Here are the seven key disadvantages of partnership that can cause Partnerships to fail:

Key Partnership Disadvantages

With all of their drawbacks, it might be hard to believe:

Starting a Partnership may be your best option.

It comes down to whether you want to make more money working with a team of highly skilled individuals or if you want more control working on your own.

Key Takeaways

Key Takeaways

- Partnerships lack limited liability protection - both partners are personally responsible for business debts and legal issues.

- Communication and trust are critical in partnerships, but conflicts can make dissolution difficult and expensive.

- Consider your risk tolerance and financial situation before forming a partnership - personal assets are at stake.

- Partnerships face self-employment taxes and complex tax filing requirements that can impact profitability.

- Partnerships work best when partners have aligned goals, complementary skills, and clear exit strategies planned.

To make the right decision, you should understand if a Partnership aligns with your goals and vision.

At the very least, take a look at what makes Partnerships excellent and terrible.

If you’re unfamiliar with Partnerships, the Fundamentals of Partnerships are included at the end of this article.

Table of Contents

Table of Contents

Read on to understand the critical weak points of Partnerships.

Afterward, look at their advantages to getting more knowledge about Partnerships.

Partnership Disadvantages

Here are the seven ways you’re missing out with a Partnership:

1. No Limited Liability Protection

Partnerships do not distinguish between business finances and personal property, which is one of the major partnership business disadvantages.

Without any separation, your Partnership’s existence is completely dependent on you and your Partners’ active involvement in its daily operations.

Since the owners “are” the business, you and your partners are all personally responsible.

Partners are also personally accountable for each other’s actions (more on this later).

If courts and banks file legal or monetary cases against a Partnership, they can take your Partners’ personal property to pay what the company owes.

If only one Partner is at fault, everyone is affected.

It doesn’t matter if they acted without the team’s explicit permission and unanimous consent.

Your personal property includes:

- Real estate

- Personal Bank Accounts

- Investments

- Vehicles

- Anything of significant value

Limited Partners can only lose their investments.

They receive Liability Protection because they are passively involved in the business.

Do you and your Partners own assets you don’t want to be taken away against your will?

Then you need to check out LLCs or Corporations.

These complex entities protect your personal property from being possessed by claimants.

If most of what you and your Partners own is going towards the business anyways, and you understand the potential risk of losing everything (including the property you don’t have in the business), then starting a Partnership is a viable option.

Due to their simplicity, you avoid registration procedures, maintenance requirements, recurring filing fees, and Corporate tax.

Unfortunately, you also lose out on Liability Protection.

LLCs and Corporations offer Liability Protection by distinguishing between business and personal.

They also differentiate between the Members and Shareholders, respectively.

Once created, these business entities exist independent of the owners, and owners are independent of each other.

You can upgrade to an LLC or Corporation if you want their special protection later.

Upgrading is easier once you establish your business with routine practices and protocols.

2. You Have Less Control

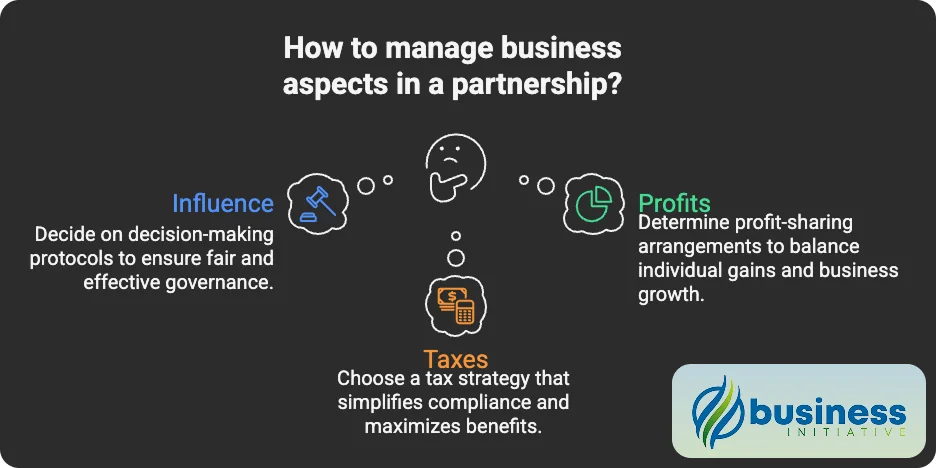

You must divide the money, taxes, and influence evenly with your Partners by default, representing significant limitations of partnership structures.

You can make special conditions to this rule by getting a custom Partnership Agreement written for your team or by writing yourselves.

Influence

You are a part of a team. You don’t have free reign to do whatever you feel like within a Partnership.

Every General Partner must agree before making significant business decisions.

Most of the time, you only need a majority vote.

For the critical actions, you need unanimous agreement.

If you can’t reach a verdict, refer to your Partnership Agreement protocol.

It tells you how to resolve disputes for both majority and unanimous decisions.

Profits

You’re only worried about your neck when you run a business on your own.

In a Partnership, you have more mouths to feed.

The profits are split evenly between you and your Partners (unless otherwise stated in your Partnership Agreement).

Consider the following scenarios:

- You’re a Sole Proprietor making 200K in profits a year. Great!

or

- You are in a Partnership bringing in 1 mil a year, with more room for growth.

You have a Limited Partner getting 25% of the profits while smoothly running the business with 3 General Partners.

Even though your business is better, you only make 187,500/year.

Although you make less as a Partner than on your own, you split your workload four ways.

Having more Partners offers you better opportunities for growth and expansion.

At the same time, it also further divides the profits.

It all lies in the balance.

Taxes

Partnerships pay taxes with the Pass-Through Process.

This method simplifies the tax process by “passing” the business’s profits and taxes evenly to each Partner, hence the name; Pass-Through Process.

Everyone is responsible for paying their share of the business’s taxes according to their tax bracket.

More advanced business entities like LLCs and Corporations give you unique tax benefits.

You also have the option to upgrade your tax status, maximizing your profits and reducing your taxes.

Partnerships are straightforward; you only get one choice.

The good news is the Pass-Through Process is easy to complete because there’s nothing special about it.

3. Self-Employment Tax

Being an entrepreneur is a bit of a double-edged sword: You’re an owner and also self-employed.

In a typical 9-to-5, your employer automatically deducts Social Security and Medicare taxes from your pay before you even touch your paycheck.

As a Partner, you pay these taxes yourself.

Luckily, the Internal Revenue Service makes it easier to give them your money by combining these taxes and calling it Self-Employment Tax.

To pay it: use the 1040-SE Form (“SE” for Self-Employment).

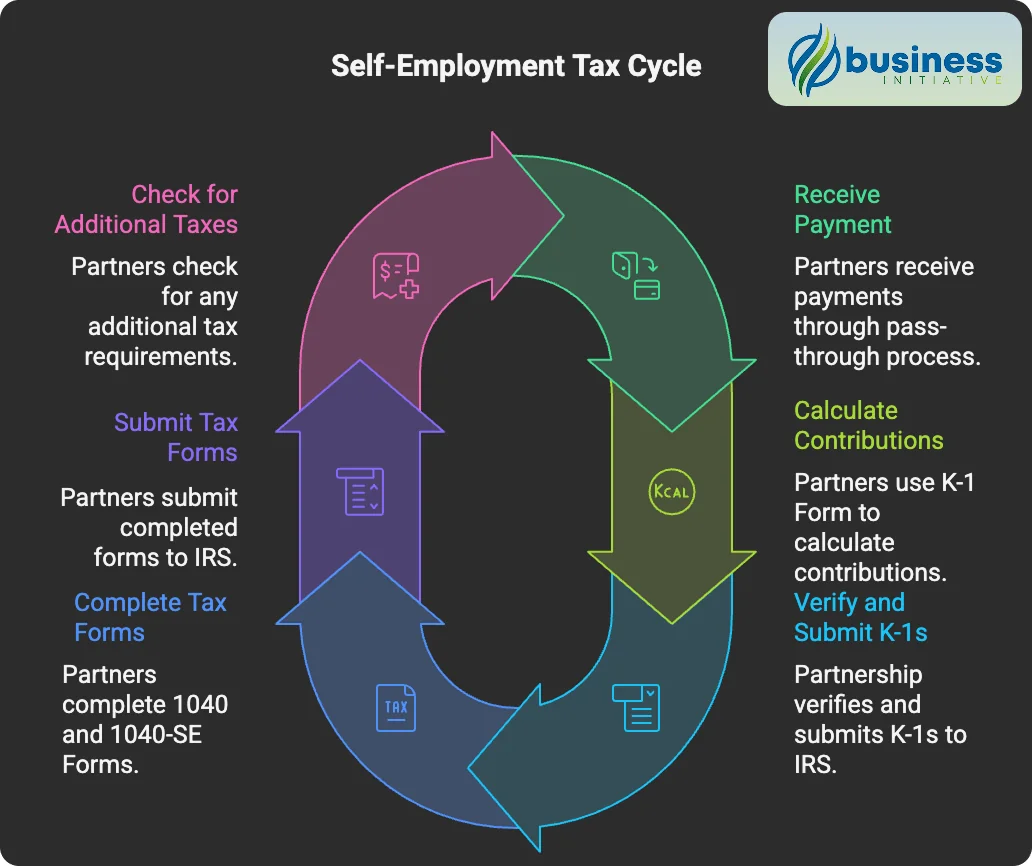

For your reference, here is a bare-bones overview of the tax process for a default Partnership:

-

Partners get paid via Pass-Through Process (direct deposit or check)

-

Partners calculate their contributions using the K-1 Form.

-

The Partnership verifies and submits copies of the K-1s to the IRS using the 1065 Form.

-

Partners use their K-1 to complete their 1040 Form (Income Tax) and 1040-SE Form (Self-Employment Tax) and submit them to the IRS.

-

Be sure to check out if your business requires additional taxes.

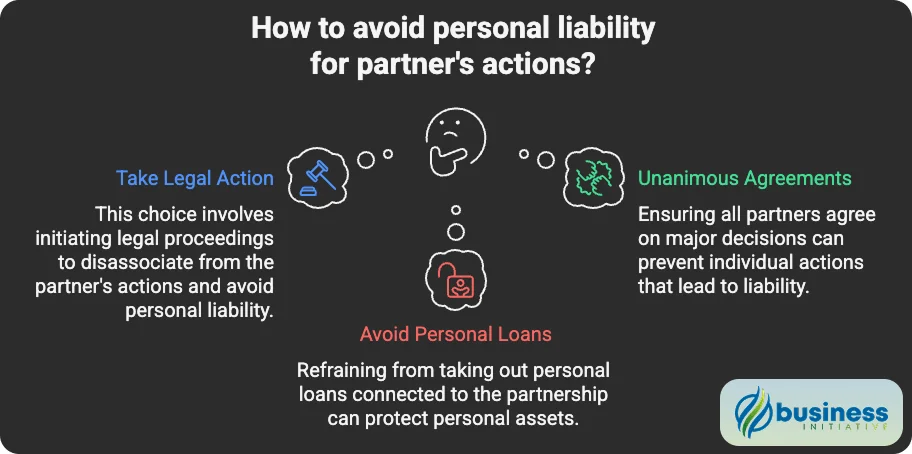

4. Liable for Your Partner’s Actions

If something immoral or illegal goes down, everyone is liable, even if only one Partner is to blame. This represents one of the most significant partnership disadvantages that many entrepreneurs overlook.

The reason is:

Owners connect to the business and each other.

According to the UPA, there are only a few occasions when owners must reach unanimous agreements before acting.

Some of these activities include:

- Selling the company

- Operational Decisions

- Transferring Partnership property to creditors to pay debts

- Admitting fault or responsibility in court

- Submitting disputes to an arbitrator

- And more

Notice how it doesn’t include loans?

Nothing prevents Partners from taking out business loans by themselves.

So, what?

Let’s say a Partner takes out a business loan personally.

Since their loan connects to the Partnership, anyone actively involved is just as responsible for paying it back according to its terms and conditions.

The bank can easily take payment from every General Partner’s personal property.

In other words, if you don’t repay the loan, the bank is coming for your homes, properties, vehicles, investments, bank accounts, and whatever else you own.

The only way to get out of being personally responsible for another Partner’s decision is by taking legal action.

Not good.

5. Increased Chance of Internal Conflict

Even though working with a team is helpful, it can cause problems. This is one of the disadvantages of a partnership that many business owners don’t anticipate.

With many people sharing the business, it’s no surprise Partnerships have a higher rate of internal disputes.

Partners may feel unappreciated or argue about the correct solution to a problem.

Tensions may arise, creating an environment of scarcity and competition.

Not something you want within your company.

Optimally, you and your Partners agree on a compromise.

Realistically, people have egos and resist compromising on what they believe to be the best solution, destroying the integrity and longevity of your Partnership.

Besides the business, it can ruin personal relationships too.

Mitigate potential conflicts by getting a Partnership Agreement:

Your Partnership Agreement

- saves you time and money,

- includes what to do if Partners disagree,

- outlines how the company dissolves and divides its assets,

- clearly defines the roles and responsibilities,

- speeds up the decision-making process,

- helps avoid settling disputes in court.

For your Partnership to run smoothly, be sure your Partners are worthy and willing candidates and that you get along with them.

After all, you become legally and financially related.

Remember, it’s not necessary to make someone a Partner.

You can easily hire third-party contractors and avoid being personally responsible for their actions.

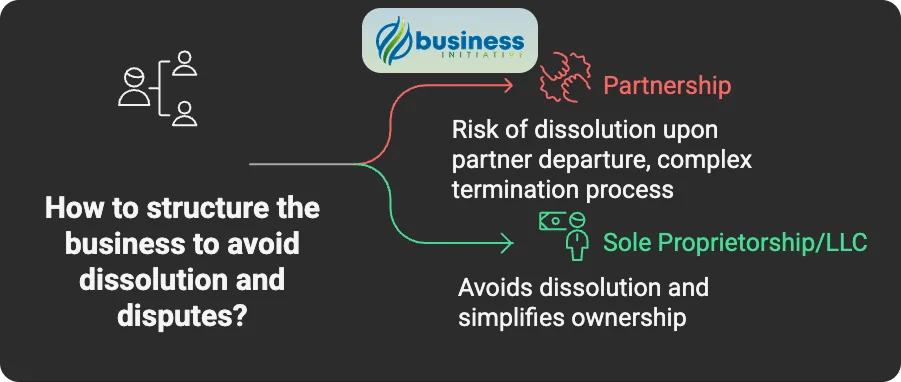

6. Difficult to Dissolve

If a General Partner wakes up one morning and decides to walk out of the Partnership, the business dissolves. This highlights another major disadvantage of partnership structures.

The same applies if they retire or die. Alternatively, the Partnership remains unaffected if Limited Partners drop out.

They aren’t critical to the business. They’re there for the money.

The process of terminating your Partnership is time-consuming on its own.

After this, you sell and distribute the value proportionally between owners.

To make matters worse, you can get a whole mess of paperwork, lawyers, and court fees to deal with if an entitlement dispute breaks out.

You can avoid this by registering your business as a Sole Proprietorship or Single Member LLC.

In these businesses, you don’t distribute anything to anybody (besides taxes to the Feds).

When you’re the only owner, everything becomes your personal property.

7. Difficult to Change Ownership

To add or remove a Partner, you must value the Partnership’s assets. This represents one of the partnership business disadvantages that can make ownership changes extremely difficult.

Depending on your business’s size and age, this can drag on and get quite pricy.

You need the explicit approval of every General Partner for additions, removals, transfers, or other changes in ownership to take effect.

However, you do not need the permission of Limited Partners.

Should a Partner leave, the remaining Partners regroup and figure out how they want to reallocate the extra portion of ownership.

Assuming they wish to continue doing business, the company dissolves and reforms as a new Partnership.

On top of this, you need a unanimous agreement from the remaining owners on the new Partnership Agreement.

In the case of adding a Partner, the process is similar.

The difference is that instead of reallocating a vacant position, you make room for your new Partner by reducing everyone’s share of ownership.

The rest is the same: dissolve, reform, write a new Partnership Agreement, get a unanimous vote, and you’re good to go.

As you can see, Partnerships are highly dependent on the owners.

Partnerships (and Sole Proprietorships) are dependent business entities.

They simply cease to exist as soon as the ownership changes.

By contrast, Corporations and LLCs are known as “stand-alone” entities because they exist independently of their shareholders and members.

People transfer companies, buying them all the time, keeping them intact while completely changing their ownership.

Enough doom and gloom.

Want to see all the perks Partnerships offer?

Check out the Partnership Advantages.

On behalf of Business Initiative, we wish you much success in your entrepreneurial journey!

Fundamentals of Partnerships

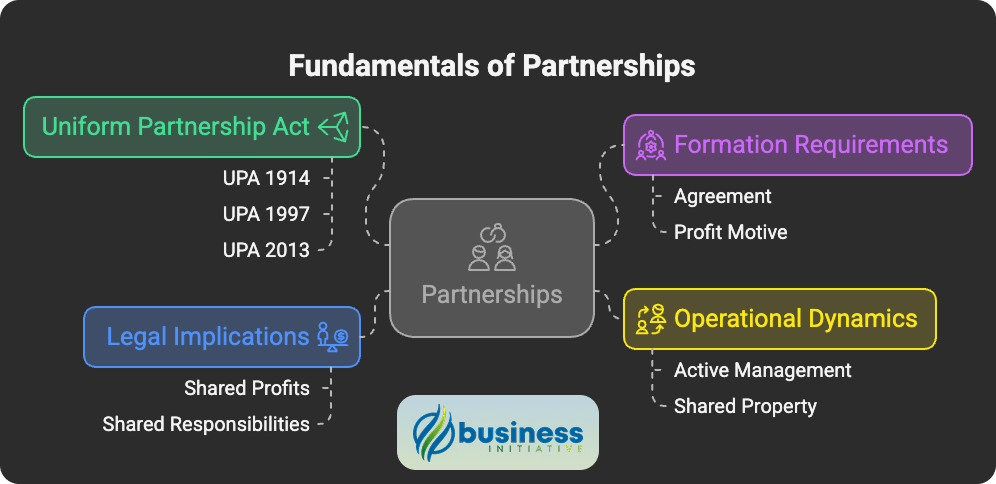

images/content/diagrams/partnership-disadvantages-fundementals.png The Uniform Partnership Act (UPA) was released in 1914 and created the Partnership we are familiar with today.

The disadvantages discussed in the above article are according to the most recent version of the UPA, written in 1997 and updated in 2013.

Most states accept the UPA.

If yours is an exception, refer to your specific state’s guidelines on establishing and operating a Partnership.

You can only establish a Partnership if you and one or more partners agree to join forces and provide a product or service for a profit.

Anything short of this and the business is not a legally recognized Partnership.

For instance, if you are the sole owner or the company is a Non-Profit, it’s simply not a Partnership.

Even though Partnerships can own property, they are not stand-alone entities like LLCs and Corporations.

For your Partnership to exist, Partners must actively run the business, not just sit on the sidelines.

Legally speaking, Partners are not separate from the company or one another.

Everyone shares the profits, property, and responsibility of every aspect of the business.

The 3 Types of Partnerships

You have three categories of Partnership to choose from:

1. General Partnership

2. Limited Partnership

3. Limited Liability Partnership (LLP)

Multi-Member LLCs and Corporations are also made specifically for multi-owner operations.

The right one for you depends on everyone’s goals and the size, structure, and risk of your business.

The LLP is less common and more complicated.

A realistic review of LLPs goes beyond the scope of this article and is therefore not included.

General Partnerships

General Partners are actively involved in and responsible for the business’s operation and management.

For significant decisions to take effect, Partners must reach a unanimous agreement.

These choices affect the whole company.

Let’s say your Partnership catches a lawsuit or owes outstanding debts.

Every Partner is personally responsible.

On top of being personally liable for the actions of the Partnership, General Partners are accountable for each other.

If an owner takes out a business loan on behalf of the business, everybody is personally liable for the consequences of their decision.

It doesn’t matter if they asked the rest of the team.

Limited Partnerships

Limited Partners are passive investors.

They do not participate in the company’s decision-making, management, or operation.

Since they are not involved, Limited Partners are not personally responsible for the actions of the business or the General Partners.

The biggest risk Limited Partners face is losing their investment.

In other words, they receive personal liability protection.

Keep in mind: Your business doesn’t need Limited Partners.

You can’t have only Limited Partners, or else who would run the business?

If running a business with like-minded individuals in the simplest way possible is appealing to you, the Partnership is likely your best bet.

Whether you end up starting a Partnership or opt for another form of business, you should keep reading to get a well-rounded understanding of the drawbacks of Partnerships.

The 3 Main Reasons to Avoid a Partnership:

1. You are personally responsible for the actions of your business and your Partners.

2. You lose autonomy when you share every aspect of the business with your team.

3. If a dispute arises, you better find a solution quickly. Otherwise, you risk losing the business and your property.

You might be better off doing your own thing as a Sole Proprietor.

In a riskier setup (requiring limited liability protection) or where you share ownership with more than 20 professionals, you should start a Multi Member LLC or Corporation.

Taking everything into account, Partnerships are the simplest solution to sharing the workload, responsibility, and profits with a team.

But, just as every rose has its thorn, the Partnership’s simplicity comes with a few significant disadvantages, like total personal responsibility for everything.

FAQs - Common Questions About Partnership Drawbacks

In Summary…

Partnerships are a major business decision with both benefits and risks.

While they offer collaboration and shared resources, they also come with significant partnership disadvantages that every entrepreneur should understand.

Understanding these disadvantages of partnership business structures can help you make informed decisions about your business formation.

Key Takeaways

- Risk Awareness: Know the risks to protect your assets and financial security.

- Partner Selection: Choose partners wisely to align goals and values.

- Strategic Planning: Plan for potential issues and consider alternative structures like LLCs.

- Financial Preparedness: Be aware of tax and liability implications.

- Exit Strategy: Plan for dissolution to avoid conflicts and legal fees.

Practical Steps

-

For Entrepreneurs: Assess risks, draft detailed agreements, and consider LLCs.

-

For Existing Partners: Review agreements and plan for conflicts.

-

For Advisors: Guide clients in choosing the right structure and agreements.

Final Thoughts

Partnerships can be beneficial but require careful consideration. Make informed decisions based on your situation and goals.

For personalized guidance, schedule a consultation with Business Initiative experts to explore the best structure for your needs.

Schedule Your Free Consultation

Sources and Additional Information

This article draws from comprehensive research and analysis of partnership structures, legal frameworks, and business best practices.

Below you’ll find the sources used to compile this information, as well as additional resources to help you learn more about partnerships and alternative business structures.

Sources & Additional Information

Legal Framework and Regulations:

- Uniform Partnership Act (UPA) - 1914 original, 1997 revision, 2013 updates

- U.S. Small Business Administration (SBA) - Business structure guidelines and regulations

- Internal Revenue Service (IRS) - Partnership tax requirements and self-employment tax information

- State-specific partnership laws - Varying regulations across different jurisdictions

Business Statistics and Data:

- U.S. Census Bureau - Business formation and partnership statistics

- Bureau of Labor Statistics (BLS) - Business survival rates and partnership performance data

- Small Business Administration - Partnership formation rates and success metrics

Industry Research and Analysis:

- PricewaterhouseCoopers (PwC) - Joint venture and strategic alliance success rates

- Business structure comparison studies - LLC vs Partnership vs Corporation analysis

- Entrepreneurial risk assessment frameworks - Liability protection and business structure selection

Related Articles and Content:

- Partnership Advantages - Explore the benefits and positive aspects of partnerships

- Types of Business Partnerships - Comprehensive guide to different partnership structures

- Partnership Success Statistics - Data-driven analysis of partnership performance

- Modern Business Partnerships - Current trends and partnership evolution

Business Structure Comparisons:

- Converting to LLC - Understanding the differences and conversion options

- Sole Proprietorship vs LLC - Detailed comparison of business structures

- LLC vs Corporation - Understanding business structure differences

- LLC vs Sole Proprietorship Comparison - In-depth analysis of both structures

Alternative Business Structures:

- Multi-Member LLC - Limited liability protection with multiple owners

- What Does LLC Mean - Comprehensive guide to Limited Liability Companies

- LLC Operating Agreement - Templates and guidance for business agreements

- LLC vs Sole Proprietorship Differences - Key differences between business structures

Tools and Calculators:

- Partnership ROI Calculator - Evaluate potential returns and risks of partnerships

- Business Structure Selector - Interactive tool to choose the right business structure

- LLC Name Generator - Generate and check LLC name availability

Financial Planning Tools:

- Funding Need Calculator - Calculate capital requirements for your business

- Market Opportunity Finder - Identify market potential for partnerships

- Market Segmentation Analyzer - Analyze target markets for partnership opportunities

Statistics and Research Pages:

- Partnership Growth and Success - Formation rates, success metrics, and industry trends

- Business Structure Statistics - Comprehensive data on all business structure types

- Small Business Statistics - Performance data and survival rates across business structures

Industry-Specific Data:

- Business Dynamics Statistics - Overall business formation and dissolution trends

- Innovation and Business Structure - How structure affects innovation and growth

- Company Size Impact - Relationship between business size and structure choice

Educational Resources:

- Business Formation - Step-by-step guides for starting different business types

- Operating Agreements - Templates and guidance for business agreements

- Registered Agent Services - Professional services for business compliance

Legal and Compliance:

- LLC Formation Guide - Comprehensive guide to forming and managing LLCs

- Partnership Formation - Complete partnership formation and management resources

- Business Structure Comparisons - Compare different business structure options

External Resources and References:

- U.S. Small Business Administration - Official government guidance on business structures

- Internal Revenue Service - Tax information and partnership filing requirements

- State Secretary of State Offices - State-specific business formation requirements

Professional Organizations:

- American Bar Association - Legal guidance on partnership formation

- National Federation of Independent Business - Resources for small business owners

- SCORE - Free business mentoring and education

Stay Connected and Informed:

- The Initiative Newsletter - Weekly insights on business structures and strategies

- Contact Form - Get personalized advice on your business structure decision

- Consultation Services - Schedule a free consultation with business structure experts

Social Media and Community:

- Follow us on X (Twitter) - Real-time updates and business tips

- Business Initiative Blog - Latest articles on business formation and management

- LLC FAQs - Answers to common LLC and business structure questions

Note: This information is provided for educational purposes and should not be considered legal, tax, or financial advice. Always consult with qualified professionals before making business structure decisions that could impact your personal finances and legal liability.