, 67.9% of new businesses survive at least two years, 49.2% survive five years, and only 25.6% survive fifteen years.

Learn More...

According to the latest SBA 2024 data covering 1994-2021, business survival rates are: 67.9% survive at least two years, 49.2% survive five years, 33.8% survive ten years, and 25.6% survive fifteen years.

Sole proprietorships, representing the majority of nonemployer firms, face even greater challenges than these general statistics suggest due to single-owner dependency.

These statistics vary significantly depending on the industry and specific circumstances of each business.

What industries are common for sole proprietorships?

Retail, professional services, home-based businesses, food service, personal care services, and creative services.

Learn More...

Popular industries for sole proprietorships include:

- Retail

- Professional services (e.g., consulting, freelance work)

- Home-based businesses (e.g., online sales, tutoring)

- Food service (e.g., catering, food trucks)

- Personal care services (e.g., hairstyling, massage therapy)

- Creative services (e.g., graphic design, photography)

How do I dissolve a sole proprietorship?

Close your business bank account, pay any remaining taxes and debts, cancel business licenses, notify stakeholders, dispose of assets, and keep records.

Learn More...

To dissolve a sole proprietorship, you must:

- Close your business bank account.

- Pay any remaining taxes, debts, and liabilities.

- Cancel business licenses and permits.

- Notify customers, suppliers, and creditors of the business closure.

- Dispose of business assets and inventory.

- Keep records of the dissolution process for tax and legal purposes.

What is the average income of a sole proprietor?

The average annual net income for a sole proprietor in the U.S. was approximately $47,000 in 2019.

Learn More...

According to data from the Internal Revenue Service (IRS), the average annual net income for a sole proprietor in the United States was approximately $47,000 in 2019.

How do sole proprietorships contribute to the economy?

Sole proprietorships provide employment, promote innovation, and contribute to local communities.

Learn More...

Sole proprietorships play an essential role in the U.S. economy by providing employment opportunities, promoting innovation, and contributing to local communities.

In 2019, sole proprietorships reported total receipts of over $1.4 trillion.

How has the number of sole proprietorships changed over time?

The number of nonemployer firms (primarily sole proprietorships) has increased dramatically by 84% since 1997.

Learn More...

According to the latest SBA 2024 data, nonemployer firms have increased by 84% since 1997, representing significant growth in sole proprietorship formation.

Currently, there are 28,477,518 nonemployer firms in the U.S., with 86.3% being sole proprietorships, meaning approximately 24.6 million sole proprietorships operate without employees.

This growth trend reflects the rise of the gig economy, remote work opportunities, and increased entrepreneurship.

What is the survival rate of minority-owned sole proprietorships compared to non-minority-owned businesses?

Minority-owned businesses have a lower survival rate than non-minority-owned businesses overall.

Learn More...

Research conducted by the Minority Business Development Agency (MBDA) indicates that minority-owned businesses have a lower survival rate than non-minority-owned businesses overall.

However, this research does not differentiate between sole proprietorships and other business structures, so it is unclear whether the same trend applies specifically to minority-owned sole proprietorships.

Are there any tax deductions specific to sole proprietorships?

There are several tax deductions that can benefit sole proprietorships, such as home office deduction, business travel expenses, vehicle expenses, and self-employed health insurance deduction.

Learn More...

While there aren't deductions exclusive to sole proprietorships, there are several tax deductions that can benefit these businesses.

- Home office deduction: If you use a portion of your home exclusively for business purposes, you may be able to deduct expenses related to that space.

- Business travel expenses: Sole proprietors can deduct costs associated with business trips, such as transportation, lodging, and meals.

- Vehicle expenses: If you use your personal vehicle for business purposes, you can either claim the standard mileage rate or actual expenses incurred (e.g., gas, maintenance).

- Self-employed health insurance deduction: If you're self-employed and pay for health insurance premiums for yourself and your dependents, you may be eligible for this deduction.

These deductions can help reduce the taxable income of a sole proprietorship, ultimately lowering the overall tax burden on the owner.

In Summary…

While the statistics on the success and failure rates of sole proprietorships may seem daunting, understanding the factors that contribute to these outcomes can help you make informed decisions as an entrepreneur.

These small business success statistics provide valuable insights for anyone considering this business structure.

By choosing the right industry, securing adequate capital, planning effectively, investing in personal development, and building a strong professional network, you can increase your chances of success.

➤ Need personalized assistance? Book a FREE Consultation Today!

If you’re considering starting a sole proprietorship, use the insights provided in this article to make the best decision for your business.

Remember, knowledge is power, and being well-informed about the challenges and potential rewards of this business structure will set you on the path to success.

Ready to take the leap and start your sole proprietorship?

Equip yourself with expert information and guidance to help you navigate the world of entrepreneurship.

Subscribe to our newsletter and stay updated on the latest trends, tips, and strategies for business success!