Starting an LLC can feel overwhelming.

You’re drowning in legal jargon, state requirements, and endless paperwork.

But it doesn’t have to be this complicated…

We’ve spent years researching every state requirement, consulting with business formation experts, and analyzing thousands of successful LLC formations.

The result?

This comprehensive, step-by-step guide that cuts through the confusion.

Key Takeaways

Key Takeaways

- LLC filing fees range from $50-$500 depending on your state, plus optional costs for registered agents and legal help.

- Your LLC name must be unique and available - check your state's business database before filing your paperwork.

- You can serve as your own registered agent to save money, but need a physical address in your formation state.

- Create an operating agreement even if not required - it protects your business and prevents costly member disputes later.

- Obtain an EIN from the IRS for free, and file annual reports on time to maintain good standing.

This isn’t another generic “how-to” article. Below you’ll find a practical breakdown of the exact steps to form your own LLC.

You’ll discover how to choose a bulletproof business name, navigate registered agent requirements, and create an operating agreement that protects your interests.

Table of Contents

Table of Contents

Follow this guide from start to finish. Take notes. Bookmark the resources. By the end, you’ll have everything you need to form your LLC with confidence.

Ready to turn your business idea into a legally protected reality? Let’s dive in.

Developing a Winning Business Plan for Your LLC

One of the most critical steps in forming an LLC is developing a well-thought-out business plan.

A business plan outlines your company’s goals, strategies, and tactics to achieve success.

It provides a roadmap for how you’ll run and grow your business, making it easier to secure funding, attract customers, and stay competitive.

To create a winning business plan for your LLC, start by defining your mission statement and core values.

- What problem do you solve?

- Who are your target customers?

- What makes your product or service unique?

Answering these questions will help you clarify your purpose and differentiate from competitors.

Next, conduct market research to understand industry trends, customer preferences, and potential challenges.

Analyze the competition to identify strengths and weaknesses that can inform your strategy.

Once you have a clear understanding of your business’s purpose and the market landscape, develop a detailed marketing plan that outlines how you’ll reach and engage with customers.

This should include branding elements like logos, website design, social media presence, as well as advertising campaigns and promotional events.

➤ DISCOVER: Learn the fundementals of designing a bulletproof marketing plan

Finally, create financial projections that estimate revenue streams, expenses, profits, and cash flow over time.

This will help you determine how much money you need to get started and when you can expect to break even or turn a profit.

Remember… A great business plan is not set in stone but rather serves as a living document that adapts with changing circumstances.

Review your business plan regularly to ensure alignment with your goals and make adjustments as needed.

Choosing a Name

The first step in forming an LLC is choosing an appropriate name for your company.

Here are some tips to help you find the perfect name:

1. Check for Availability:

Your chosen name must be unique and not in use by another business.

Search your state’s LLC database to ensure your desired name is available. Most states offer this as a free service online.

Use our complete list of state secretariesto find the right one for your state.

On their website you can conduct a business name availablity search.

➤ MORE: Come up with the perfect name for your LLC

2. Follow State Requirements:

Each state has specific rules and regulations regarding LLC names.

Generally, an LLC name must include the words “Limited Liability Company” or its abbreviation (LLC or L.L.C.).

Additionally, you should avoid using prohibited words, such as “bank” or “insurance,” which may require additional paperwork or licensing.

3. Secure a Domain Name:

If you plan to have an online presence, it’s a good idea to secure a matching domain name for your business.

Use a domain registrar, like Namecheap, to check for availability and purchase your domain.

Selecting a Registered Agent

A registered agent is an individual or business entity responsible for receiving legal documents and official correspondence on behalf of your LLC.

This includes service of process, tax notices, and annual reports.

Most states require an LLC to have a registered agent with a physical address within the state.

You can appoint yourself, a friend, a family member, or hire a professional registered agent service, such as Business Initiative.

➤ DISCOVER: What does it take to be a registered agent?

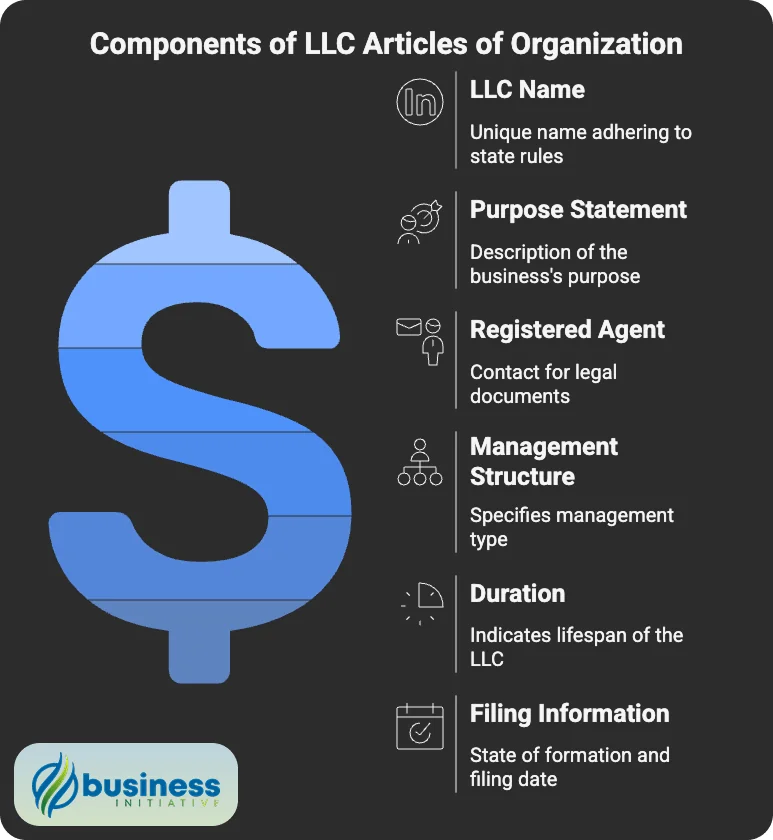

Filing Articles of Organization

To officially create your LLC, you must file the Articles of Organization with the Secretary of State in your chosen state.

This document contains basic information about your LLC, such as its name, registered agent, and purpose.

The filing fee varies by state, typically ranging from $50 to $500. You can usually file online, by mail, or in-person.

For example, in Texas, you can submit the Articles of Organization through the Texas Secretary of State’s website.

Creating an Operating Agreement

An operating agreement is a legal document outlining the ownership structure, member roles, and operating procedures of your LLC.

Though not always required by law, it’s highly recommended to create one to avoid potential conflicts and establish clear guidelines for your business.

➤ MORE: Do you REALLY need an operating agreement?

An operating agreement typically includes:

- Ownership percentages

- Voting rights

- Profit distribution

- Management structure

- Meeting schedules

You can create an operating agreement using online templates or hire an attorney for a more customized approach.

➤ DISCOVER: Step-by-step guide to writing your own Operating Agreement

Obtaining an Employer Identification Number (EIN)

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is used by the Internal Revenue Service (IRS) to identify your business for tax purposes.

➤ LEARN: Why is your EIN so important?

You’ll need an EIN to open a business bank account, file taxes, and hire employees.

Applying for an EIN can be done online through the IRS website.

Annual Reporting

Most states require LLCs to file an annual report, also known as a statement of information or a periodic report.

This report keeps your business in good standing and ensures your state has up-to-date information on your LLC.

➤ DISCOVER: How long should businesses keep their documents on file?

Filing deadlines and fees vary by state, so be sure to check your state’s requirements.

For instance, in New York, LLCs must file a Biennial Statement every two years for a $9 fee.

FAQs - Frequently Asked Questions About Forming an LLC

How much does it cost to form an LLC?

Filing fees typically range from $50 to $500 depending on your state.

Additional costs may include registered agent services and EIN application.

Learn More...

The primary cost of forming an LLC is the state filing fee for Articles of Organization, which varies significantly by state.

For example, some states like Arkansas charge as little as $45, while others like Massachusetts can charge up to $520.

Beyond the mandatory state filing fee, you may have additional expenses including:

- Registered agent service: $100-$300 annually if you hire a professional service

- Operating agreement drafting: $0-$1,500 depending on complexity

- Domain name registration: $10-$20 annually

- Business bank account setup: Often free but may have monthly fees

If you choose to hire an attorney for the entire process, expect to pay $1,000-$3,000 in legal fees.

However, many entrepreneurs successfully form their LLC without legal assistance by following state guidelines and using online resources.

How long does it take to form an LLC?

Processing time varies by state, typically taking 1-15 business days after filing.

Learn More...

The timeline for LLC formation depends on your state's processing speed and whether you choose expedited filing options.

Most states process standard filings within 5-10 business days, though some can take up to 15 business days during busy periods.

Several factors can affect your formation timeline:

- Preparation time: 1-3 days to gather information and complete paperwork

- Name availability check: Can be done instantly online in most states

- State processing: 1-15 business days depending on the state

- Expedited processing: Available in most states for additional fees ($25-$200)

States like Delaware and Wyoming are known for faster processing times, often completing filings within 24-48 hours.

After approval, you can immediately begin operating your business, though obtaining your EIN and setting up business banking may add another 1-2 weeks to become fully operational.

Can I be my own registered agent for my LLC?

Yes, you can serve as your own registered agent if you meet state requirements.

Learn More...

Most states allow LLC owners to serve as their own registered agent, provided they meet specific criteria.

To qualify as your own registered agent, you typically must:

- Be at least 18 years old

- Have a physical street address (not a P.O. Box) in the state of formation

- Be available during normal business hours to receive legal documents

- Maintain the same address consistently for official correspondence

While serving as your own registered agent can save money, there are important considerations:

Your personal address becomes part of public record, which may compromise privacy.

You must be available during business hours to accept legal documents and official notices.

If you travel frequently or move locations, maintaining consistent availability can be challenging.

Professional registered agent services like Incfile or Northwest Registered Agent typically charge $100-$300 annually and provide benefits like mail forwarding, document scanning, and privacy protection.

Do I need an operating agreement for my LLC?

While not always legally required, an operating agreement is highly recommended for all LLCs.

Learn More...

An operating agreement is a legal document that outlines your LLC's ownership structure, member roles, and operating procedures.

Although most states don't legally require operating agreements, creating one provides crucial benefits:

- Establishes clear ownership percentages and voting rights

- Defines profit and loss distribution methods

- Outlines management structure and decision-making processes

- Prevents potential conflicts between members

- Protects your LLC's limited liability status

- Provides flexibility in tax treatment options

Even single-member LLCs benefit from operating agreements as they help maintain the legal separation between personal and business assets.

Without an operating agreement, your LLC will be governed by default state laws, which may not align with your business goals or member preferences.

You can create a basic operating agreement using online templates or hire an attorney for more complex business structures.

The investment in a properly drafted operating agreement can save significant legal costs and disputes in the future.

What is an EIN and do I need one for my LLC?

An EIN is a federal tax identification number that most LLCs need for banking and tax purposes.

Learn More...

An Employer Identification Number (EIN), also called a Federal Tax Identification Number, is a unique nine-digit number assigned by the IRS to identify your business for tax purposes.

You'll need an EIN for your LLC if you:

- Have employees or plan to hire employees

- Want to open a business bank account (most banks require an EIN)

- Have multiple members in your LLC

- Choose to be taxed as a corporation

- Need to file certain tax forms with the IRS

Even single-member LLCs often benefit from obtaining an EIN to separate business and personal finances.

The application process is free when done directly through the IRS website, though many services charge fees for assistance.

You can apply online, by phone, fax, or mail, with online applications typically processed immediately during business hours.

Once obtained, your EIN remains with your business permanently, even if you change business structure or move to different states.

Having an EIN also adds credibility when dealing with vendors, clients, and financial institutions.

What happens if I don't file my LLC's annual report?

Failure to file annual reports can result in penalties, late fees, and potential dissolution of your LLC.

Learn More...

Annual reports are required by most states to keep your LLC in good standing and maintain current business information on file.

Consequences of not filing your annual report include:

- Late fees and penalties that increase over time

- Loss of good standing status with the state

- Potential administrative dissolution of your LLC

- Loss of liability protection for business owners

- Inability to conduct certain business activities

- Difficulty opening bank accounts or obtaining business licenses

Filing requirements vary by state - some require annual reports, while others like New York require biennial statements every two years.

Fees typically range from $9 in New York to several hundred dollars in other states.

If your LLC is dissolved for non-compliance, you may be able to reinstate it by paying all back fees and penalties, though this process can be costly and time-consuming.

Many states send reminder notices, but it's ultimately the business owner's responsibility to track and meet filing deadlines.

Setting up calendar reminders or working with a business service provider can help ensure timely compliance.

Can I form an LLC in any state or does it have to be where I live?

You can form an LLC in any state, but you'll likely need to register as a foreign LLC in states where you conduct business.

Learn More...

There's no legal requirement to form your LLC in your home state, and many business owners choose to incorporate in business-friendly states.

Popular incorporation states include:

- Delaware: Known for business-friendly laws and established court system

- Wyoming: Low fees, strong privacy protections, and no state income tax

- Nevada: No state income tax and strong asset protection laws

- Texas: Reasonable fees and straightforward filing process

However, forming in a different state has important considerations:

If you conduct business in your home state, you'll likely need to register as a 'foreign LLC,' which involves additional fees and paperwork.

You'll need a registered agent with a physical address in your state of formation.

You may be subject to taxes in both your formation state and any state where you conduct business.

For most small businesses operating in one state, forming locally is often the most cost-effective and straightforward option.

The benefits of out-of-state formation typically outweigh the costs only for larger businesses or those with specific legal or tax considerations.

Do I need a lawyer to form an LLC?

No, you can legally form an LLC yourself, though legal consultation may be helpful for complex situations.

Learn More...

Forming an LLC is a relatively straightforward process that many entrepreneurs successfully complete without legal assistance.

You can handle the formation process yourself by:

- Researching your state's specific requirements online

- Using your Secretary of State's website to file Articles of Organization

- Obtaining an EIN directly from the IRS website

- Using online templates for operating agreements

- Following step-by-step guides like this comprehensive formation guide

However, legal consultation may be valuable if you have:

- Multiple members with complex ownership structures

- Unique business models or industry-specific requirements

- Significant assets requiring specialized protection strategies

- Plans for complex tax elections or corporate structures

- Concerns about liability issues specific to your business type

Many online services offer middle-ground solutions, providing formation assistance at lower costs than traditional legal services.

If you choose the DIY route, ensure you understand your state's requirements and consider consulting an attorney for the operating agreement if your business structure is complex.

The money saved by self-filing can be significant, often $1,000-$3,000 in legal fees for straightforward formations.

In Conclusion…

Forming an LLC is an exciting step for any entrepreneur or business owner.

By following this ultimate guide and diligently completing each step, you’ll be well on your way to launching a successful and legally compliant business.

So don’t wait another minute…

Start building your dream business today!

➤ MORE: How do LLC owners get paid?

As you embark on your LLC formation journey, remember: You don’t have to do it alone…

Consider reaching out to a trusted business consultant for guidance and support.

At Business Initiative, we offer personalized consultations to help you navigate the process with confidence.

Our team of experts can assist you with everything from developing a winning business plan to creating an operating agreement and obtaining an EIN.

We also provide comprehensive registered agent and business filing services to ensure your LLC remains compliant with state regulations. Learn more about our services.

We’ll work closely with you every step of the way to ensure your LLC is set up for success.

Don’t hesitate to contact us at any time using our contact form here or by hitting us up @BisInitiative.

Let’s work together to turn your entrepreneurial vision into reality!