Understanding small business taxes doesn’t have to feel overwhelming.

This comprehensive guide breaks down exactly what small businesses pay in taxes across different industries and business structures.

We’ve compiled the latest 2025 data from the IRS, Tax Foundation, and Small Business Administration to give you the most current tax landscape.

Key Takeaways

Key Takeaways

- Self-Employment Tax: Pay 15.3% on net earnings over $400 - includes Social Security and Medicare contributions.

- Corporate Tax Savings: North Carolina offers the lowest rate at 2.25%, while South Dakota and Wyoming have no corporate tax.

- Industry Impact: Manufacturing businesses pay 21% average tax rate, while agriculture pays only 14.9% - choose your industry wisely.

- Estimated Taxes: Make quarterly payments if you expect to owe $1,000+ as individual or $500+ as corporation to avoid penalties.

- Business Structure Matters: Your entity type determines which of the 15 different tax obligations apply to your business.

You’ll discover which industries pay the highest and lowest tax rates.

We reveal the five core tax types every small business owner must understand.

Plus, you’ll get updated state corporate tax rates that changed in 2025.

This isn’t generic advice—it’s data-driven intelligence that helps you make informed decisions about your business structure and tax planning.

We’ve organized everything with industry comparisons, state-by-state breakdowns, and practical examples.

Table of Contents

Table of Contents

Whether you’re starting a business or optimizing your current tax strategy, this guide provides the clarity you need.

You’ll understand exactly what to expect and how to prepare.

Ready to master small business taxes?

Let’s dive into the numbers that matter most.

What percentage of small businesses pay taxes?

Small businesses have always been an essential part of the economy, providing employment opportunities and driving innovation.

However, one critical aspect that often gets overlooked is their contribution to the tax system.

Small businesses are not exempt from paying taxes, but what percentage of small businesses actually pay taxes and how much is small business tax on average?

Current Tax Compliance Rates

According to the latest IRS Tax Gap Projections for Tax Year 2022, the overall voluntary compliance rate is 85.0% across all taxpayers. This means that 85% of taxes owed are paid voluntarily and on time.

The IRS data shows that the net compliance rate is 86.9% when including taxes eventually collected through enforcement and late payments.

It’s essential to note that filing taxes and paying taxes are two different things. Not all businesses that file taxes end up owing taxes.

Business Tax Compliance by Type

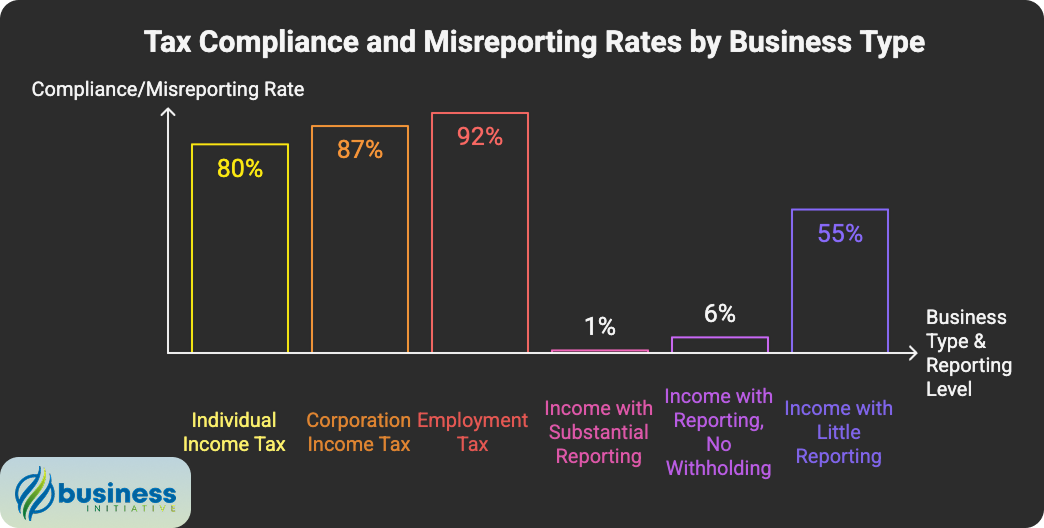

The 2022 IRS Tax Gap analysis reveals significant differences in compliance rates by business type:

Individual Income Tax (includes sole proprietors): Voluntary compliance rate of 80%

Corporation Income Tax: Voluntary compliance rate of 87%

Employment Tax: Voluntary compliance rate of 92%

The Impact of Information Reporting

The IRS research consistently shows that compliance is higher when there is third-party information reporting and withholding:

- Income with substantial information reporting and withholding: Only 1% misreporting rate

- Income with substantial information reporting (no withholding): 6% misreporting rate

- Income with little or no information reporting: 55% misreporting rate

This data is particularly relevant for small businesses, as nonfarm proprietor income (typical of small businesses) has a 55% misreporting rate due to little information reporting.

One study conducted by the National Small Business Association (NSBA) found that 65% of small businesses pay taxes at a rate of 25% or less.

The remaining 35% pay taxes at a rate of 26% or higher. The NSBA’s study also found that small businesses pay an average effective tax rate of 19.8%.

The Hidden Costs Beyond Tax Rates

While tax rates tell part of the story, small businesses face significant administrative burdens that add to their total tax costs:

Time Investment: According to the NSBA, a majority of small businesses spend more than 20 hours per year on federal taxes alone, with 2-in-5 spending more than 40 hours.

Out-of-Pocket Administrative Costs: Beyond the taxes owed, small businesses pay substantial compliance costs:

- 32% spend $1,001–$5,000 annually

- 15% spend $5,001–$10,000 annually

- 23% spend more than $10,000 annually

Most small businesses (71%) hire external practitioners or accountants to handle their taxes, with only 16% doing taxes themselves.

Which industries do small businesses pay the MOST in taxes?

It’s worth noting that the small business tax bracket and effective rates vary significantly depending on the industry.

Some industries have higher average effective tax rates than others.

Here are the three industries where small businesses pay the most in taxes on average:

1. Manufacturing: Manufacturing companies pay an average effective tax rate of 21%

2. Wholesale Trade: Businesses in the wholesale industry pay an average effective tax rate of 19.9%

3. Retail Trade: Small businessses in this industry pay an average effective tax rate of 19.4%

➤ MORE: Click here to see which industry pays HIGHER tax than Manufacturing!

Which industries do small businesses pay the LEAST in taxes?

On the other hand, here are the three industries where small businesses pay the least in taxes on average:

1. Agriculture, Forestry, Fishing, and Hunting: Small businesses in this category pay an average effective tax rate of 14.9%

2. Accommodation and Food Services: Small businesses in this industry pay an average effective tax rate of 15.2%

3. Real Estate, Rental, and Leasing: Small businesses in this industry pay an average effective tax rate of 16.9%

What are the most common taxes a small business pays?

According to the IRS, the form of business you operate determines what taxes you must pay and how you pay them. Small businesses face federal, state, and local tax obligations to stay in good legal standing.

The IRS identifies five general types of business taxes that answer the question “what taxes do small businesses pay”:

➤ SAVE: 7 Quick tax deductions you can benefit from TODAY!

1. Income Tax

All businesses except partnerships must file an annual income tax return. Partnerships file an information return. The federal income tax is a pay-as-you-go tax, meaning you must pay the tax as you earn or receive income during the year.

2. Self-Employment Tax

Self-employment tax (SE tax) is a Social Security and Medicare tax primarily for individuals who work for themselves. This tax on small business income is currently 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare.

The IRS requires you to pay SE tax and file Schedule SE if your net earnings from self-employment were $400 or more.

3. Employment Taxes

When you have employees, you have certain employment tax responsibilities including:

- Social Security and Medicare taxes

- Federal income tax withholding

- Federal unemployment (FUTA) tax

Administrative Burden: Even with payroll service vendors, 46% of small businesses spend 1–2 hours per month on payroll tax administration, with 26% spending 3–5 hours monthly.

Most spend more than $100/month on payroll services, with approximately 1 in 5 spending more than $1,000/month.

4. Estimated Taxes

Generally, you must pay taxes on income by making regular payments of estimated tax during the year.

According to the IRS, individuals generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed, while corporations must make estimated payments if they expect to owe $500 or more.

5. Excise Tax

Excise taxes apply if you manufacture or sell certain products, operate certain kinds of businesses, use various kinds of equipment, facilities, or products, or receive payment for certain services.

Examples include taxes on fuel, air transportation, and heavy trucks.

Additional State and Local Taxes

Beyond federal taxes, small businesses may face various state and local tax requirements:

6. State Corporate Income Tax

Forty-four states levy a corporate income tax as of 2025. The federal small business tax rate varies by state, with top rates ranging from 2.25% in North Carolina to 11.5% in New Jersey.

Among states that impose a corporate income tax, the average top rate is 6.5%.

7. Sales Tax

A tax on the sale of goods and services, imposed by most U.S. states, as well as many counties and cities.

Time Investment: 54% of small businesses spend no time on sales tax (don’t collect), while those that do collect spend varying amounts: 14% spend less than 1 hour per month, 16% spend 1–2 hours, and 17% spend 3 or more hours monthly.

8. Property Tax

Businesses that own buildings, land, or other real property may be taxed on it at state and local levels.

9. Franchise Tax

Roughly a dozen states impose a franchise tax on businesses that want to do business in that state.

10. Business License Fees

The federal government, as well as many state and local governments, require certain types of businesses to obtain licenses and pay fees.

11. Gross Receipts Tax

Nevada, Ohio, Texas, and Washington impose gross receipts taxes instead of corporate income taxes. Delaware, Oregon, and Tennessee impose gross receipts taxes in addition to their corporate income taxes.

12. Use Tax

A tax on goods purchased outside of the state and used in the state.

13. Capital Gains Tax

A tax on the profit earned from the sale of an asset.

14. Estate Tax

A tax on the transfer of assets after a person’s death.

15. Import or Tariff Tax

A tax on goods imported from other countries.

What Small Businesses Find Most Burdensome

Understanding which taxes create the biggest burden helps business owners answer “how much should a small business save for taxes” and prioritize their tax planning efforts.

According to the NSBA, small businesses face both administrative and financial burdens:

Administrative Burden (Most Time-Consuming)

-

Income taxes for pass-throughs (37%) - The biggest administrative challenge

-

Payroll taxes (15%) - Despite outsourcing to vendors

-

Corporate (C-corp) taxes (11%)

-

State & local compliance (10%)

-

Sales tax (8%)

Financial Burden (Highest Cost Impact)

-

Income taxes for pass-throughs (37%) - Also the largest financial burden

-

Payroll taxes (19%) - Higher financial impact than administrative

-

Corporate taxes (11%)

-

State & local compliance (8%)

-

Property taxes (7%)

Why Pass-Through Taxes Dominate: 83% of small businesses are pass-through entities (S-corps, LLCs, sole proprietorships, partnerships), making income tax changes disproportionately impactful.

Overall Tax System Challenges

The NSBA identifies the biggest issues with the federal tax code:

- Financial cost (36%)

- Complexity (20%)

- Constantly changing rules (12%)

- Paperwork burden (10%)

Key Insight: Administration and complexity—not just cost—are the dominant burdens for small businesses.

2025 Corporate Tax Rate Updates

For small businesses structured as corporations, state corporate income tax rates have seen significant changes in 2025.

Here are the key updates from the Tax Foundation:

States That Reduced Corporate Tax Rates in 2025

Louisiana: Corporate income tax rate was cut to 5.5% as of January 1, 2025.

Previously, the state had rates ranging from 3.5% to 7.5%.

The state also eliminated the corporation franchise tax.

Nebraska: Lowered its corporate income tax to a flat rate of 5.2%.

This rate is scheduled to be reduced further to 4.55% for 2026 and then to 3.99% for 2027.

North Carolina: Reduced its flat corporate income tax rate to 2.25% starting January 1, 2025.

This is part of a plan to progressively eliminate the tax by 2030.

Pennsylvania: Corporations face a flat 7.99% income tax in Pennsylvania for 2025, down from 8.49% in 2024.

This is part of a multi-year phasedown that will bring the rate to 4.99% by 2031.

States That Increased Corporate Tax Burdens in 2025

New Jersey: Reimposed a 2.5% additional surtax on corporations with taxable income exceeding $10 million.

This brings the top rate to 11.5% for large corporations.

New Mexico: Moved to a flat rate corporate income tax system at 5.9%, representing an increase in the effective average rate.

Highest and Lowest Corporate Tax States

Highest rates: Four states—Alaska, Illinois, Minnesota, and New Jersey—have the highest small business tax brackets with top marginal corporate income tax rates of 9% or higher.

Lowest rates: Twelve states have top rates at or below 5%: Arizona, Arkansas, Colorado, Indiana, Kentucky, Mississippi, Missouri, North Carolina, North Dakota, Oklahoma, South Carolina, and Utah.

No corporate income tax: South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax.

2025 Tax Planning Considerations

Small business owners should be aware of upcoming changes that could affect how much tax a small business will pay.

According to the NSBA, 46% of small businesses say expiring Tax Cuts and Jobs Act (TCJA) provisions are a very significant issue, with another 22% calling it somewhat significant.

Currently Used Tax Benefits: Small businesses commonly utilize:

- Standard deduction (65%)

- 199A/QBI deduction (48%) - Critical for pass-through entities

- Pass-through entity tax election (35%)

- Bonus depreciation (26%)

- R&D amortization (14%)

As Congress embarks on this tax extender discussion, it is imperative that small businesses are afforded tax stability, predictability, and permanency, not to mention parity with larger businesses.

➤ Take Initiative: Start your very own Sole Proprietorship TODAY!

FAQs - Frequently Asked Questions About Small Business Taxes

What is the average tax rate for small businesses?

Small businesses pay an average effective tax rate of 19.8%.

However, 65% of small businesses pay taxes at a rate of 25% or less.

Learn More...

According to the National Small Business Association, small businesses pay an average effective tax rate of 19.8%.

The tax rate varies significantly by industry, with manufacturing companies paying the highest at 21%.

65% of small businesses pay taxes at a rate of 25% or less, while the remaining 35% pay at rates of 26% or higher.

- Manufacturing: 21% average effective tax rate

- Wholesale Trade: 19.9% average effective tax rate

- Retail Trade: 19.4% average effective tax rate

- Agriculture, Forestry, Fishing, and Hunting: 14.9% (lowest)

- Accommodation and Food Services: 15.2%

These rates include federal, state, and local taxes combined.

Do all small businesses have to pay taxes?

Yes, all businesses except partnerships must file annual tax returns.

However, not all businesses that file returns end up owing taxes.

Learn More...

According to the IRS, approximately 93% of small businesses file their taxes on time, including sole proprietorships, partnerships, and corporations.

It's important to distinguish between filing taxes and paying taxes - they are two different things.

All businesses except partnerships must file an annual income tax return, while partnerships file information returns.

The actual tax liability depends on the business's profit, deductions, credits, and business structure.

Some businesses may show a loss for the year and face no tax liability, but they still must file returns.

What is self-employment tax and how much is it?

Self-employment tax is 15.3% of your net earnings from self-employment.

You must pay it if your net earnings were $400 or more.

Learn More...

Self-employment tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

The current self-employment tax rate is 15.3%, which breaks down as follows:

- 12.4% for Social Security

- 2.9% for Medicare

You must pay self-employment tax and file Schedule SE if your net earnings from self-employment were $400 or more.

This tax contributes to your coverage under the Social Security system, providing retirement benefits, disability benefits, survivor benefits, and hospital insurance (Medicare) benefits.

Self-employed individuals pay both the employer and employee portions of these taxes.

Which states have the lowest corporate tax rates?

North Carolina has the lowest rate at 2.25%.

Twelve states have corporate tax rates at or below 5%.

Learn More...

As of 2025, North Carolina has the lowest corporate income tax rate at just 2.25%, down from 2.5% in 2024.

Twelve states have top corporate tax rates at or below 5%:

- Arizona: 4.90%

- Arkansas: 4.30% (top rate)

- Colorado: 4.40%

- Indiana: 4.90%

- Kentucky: 5.00%

- Mississippi: 5.00% (top rate)

- Missouri: 4.00%

- North Carolina: 2.25%

- North Dakota: 4.31% (top rate)

- Oklahoma: 4.00%

- South Carolina: 5.00%

- Utah: 4.55%

South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax.

Nevada, Ohio, Texas, and Washington impose gross receipts taxes instead of corporate income taxes.

When do I need to make estimated tax payments?

You need to make estimated payments if you expect to owe $1,000 or more as an individual.

Corporations must make estimated payments if they expect to owe $500 or more.

Learn More...

Estimated taxes are quarterly payments made throughout the year to cover your tax liability.

The IRS requires estimated tax payments based on these thresholds:

- Individuals (including sole proprietors, partners, and S corporation shareholders): $1,000 or more

- Corporations: $500 or more

These payments are due on the 15th of January, April, June, and September (or the next business day if the 15th falls on a weekend or holiday).

Failure to pay estimated taxes, or paying too little, can result in underpayment penalties when you file your annual return.

You can make payments online through the IRS Electronic Federal Tax Payment System (EFTPS), by phone, or by mail.

What taxes do I need to pay if I have employees?

You must pay Social Security, Medicare, federal income tax withholding, and federal unemployment (FUTA) tax.

Learn More...

When you have employees, you become responsible for several employment taxes:

- Social Security and Medicare taxes (both employer and employee portions)

- Federal income tax withholding from employee paychecks

- Federal Unemployment Tax Act (FUTA) tax

- State unemployment insurance taxes (varies by state)

- Workers' compensation insurance (varies by state)

- Temporary disability insurance (in some states)

You must withhold the employee's portion of Social Security and Medicare taxes from their paychecks and match it with your own contribution.

Employment taxes are typically filed using Form 941 (quarterly), Form 943 (agricultural employers), or Form 944 (small employers).

FUTA taxes are filed separately using Form 940.

You may also need to withhold state income taxes depending on your state's requirements.

Which industries pay the most in small business taxes?

Manufacturing companies pay the highest average effective tax rate at 21%.

Wholesale trade and retail trade follow at 19.9% and 19.4% respectively.

Learn More...

Tax rates vary significantly across different industries based on their business models, profit margins, and available deductions.

The three industries where small businesses pay the most in taxes are:

- Manufacturing: 21% average effective tax rate

- Wholesale Trade: 19.9% average effective tax rate

- Retail Trade: 19.4% average effective tax rate

In contrast, the industries with the lowest tax rates are:

- Agriculture, Forestry, Fishing, and Hunting: 14.9%

- Accommodation and Food Services: 15.2%

- Real Estate, Rental, and Leasing: 16.9%

These differences often reflect industry-specific deductions, depreciation schedules, and business expense patterns.

Manufacturing companies may face higher rates due to their typically higher profit margins and fewer available deductions relative to their income.

What is the difference between gross receipts tax and corporate income tax?

Gross receipts tax is based on total sales, while corporate income tax is based on profits.

Four states use gross receipts tax instead of corporate income tax.

Learn More...

Gross receipts taxes and corporate income taxes are fundamentally different in how they're calculated and applied.

Corporate income tax is calculated on a business's net income (profits) after deducting business expenses.

Gross receipts tax is applied to a company's total sales without deductions for business expenses, making it generally more economically harmful.

States that impose gross receipts taxes instead of corporate income taxes:

- Nevada

- Ohio

- Texas

- Washington

Some states impose gross receipts taxes in addition to corporate income taxes:

- Delaware

- Oregon

- Tennessee

Gross receipts taxes can lead to 'tax pyramiding' where the same economic activity is taxed multiple times as it moves through the supply chain.

This makes gross receipts taxes generally understood to be more economically harmful than corporate income taxes.

How do I know which business taxes apply to my company?

Your business structure and location determine which taxes you must pay.

All businesses face federal taxes, plus state and local taxes that vary by location.

Learn More...

The taxes your business must pay depend on several key factors:

- Business structure (sole proprietorship, partnership, LLC, corporation)

- Geographic location (state and local tax requirements)

- Industry type (some industries face specific excise taxes)

- Whether you have employees

- Your annual revenue and profit levels

The IRS identifies five general types of business taxes that commonly apply:

- Income tax (varies by business structure)

- Self-employment tax (for self-employed individuals)

- Employment taxes (if you have employees)

- Estimated taxes (quarterly payments)

- Excise taxes (industry-specific)

State and local taxes can include corporate income tax, sales tax, property tax, franchise tax, and business license fees.

It's recommended to consult with a tax professional or use IRS resources to determine your specific obligations.

The Small Business Administration provides state-specific tax information to help you understand local requirements.

In Conclusion…

While the exact percentage of small businesses that pay taxes is challenging to determine, it’s clear that the majority of small businesses do file their taxes on time.

The percentage of small businesses that pay taxes varies depending on the industry, with some industries having higher average effective tax rates than others.

Small businesses have to pay various types of taxes, and it’s crucial to understand each one of them to avoid any penalties or fines.

Are you feeling overwhelmed by the various types of taxes your small business has to pay?

Don’t worry…

Business Initiative is here to help!

Take advantage of our tax resources, including guides on different types of taxes, business entities, and friendly expert advice.

With our help, you’ll be able to take the initiative and get ahead.

Don’t wait until it’s too late…

➤Book a FREE Consultation Today!

Sources

- Intuit - Small Business Tax Center

- IRS - Taxpayer Compliance and Burden Research

- IRS - Business Taxes

- IRS - Tax Gap Projections for Tax Year 2022, Publication 5869 (Rev. 10-2024)

- National Small Business Association: 2023 Economic Report and 2018 Mid-Year Economic Report

- National Small Business Association: 2025 Tax Survey Report

- Small Business Administration - Pay Taxes

- Tax Foundation - State Corporate Income Tax Rates and Brackets, 2025

- Investopedia - Understanding Small Business Taxes: A Comprehensive Guide