Key Takeaways

Key Takeaways

- Protection and clarity: An operating agreement helps preserve limited liability and clarifies management and financial expectations among members.

- Two structures: Choose member-managed (all members run the LLC) or manager-managed (designated managers run day-to-day operations).

- Financial terms: Define capital contributions, profit and loss allocation, distributions, and buyout or transfer rules.

- Dispute resolution: Include dispute resolution methods, voting procedures, and deadlock provisions to avoid costly litigation.

- Consult a lawyer: Have an attorney review or draft the agreement so it complies with state law and fits your business.

Table of Contents

Table of Contents

Limited Liability Companies (LLCs) are a popular choice for entrepreneurs and business owners due to their flexibility, simplicity, and protection from personal liability. However, many new business owners overlook the importance of drafting a solid LLC operating agreement.

This legally binding document outlines the rules and procedures for your company’s management, financial provisions, and dispute resolution.

In this article, we’ll explore the significance of an LLC operating agreement, its essential components, and practical tips for drafting a comprehensive and effective agreement.

The Purpose of an LLC Operating Agreement

An LLC operating agreement serves several vital purposes:

-

Legal protection: It helps safeguard your limited liability status, preventing any potential personal liability for business debts or legal issues.

-

Hierarchical Customization: It allows you to customize your company’s management and operational structure according to your specific needs and preferences.

-

Conflict resolution: It provides a clear framework for resolving disputes among members, reducing the likelihood of costly and time-consuming litigation.

-

Clarification: It clarifies verbal agreements and expectations among members, ensuring a smooth and efficient operation of the business.

Consider the case of Gatz Properties, LLC v. Auriga Capital Corp., where the absence of a well-drafted operating agreement led to a lengthy and costly legal battle. Had the parties involved created a comprehensive agreement, they could have avoided this dispute altogether.

➤ TAKE INITIATIVE: Maximize your Operating Agreement

Management Structure

There are two primary management structures for LLCs: member-managed and manager-managed. Your operating agreement should clearly specify which structure your company will adopt.

Member-Managed LLC

In a member-managed LLC, all members are actively involved in the day-to-day management of the business. Each member has an equal say in decision-making, and all major decisions require a majority vote. This structure is ideal for small LLCs where all members are actively involved in the business and want to have a say in its management.

In a member-managed LLC, the members are responsible for:

- Making day-to-day decisions

- Overseeing the company’s operations

- Managing the company’s finances

- Maintaining company records and paperwork

- Filing taxes and other legal documents

Manager-Managed LLC

In a manager-managed LLC, one or more designated managers (who may be members or non-members) are responsible for making decisions on behalf of the company. This structure is preferred when some members prefer a more passive role or when the company requires specialized management expertise.

In a manager-managed LLC, the managers are responsible for:

- Making day-to-day decisions

- Overseeing the company’s operations

- Managing the company’s finances

- Maintaining company records and paperwork

- Filing taxes and other legal documents

The members of a manager-managed LLC have limited involvement in the day-to-day management of the business and are not responsible for making major decisions. Instead, they have the right to vote on certain matters, such as:

- Removing a manager

- Amending the operating agreement

- Approving major business decisions, such as mergers or acquisitions.

It’s essential to outline the roles and responsibilities of each member or manager, along with decision-making and voting procedures in your LLC’s operating agreement.

Financial Provisions

Your LLC operating agreement should address key financial aspects of your business, including:

-

Capital contributions: Specify the amount of money or property each member will contribute to the company and the process for making additional contributions in the future.

-

Profit and loss allocation: Determine how profits and losses will be distributed among members. This can be in proportion to their capital contributions or based on another agreed-upon method.

-

Distributions: Establish a method for distributing funds to members, such as a regular schedule or upon meeting specific financial benchmarks.

-

Buyout provisions: Set rules for how a member can sell or transfer their ownership interest, including the right of first refusal, buy-sell agreements, and valuation methods.

Take the case of Fisk Ventures, LLC v. Segal, where a poorly defined buyout provision resulted in a legal dispute. A well-drafted operating agreement could have prevented this conflict and protected the parties involved.

Dispute Resolution

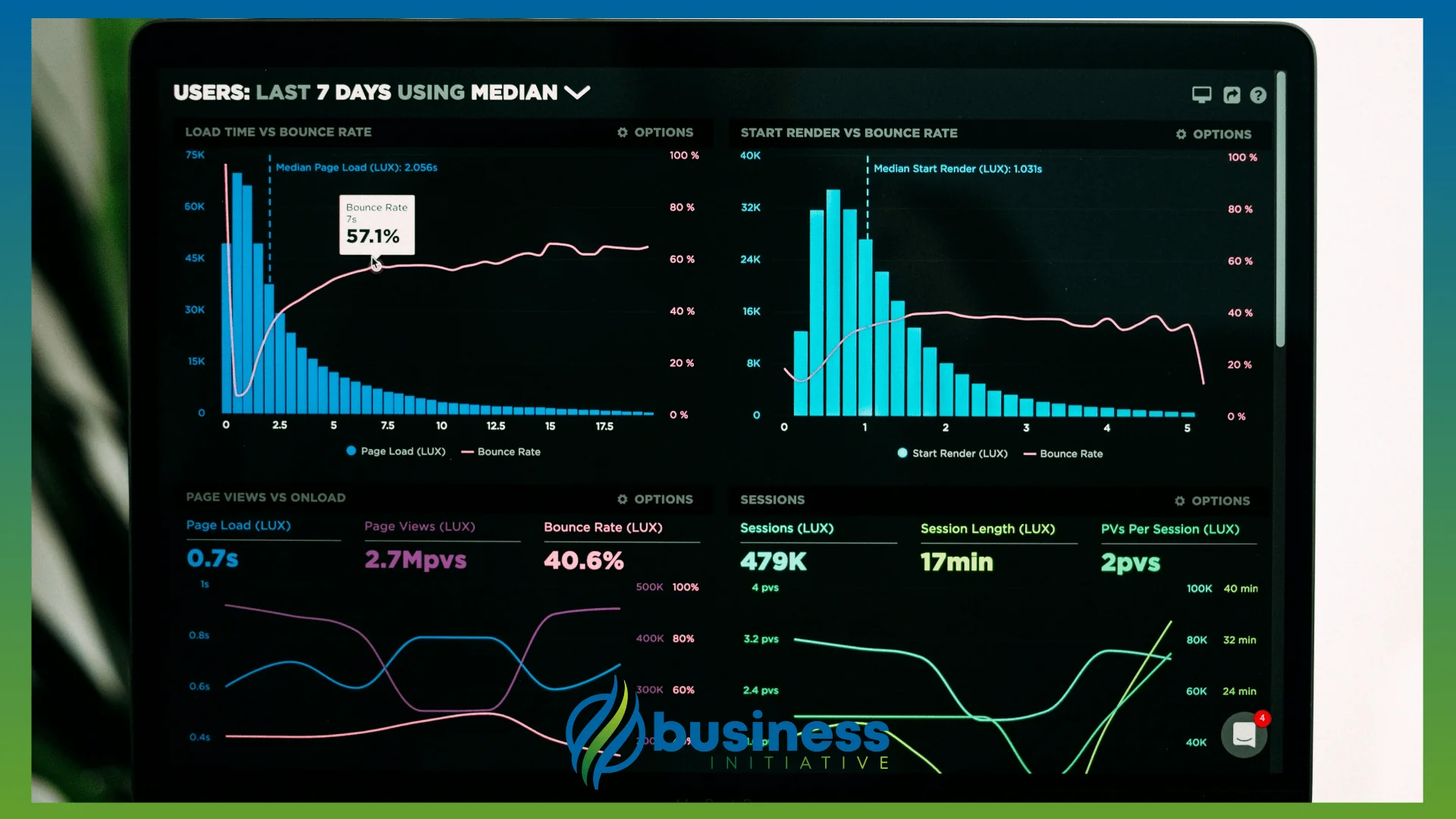

Disagreements among members are inevitable, but a well-written operating agreement can help prevent conflicts from escalating. Your agreement should include:

-

Dispute resolution mechanisms: Specify the methods for resolving disputes, such as mediation, arbitration, or litigation.

-

Decision-making procedures: Define the voting processes and quorum requirements for making decisions.

-

Deadlock resolution: Describe the steps to be taken if members are unable to reach a consensus on a critical issue, such as seeking advice from a neutral third party or dissolving the company.

Practical Tips for Drafting an Effective Operating Agreement

-

Consult an attorney: Seek legal advice to ensure your operating agreement complies with state laws and addresses the unique needs of your business.

-

Keep it flexible: Make provisions for amending the agreement as your business grows and circumstances change.

-

Be detailed: Clearly outline each member’s rights, responsibilities, and obligations to prevent misunderstandings and conflicts.

-

Consider the future: Address potential scenarios, such as adding new members, the death or incapacity of a member, or the dissolution of the company.

➤ TAKE INITIATIVE: Follow our step-by-step process to craft the optimal Operating Agreement

In Summary…

A well-drafted LLC operating agreement is crucial for the success and stability of your business. It provides legal protection, allows customization of your management structure, and establishes a framework for resolving disputes.

Don’t leave your business’s future to chance…

Take the time to create a comprehensive and effective operating agreement tailored to your company’s needs.

FAQs - Frequently Asked Questions About the Importance of an LLC Operating Agreement

Why is an LLC operating agreement important?

It protects your limited liability status, customizes management and operations, provides a framework for resolving disputes, and clarifies expectations among members.

Learn More...

Courts may look at whether you followed formalities like having a written operating agreement when deciding if your LLC veil should be respected.

It lets you choose member-managed or manager-managed structure and set voting and decision-making rules.

Dispute resolution provisions (e.g., mediation or arbitration) can reduce the cost and delay of litigation.

Case law (e.g., Gatz Properties, Fisk Ventures) shows that unclear or missing agreements can lead to lengthy and expensive disputes.

What is the difference between member-managed and manager-managed LLCs?

In a member-managed LLC all members participate in day-to-day management and decisions; in a manager-managed LLC designated managers run the business and members have limited roles.

Learn More...

Member-managed is common for small LLCs where every owner is active in the business.

Manager-managed is useful when some members are passive investors or when you want specialized management.

The operating agreement must clearly state which structure applies and define the powers and duties of members and managers.

State default rules may differ, so specifying your choice in the agreement avoids confusion.

What financial provisions should an operating agreement include?

Include capital contributions, profit and loss allocation, distributions to members, and buyout or transfer rules, including valuation methods.

Learn More...

Capital contributions define what each member has put in and whether more contributions can be required.

Profit and loss allocation can follow ownership percentages or a different agreed formula.

Distribution provisions set when and how money can be paid out to members.

Buyout and transfer rules (e.g., right of first refusal, appraisal) help avoid disputes when a member wants to leave or sell.

How can an operating agreement help with dispute resolution?

It can specify dispute resolution methods (e.g., mediation, arbitration), decision-making and voting procedures, and deadlock resolution so members know how conflicts will be handled.

Learn More...

Agreeing in advance to mediation or arbitration can keep disputes out of court and reduce costs.

Clear voting and quorum rules reduce ambiguity about whether a decision is valid.

Deadlock provisions (e.g., buy-sell, third-party mediator) address what happens when members cannot agree on critical issues.

Without these provisions, members may resort to litigation, which can be expensive and damage the business.

Do I need a lawyer to draft an LLC operating agreement?

It is recommended to consult an attorney so the agreement complies with state law and fits your business; templates can help but may not cover your situation.

Learn More...

State LLC laws vary; an attorney can ensure your agreement is valid and enforceable in your state.

Complex ownership, vesting, or tax elections often need professional drafting.

Investors, banks, or partners may expect a professionally reviewed operating agreement.

The cost of an attorney is often small compared to the cost of resolving a dispute or losing limited liability later.

Schedule a consultation call with us today to ensure your agreement is legally sound and aligns with your business objectives.

or

Ask any questions you might have directly HERE or by DMing @BisInitiative on Twitter