Traditional burn rate calculations assume static expenses, but growing businesses face increasing costs as they scale operations, hire staff, and invest in growth initiatives. Understanding your growth-adjusted burn rate is crucial for accurate financial planning, fundraising, and maintaining sustainable growth trajectories.

Whether you’re scaling a startup, planning aggressive expansion, preparing investor presentations, or managing hypergrowth scenarios, accounting for growth-related expense increases ensures your financial projections remain realistic and your runway calculations stay accurate throughout periods of rapid change.

Our comprehensive growth-adjusted burn rate calculator not only projects your scaling expenses but also provides strategic insights into growth efficiency, investment timing, and sustainable scaling practices to help you maintain financial control while pursuing ambitious growth targets.

Table of Contents

Table of Contents

Key Takeaways

Key Takeaways

- Calculate realistic burn rates during growth

- Plan for scaling expense increases

- Optimize growth investment timing

- Maintain financial control during expansion

- Make informed hiring and investment decisions

Quick Reference: Growth Stage Burn Rate Multipliers

| Growth Stage | Typical Growth Rate | Burn Rate Impact | Key Cost Drivers |

|---|---|---|---|

| Early Growth | 10-30% monthly | 1.2-1.5x base burn | Initial team expansion, systems setup |

| Rapid Scaling | 20-50% monthly | 1.5-2.0x base burn | Aggressive hiring, infrastructure investment |

| Hypergrowth | 30-100% monthly | 2.0-3.0x base burn | Market expansion, competitive positioning |

| Mature Growth | 5-15% monthly | 1.1-1.3x base burn | Efficiency optimization, market expansion |

Understanding Growth-Adjusted Burn Rate

Growth-adjusted burn rate calculation considers:

- Base Burn Rate: Current monthly cash consumption without growth factors

- Growth Rate: Expected percentage increase in business activity or revenue

- Scaling Coefficient: How much expenses increase relative to growth (typically 0.7-1.2x)

- Formula: Adjusted Burn = Base Burn × (1 + Growth Rate × Scaling Factor)

How to Use This Calculator

Quick Start Guide

Calculate Base Burn Rate

Determine current monthly cash consumption before growth factors

Estimate Growth Rate

Project expected monthly growth in revenue or business activity

Calculate Adjusted Burn

Get your growth-adjusted burn rate for accurate planning

Plan Growth Strategy

Use insights to optimize growth investments and timing

Burn Rate Comparison

Growth Impact

Interpreting Your Results

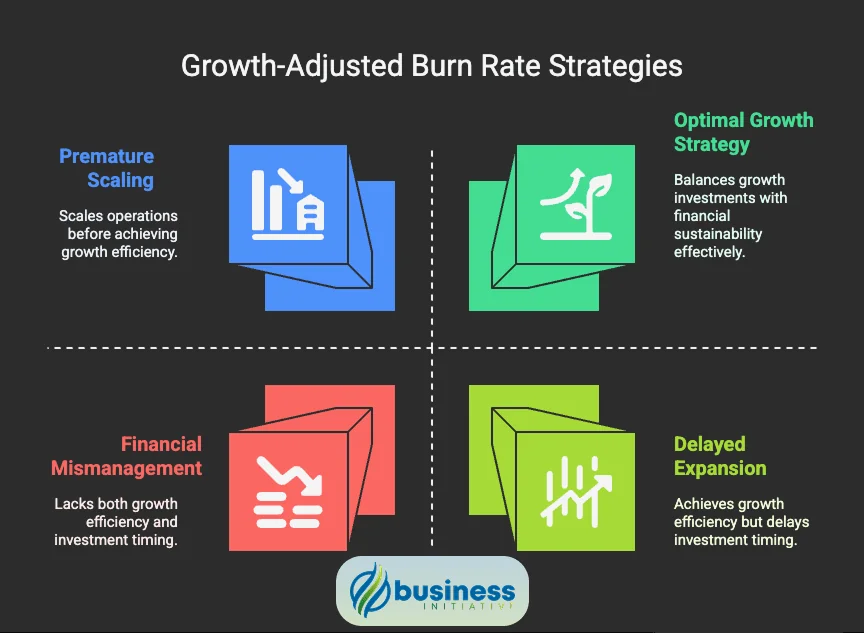

Understanding your growth-adjusted burn rate helps optimize scaling strategies:

Growth Impact Assessment

Low Growth Impact (10-20% increase)

- Efficient scaling with controlled cost increases

- Good operational leverage and unit economics

- Sustainable growth trajectory

- Focus on maintaining efficiency while scaling

Moderate Growth Impact (20-50% increase)

- Standard scaling costs for growing businesses

- Balance between growth speed and efficiency

- Monitor unit economics and customer acquisition costs

- Plan for increased infrastructure and team needs

High Growth Impact (50-100% increase)

- Aggressive growth requiring significant investment

- Higher risk but potentially higher rewards

- Ensure sufficient runway for growth trajectory

- Focus on achieving key milestones quickly

Extreme Growth Impact (100%+ increase)

- Hypergrowth scenario with substantial cost scaling

- High burn rate requiring careful cash management

- Critical to achieve revenue milestones rapidly

- Consider staged growth approach or additional funding

Key Growth Metrics to Monitor

Revenue per Employee: Track efficiency as team grows Customer Acquisition Cost (CAC): Monitor scaling efficiency Lifetime Value to CAC Ratio: Ensure sustainable unit economics Gross Margin: Maintain profitability during scaling

Growth Efficiency Strategies

Optimizing Scaling Costs

1. Smart Hiring Strategies

- Hire for leverage and impact, not just growth

- Use contractors and freelancers for variable work

- Implement performance-based compensation

- Focus on revenue-generating roles first

2. Technology and Automation

- Invest in scalable systems early

- Automate repetitive processes before hiring

- Use cloud infrastructure for flexible scaling

- Implement efficient customer service tools

3. Operational Efficiency

- Standardize processes before scaling

- Create efficient onboarding and training programs

- Implement project management and collaboration tools

- Focus on high-impact, measurable activities

Revenue-First Growth

1. Customer-Centric Scaling

- Prioritize customer success and retention

- Focus on expanding existing customer relationships

- Optimize conversion rates before increasing traffic

- Implement referral and advocacy programs

2. Market Expansion Strategy

- Validate new markets before major investment

- Use data-driven approach to expansion decisions

- Leverage existing strengths in new markets

- Consider partnerships for faster market entry

3. Product Development Efficiency

- Focus on features that drive revenue growth

- Use customer feedback to prioritize development

- Implement rapid prototyping and testing

- Balance innovation with execution

Financial Control During Growth

1. Cash Flow Management

- Maintain detailed cash flow forecasts

- Plan for growth-related working capital needs

- Negotiate flexible payment terms with vendors

- Consider revenue-based financing for growth

2. Unit Economics Optimization

- Track contribution margins by customer segment

- Optimize pricing for different market segments

- Focus on high-margin customer acquisition

- Eliminate or improve low-margin activities

3. Performance Monitoring

- Implement real-time financial dashboards

- Track key metrics weekly during growth phases

- Set clear milestones and success criteria

- Regular review and adjustment of growth plans

Scaling Best Practices

Growth Stage Planning

Pre-Growth Preparation

- Establish scalable systems and processes

- Build strong financial controls and reporting

- Develop clear organizational structure

- Create detailed growth and hiring plans

Early Growth Management

- Monitor cash flow weekly

- Track key performance indicators daily

- Maintain clear communication channels

- Focus on customer satisfaction and retention

Rapid Scaling Execution

- Implement strong project management

- Maintain quality standards during growth

- Plan for infrastructure and capacity needs

- Develop crisis management procedures

Post-Growth Optimization

- Analyze growth efficiency and lessons learned

- Optimize processes based on scale achieved

- Plan for next growth phase or consolidation

- Develop sustainable operational practices

Common Growth Scaling Mistakes

Over-Hiring Too Early

- Hiring before revenue justifies costs

- Adding layers of management prematurely

- Not considering productivity ramp-up time

- Failing to plan for integration and training

Infrastructure Neglect

- Underinvesting in systems and processes

- Failing to plan for capacity requirements

- Not considering security and compliance needs

- Ignoring customer service capacity

Financial Mismanagement

- Not accounting for growth-related cash needs

- Failing to monitor unit economics during scaling

- Over-optimistic revenue projections

- Inadequate cash reserves for growth fluctuations

Growth Funding Strategies

Internal Funding

- Reinvest profits for sustainable growth

- Optimize cash conversion cycles

- Use revenue-based financing options

- Consider asset-based lending for inventory

External Funding

- Plan fundraising timeline with growth needs

- Maintain relationships with potential investors

- Consider strategic partnerships for growth

- Evaluate debt vs. equity financing options

Need help developing a sustainable growth strategy and managing scaling costs? Schedule a consultation with our growth strategy experts at Business Initiative.

Stay informed about business strategies and tools by following us on X (Twitter) and subscribing to our newsletter.

FAQs - Frequently Asked Questions About Growth-Adjusted Burn

How much should my burn rate increase during growth phases?

Burn rate increases typically range from 20-100% depending on growth stage and strategy, but revenue growth should outpace burn rate increases. Maintain positive unit economics and ensure growth investments generate proportional returns.

Learn More...

Early-stage growth typically sees 20-50% burn rate increases as companies invest in foundational scaling elements: key hires, basic infrastructure, and initial market expansion. This phase focuses on proving scalability while maintaining capital efficiency and extending runway for continued growth opportunities.

Rapid growth phases often require 50-100% burn rate increases for aggressive market capture: large hiring pushes, significant marketing investments, infrastructure scaling, and geographic expansion. Success requires maintaining positive unit economics and demonstrating that increased spending generates proportional or accelerating revenue growth.

Hypergrowth scenarios can see 100%+ burn rate increases but require exceptional discipline: investors expect 3-5x revenue multiple returns on increased burn, market leadership opportunities, clear competitive advantages, and path to profitability. This level of spending requires extensive funding and detailed performance monitoring.

When should I start planning for growth-adjusted burn rate?

Begin planning 3-6 months before anticipated growth phases, allowing time to establish systems, secure funding, create detailed scaling plans, and avoid cash flow disruptions during expansion.

Learn More...

Growth planning requires extensive preparation: financial modeling for multiple scenarios, team expansion planning, infrastructure capacity assessment, and market analysis for expansion opportunities. Early planning prevents reactive decisions and enables strategic resource allocation for optimal growth outcomes.

Funding considerations demand advance planning: growth phases require significant capital, fundraising takes 3-6 months, investors need detailed growth plans, and cash runway must sustain operations during expansion. Plan funding needs well before growth initiatives begin to maintain negotiating leverage.

Operational preparation prevents growth bottlenecks: hiring and training timelines, technology infrastructure scaling, process documentation, and quality control systems. Establish robust operational foundations before rapid scaling to maintain service quality and customer satisfaction during expansion.

What expenses typically increase most during growth phases?

Personnel costs usually dominate (50-70% of growth expenses), followed by marketing and customer acquisition (20-30%), infrastructure and technology (10-15%), and operational costs (5-10%).

Learn More...

Personnel expenses include both direct hiring costs and infrastructure support: new employee salaries and benefits, recruiting and onboarding expenses, training and development programs, additional management layers, and workspace expansion. Quality hiring often requires premium compensation to attract top talent quickly.

Marketing and customer acquisition costs scale with growth ambitions: paid advertising channel expansion, content creation and marketing team growth, sales team expansion and territory development, partnership development, and brand building investments. Customer acquisition cost efficiency becomes critical during scaling.

Infrastructure and technology investments support scaling: cloud infrastructure and software licensing, security and compliance systems, automation and process tools, data analytics and reporting systems, and integration platforms. Technology investments should reduce long-term operational costs while enabling growth.

How do I maintain unit economics during rapid growth?

Focus on customer lifetime value (CLV) to customer acquisition cost (CAC) ratios, maintain gross margins through pricing optimization, track contribution margins by segment, and monitor weekly during growth phases.

Learn More...

Unit economics monitoring requires detailed tracking: CLV/CAC ratios should remain above 3:1, gross margins should maintain or improve during scaling, contribution margins by customer segment, and payback periods for customer acquisition investments. Weekly monitoring prevents deterioration from going unnoticed.

Pricing optimization becomes critical during growth: value-based pricing strategies aligned with customer outcomes, regular pricing analysis and competitor benchmarking, premium pricing for differentiated offerings, and dynamic pricing for different customer segments. Pricing power often increases with scale and market position.

Cost management prevents margin erosion: vendor negotiation for volume discounts, operational efficiency improvements, automation implementation, and elimination of low-value activities. Growing companies often have more negotiating power with suppliers and service providers.

Should I slow growth if burn rate increases too dramatically?

Consider slowing growth if runway drops below 12 months, unit economics deteriorate significantly, cash flow becomes unsustainable, or quality/customer satisfaction declines. Strategic pauses enable optimization.

Learn More...

Financial triggers for growth moderation: cash runway declining below 12-15 months, unit economics showing consistent deterioration, burn rate increases exceeding revenue growth rates, or funding requirements becoming unrealistic. Maintaining financial stability should take priority over growth speed.

Operational quality indicators: customer satisfaction scores declining, employee satisfaction and retention issues, service quality problems, or operational systems becoming strained. Growth that compromises quality often leads to long-term competitive disadvantages and customer churn.

Strategic growth pauses can be beneficial: optimization of processes and systems, team training and development, technology infrastructure improvements, and preparation for more sustainable scaling. Temporary growth moderation often enables stronger long-term performance.

How do I forecast growth-adjusted burn for fundraising presentations?

Create detailed month-by-month projections showing burn rate scaling with growth milestones, including hiring plans, infrastructure needs, and market expansion costs across multiple scenarios.

Learn More...

Comprehensive financial modeling requires multiple scenarios: conservative growth with moderate burn increases, base case growth with planned investments, aggressive growth with significant burn increases. Each scenario should show clear milestone achievement, revenue correlation, and path to profitability or next funding round.

Detailed expense categorization demonstrates planning depth: personnel costs by department and role, marketing spend by channel and customer segment, infrastructure costs by capacity requirements, and operational expenses by business function. Granular planning builds investor confidence in management capabilities.

Growth milestone correlation shows strategic thinking: burn rate increases tied to specific business achievements, revenue targets aligned with investment levels, customer acquisition goals supported by marketing spend, and market expansion plans with corresponding resource allocation. Clear cause-and-effect relationships justify increased spending.

What's the difference between growth burn and operational burn?

Operational burn covers day-to-day business operations at current scale, while growth burn includes additional expenses for scaling. Growth burn should generate proportional revenue increases and may be temporary.

Learn More...

Operational burn represents baseline business requirements: current employee salaries and benefits, existing infrastructure and technology costs, routine marketing and sales activities, administrative and compliance expenses, and facility costs. These expenses maintain current business operations and should remain relatively stable.

Growth burn represents scaling investments: additional hiring for expansion, incremental marketing for customer acquisition, infrastructure upgrades for capacity, new market development costs, and strategic initiatives. Growth burn should directly correlate with business expansion and revenue growth objectives.

Investment return expectations differ between burn types: operational burn maintains current revenue and business functions, while growth burn should generate measurable revenue increases, market share gains, or strategic positioning improvements. Growth investments require clear ROI metrics and success criteria.

How do I optimize growth efficiency while scaling operations?

Focus on revenue-generating activities first, automate before hiring, use data-driven decision making, maintain strong unit economics, and regularly review growth investment performance through efficiency metrics.

Learn More...

Revenue prioritization ensures growth investments pay off: focus marketing spend on highest-converting channels, prioritize sales activities with shortest payback periods, invest in customer success to maximize lifetime value, and eliminate low-impact activities that consume resources without generating proportional returns.

Automation before hiring reduces long-term costs: implement workflow automation for repetitive tasks, use technology solutions for scaling operations, create self-service options for customers, and establish efficient processes before adding personnel. Automation investments often provide better ROI than immediate hiring.

Data-driven optimization improves growth efficiency: track key performance indicators weekly, use A/B testing for major decisions, analyze customer behavior and preferences, monitor conversion rates across channels, and adjust strategies based on performance data rather than assumptions.